Banking chaos as NatWest customers locked out of accounts and unable to access money after Sainsbury's merger glitch

A local resident just said 'they're waiting for us to die' |

GBNEWS

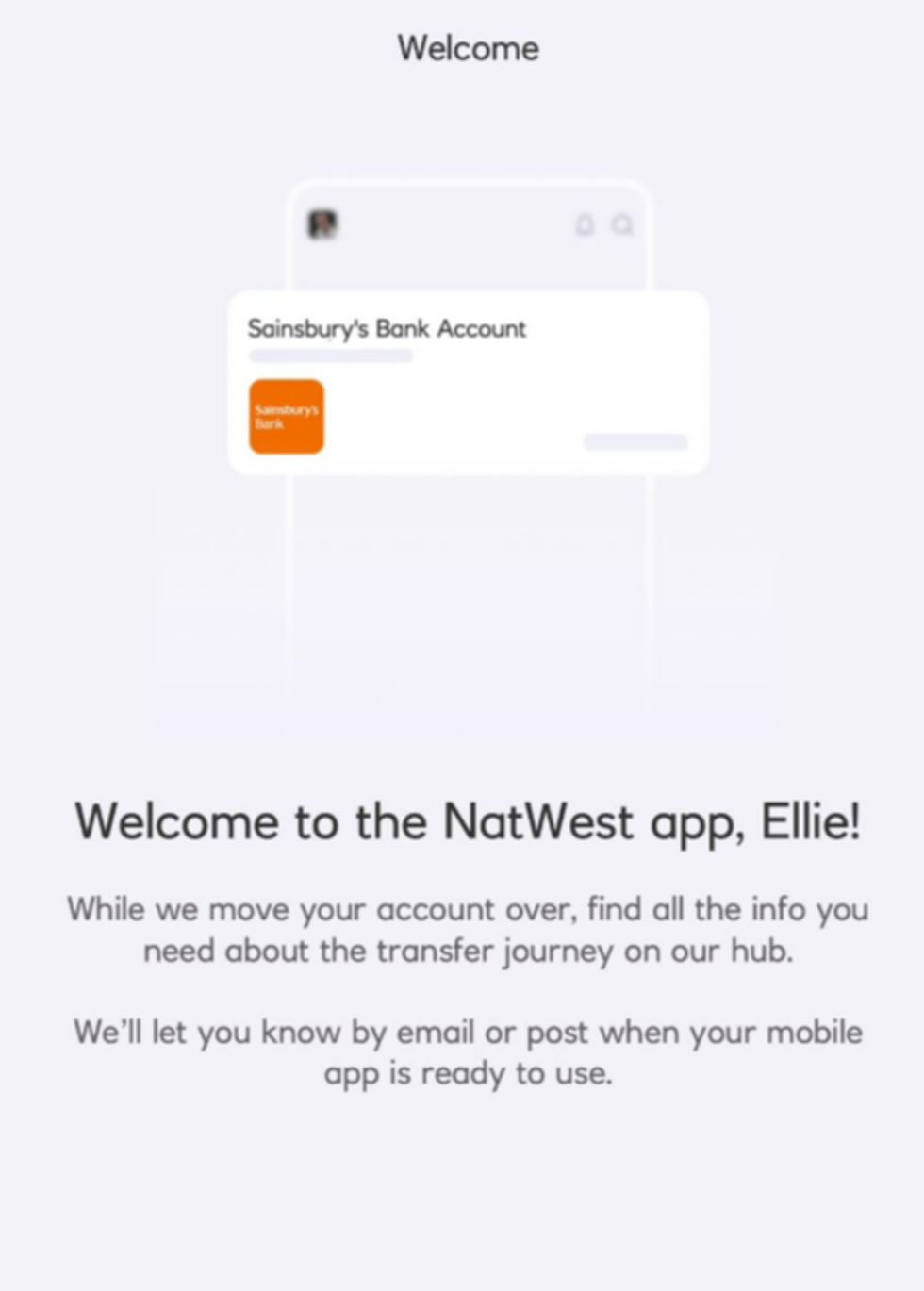

Dozens of users took to X this morning to complain they couldn't log in to their NatWest account

Don't Miss

Most Read

NatWest customers have reported problems accessing the bank’s mobile app as well as the website this morning, leaving some unable to log into their accounts.

The high street lender has not yet confirmed the cause of the disruption, but users on social media say the issue is linked to the recent transfer of Sainsbury's Bank accounts to NatWest.

NatWest has acquired the retail banking business of Sainsbury's Bank, including most of its credit card, personal loan, and savings accounts.

Frustrated customers took to X to vent their anger. One wrote: "@NatWest_Help what on Earth is happening to the NatWest app - went to log on and it’s talking waffle about Sainsbury's. I just want to do my normal internet banking?”

Another user complained: "I am unable to access any of my funds in my NatWest accounts because of the Sainsbury’s loan merge. Online banking requires the app for authentication and I can’t log in. I’ll get an email or letter through the post to tell me when it’s ready!? How long does that take?!"

NatWest has responded to affected customers on X, but has not issued a wider statement.

In one reply, the bank said: "Good morning. Sounds like you’ve been having a bit of trouble there with the app this morning, let me take some details and see what is going on. Please DM me with your full name, post code and sort code and we can take a look."

The app problems come at a sensitive time for the lender, as it integrates Sainsbury's banking arm following its acquisition earlier this year.

Customers have been advised to contact NatWest directly if they are unable to access their funds.

NatWest is set to takeover Sainsbury's Bank | PA

NatWest is set to takeover Sainsbury's Bank | PA One customer wrote on X: “@NatWest_Help app not working, service status page says it is. Tried to use online banking but it wants to verify my login through the app which I can’t access. What can I do?"

Another echoed the same sentiment as said: "When will the app be available for all of us with accounts with Sainsbury's Bank? Utterly ridiculous."

NatWest Group saw its profits climb in the first half of 2025, boosted by its takeover of Sainsbury’s Bank and lower operating costs.

Natest app down

|X

The bank reported a pre-tax operating profit of £3.6billion for the six months to June, an increase of 18 per cent on the same period last year and slightly ahead of analyst forecasts of £3.5billion.

Total income was up by around 12 per cent year-on-year, supported by a rise in customer deposits, while lending also grew during the period on the back of higher mortgage balances.

Sainsbury's Bank has also agreed to sell its travel money business to financial services and foreign exchange company Fexco Group, marking another milestone in the supermarket’s phased withdrawal from its core banking operations.

Sainsbury's said it would be undertaking a "phased withdrawal" from its banking operations

| PAThe deal forms the basis of a new long-term partnership, under which Fexco will provide foreign exchange services under the Sainsbury’s brand. The grocer will receive an ongoing share of sales and rental income from the arrangement.

Shoppers will still be able to use over 220 travel money bureaux in Sainsbury’s stores and online, with the service continuing as normal despite the change in ownership.

The move follows a series of asset sales by Sainsbury’s Bank, including the transfer of its personal loan, credit card and retail deposit portfolios to NatWest Group, its ATM business to NoteMachine, and its Argos financial services cards to NewDay Group.

Sainsbury’s said the latest agreement was consistent with its strategy of focusing on its core retail business, while still securing long-term financial services income streams more closely tied to its supermarket operations.

More From GB News