Pension confidence falls as savers favour cash over investments

Research finds workers twice as likely to save for retirement in cash than stocks and shares ISAs

Don't Miss

Most Read

More than half of working adults in the UK are saving for retirement outside of their workplace pensions, fresh research from interactive investor shows.

The study found 57 per cent of employed Britons are putting money aside for later life through other methods.

These include cash savings accounts, stocks and shares ISAs, buy-to-let property and other forms of investment.

The findings also highlight a clear trend in how people choose to save.

TRENDING

Stories

Videos

Your Say

Workers are significantly more likely to rely on cash savings than investment-based products when building retirement funds.

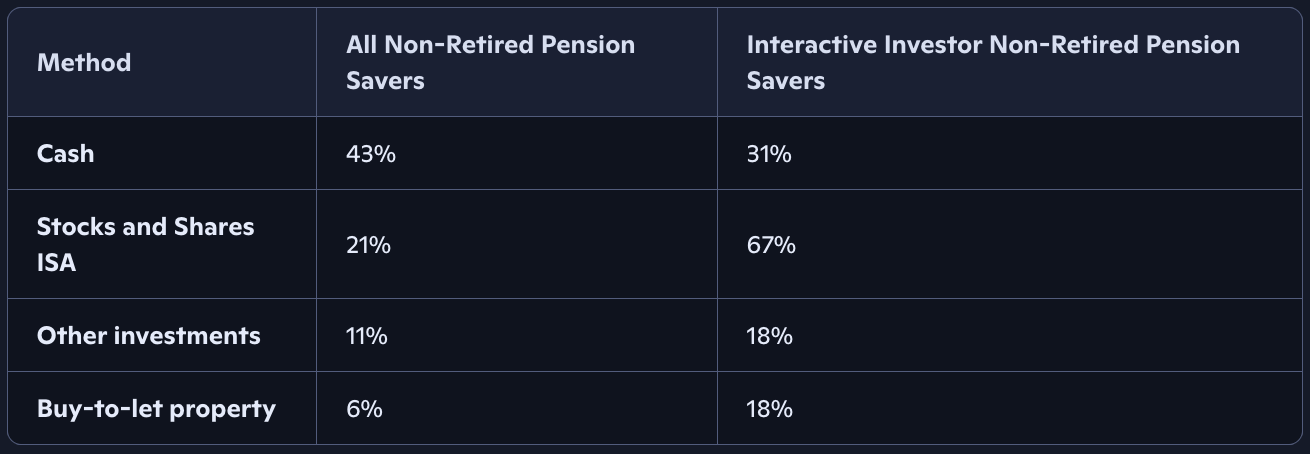

The data shows 43 per cent of people saving outside a pension are using cash deposits.

By contrast, just 21 per cent are using stocks and shares ISAs.

This means workers are more than twice as likely to hold retirement savings in cash rather than invest in the stock market.

Financial experts have raised concerns about this approach.

They warn that cash savings have historically delivered lower long-term returns than investments.

Camilla Esmund, senior manager at interactive investor, said: "It's clear from our research that the constant tinkering of the pension rules is harming public trust in pensions, disincentivising retirement saving, and risks widening the glaring pension engagement gap we have in the UK.

Over half of UK working adults save for retirement beyond workplace pensions, new interactive investor research shows

|GETTY

"Without urgent action to support savers, millions may reach later life without enough money to live comfortably."

Pensions have been under increased scrutiny over the past year.

This has been driven in part by speculation ahead of the November Autumn Budget.

Uncertainty around potential reforms led to concerns about the long-term role of pensions in retirement planning.

Earlier this year, interactive investor’s Great British Retirement Survey called for greater stability in pension policy.

Despite ongoing debate, pensions continue to offer benefits not available through other savings vehicles.

These include employer contributions, upfront tax relief and tax-free growth on investments.

LATEST DEVELOPMENTS

The lack of investing is worrying, she said

|GETTY

Pensions also allow savers to take up to 25 per cent of their pot as a tax-free lump sum.

The research suggests these advantages are not translating into higher pension contributions for many workers.

Instead, a significant proportion are choosing to build retirement funds elsewhere.

Ms Esmund said this trend was worrying.

She said: "However, it's concerning that so many are opting to save in cash for retirement.

"Higher interest rates give the impression that cash savings are a good long-term option, but interest historically lags behind investment growth."

She said this meant the real value of cash savings often declines over time.

Savers who rely too heavily on cash risk missing out on compound investment growth and could materially reduce the size of retirement pots.

Stocks and shares ISAs offer an alternative for those looking to supplement pension savings, which provide flexibility because money can be withdrawn tax-free at any time.

This can help retirement income go further.

Ms Esmund said: "For those who are comfortable with taking more risk, investing in the stock market can generate more long-term growth on their funds, benefiting from compound returns.

How people are saving according to the research

|CoPilot

"What's more, by using an ISA they're shielding any growth and dividends from tax, helping their pot to grow quicker."

Holding ISAs and pensions on a single platform can make retirement planning easier.

It allows savers to view their investments in one place.

She said: "This is especially important when using various accounts to plan for a specific goal like retirement.

"It helps keep costs under control, too, provided the platform used offers good value."

More From GB News