NatWest accused of 'trying to force businesses to stop accepting cash' as 'ludicrous' limits to be imposed

NatWest is updating the current account terms

|PA

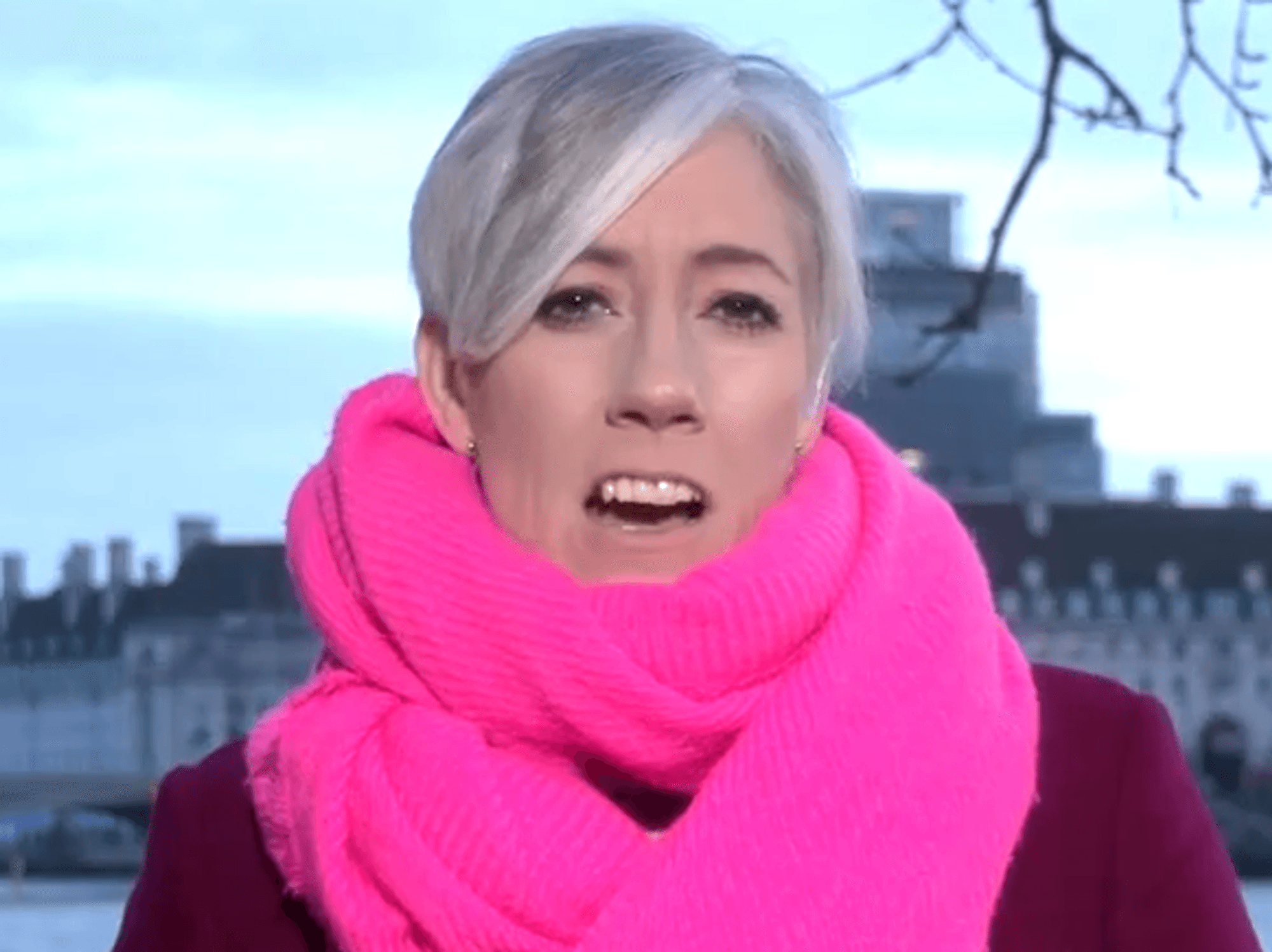

NatWest has written to current account customers advising them of changes to the terms of their account.

Don't Miss

Most Read

NatWest is set to impose new limits on cash deposits next month, fuelling concern among campaigners about an impending cashless society.

The bank has written to customers about the changes, which will take effect from September 11, 2023, stating: “Protecting you from financial crime and fraud is very important to us.”

In a summary of the changes, NatWest said they will “make it clearer” that the bank can set limits on payments to and from the customer’s account.

These limits can apply to different types of payments, including cash deposits and withdrawals, and payments that the bank identifies as going to areas of “high risk of financial crime”.

NatWest has contacted current account customers

|PA

The maximum amount of cash customers can deposit into their account at a bank branch, a Post Office or Cash & Deposit Machine (CDM) is £3,000 per day, and £24,000 in a rolling 12-month period.

In the update sent to customers, the bank said: “We monitor these limits, may change them over time and will make information on them available to you, unless there is a security reason that prevents us from doing so.”

Ron Delnevo, chairman of the Payment Choice Alliance, told GB News he thought the deposit limits were “ludicrously low”.

He said: “Many small businesses operating as sole traders have cash takings well above the level NatWest is imposing. After all, you don’t have to register a business for VAT until your sales reach £85,000 in a year.

“These daft limits are being set to try to force small businesses to stop accepting cash.

“The banks definitely want a ‘cashless’ GB - they don’t care what the small businesses or the public - their customers - want.”

Mr Delnevo urged the Treasury to step in through the Financial Conduct Authority (FCA), but claimed “there is absolutely no sign they intend to do so”.

“It is, of course, particularly bad that NatWest are seemingly trying to force ‘cashless’ on the Britain public, the public who effectively still own nearly 40 per cent of the bank.”

The terms and conditions changes outlined are applicable to personal customers only.

A NatWest spokesperson said: “We have a duty of care to protect customers, communities and society from the effects of fraud and financial crime and we’ve introduced some changes to our terms and conditions to help us to do that more effectively.

LATEST DEVELOPMENTS:

NatWest currently allows current account holders to withdraw up to £750 from an ATM per day

|ALAMY

“We review our policies regularly and always seek to balance our regulatory responsibilities with the needs of our customers”.

Most banks have a daily cap on how much cash customers can withdraw from an ATM and the amount they can transfer from their account in one transaction to try to reduce the risk of them falling victim to fraud.

NatWest currently allows current account holders to withdraw up to £750 out from a cash machine per day. They can take out up to £20,000 from a branch without notifying their branch in advance.

The Government has introduced legislation to Parliament to protect access to cash as part of the Financial Services and Markets Act 2023. The Bill appoints the FCA as the lead regulator for cash, providing it with appropriate powers to ensure reasonable provision of withdrawal and deposit facilities.