Weight loss drug spending ‘could affect size of mortgage you can get’, brokers say

They warn injections may reduce borrowing power

Don't Miss

Most Read

People spending hundreds of pounds each month on weight loss injections such as Wegovy or Mounjaro could see their borrowing power reduced when applying for a mortgage, according to warnings from brokers.

Regular payments for privately prescribed weight loss jabs may be treated in the same way as other committed outgoings during lender affordability assessments.

In some cases, this could reduce the maximum amount a borrower is able to secure by as much as £20,000.

Jamie Alexander, mortgage director at Alexander Southwell Mortgages, said lenders assess monthly expenditure closely when deciding how much they are willing to lend.

TRENDING

Stories

Videos

Your Say

He said monthly spending of £200 to £300 on weight loss injections would likely be factored into affordability checks in the same way as any other regular financial commitment.

First-time buyers and borrowers on lower incomes could be particularly affected by these additional costs.

"If someone is spending around £250 a month on privately prescribed weight loss injections, that could reduce their borrowing capacity by between £10,000 and £20,000, depending on their income and the lender."

The warning comes amid a sharp rise in the use of weight loss medications across the UK.

Research from University College London published this month found around 1.6 million adults across England, Wales and Scotland were using drugs such as Wegovy and Mounjaro between early 2024 and early 2025.

It found the vast majority of users were paying for the treatments privately rather than receiving them through the NHS.

Brokers warn injections may reduce borrowing power

|GETTY

Weight loss injections purchased with a private prescription from supermarkets and high street chemists typically cost between £100 and £350 per month last year.

Industry figures suggest prices for some treatments have since risen further.

Rising costs have led some users to switch medications or seek cheaper alternatives to manage their monthly spending.

When assessing mortgage applications, lenders typically review applicants’ finances in detail to ensure they can afford the repayments.

This often involves examining payslips and bank statements to identify regular outgoings and financial commitments.

Lenders may take into account spending on items such as gym memberships, subscription services and other recurring payments.

LATEST DEVELOPMENTS

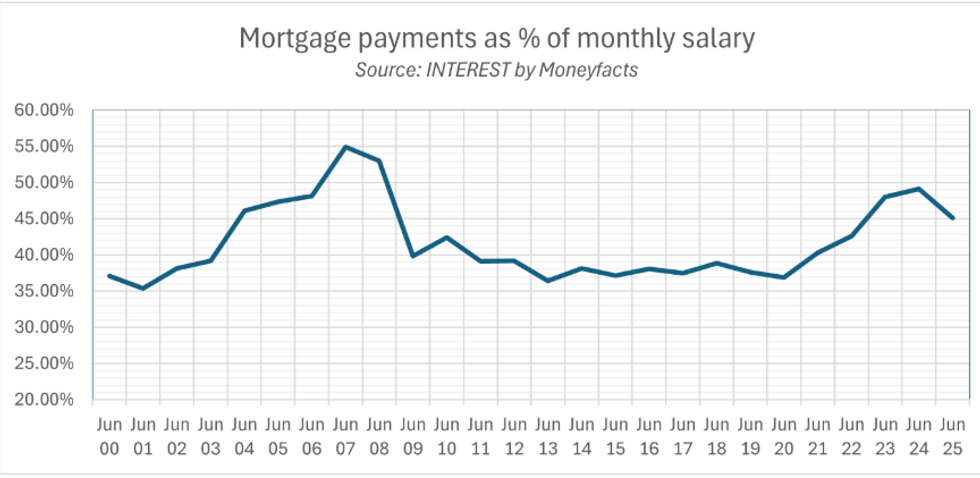

Analysis shows mortgage repayments now swallow nearly half of average earnings | INTEREST BY MONEYFACTS

Analysis shows mortgage repayments now swallow nearly half of average earnings | INTEREST BY MONEYFACTSMortgage brokers often advise applicants to reduce non-essential spending in the months leading up to a mortgage application.

However, some brokers say lenders are now less likely to scrutinise bank statements in detail than they were in the past.

Despite this, brokers warn that high monthly payments for weight loss injections may still attract attention.

Aaron Strutt, mortgage broker at Trinity Financial, said lenders are likely to query any regular outgoing running into hundreds of pounds.

"If someone is spending several hundred pounds a month on weight loss drugs, the lender is probably going to want to know about it."

He added if such payments appear on bank statements, underwriters may ask questions about whether the spending is ongoing.

Mr Alexander warned even if lenders do not raise the issue directly, regular payments could still affect affordability calculations.

He said: "If weight loss jab payments show up on bank statements, lenders will treat them like any other committed bill even if they never ask you about it.

"A regular £200 to £300 outgoing reduces disposable income in affordability checks, which means the maximum loan on offer shrinks."

Not all mortgage experts believe the issue will have a significant impact on most borrowers.

David Hollingworth, associate director at L&C Mortgages, said he had not seen weight loss injection spending cause major problems for applicants.

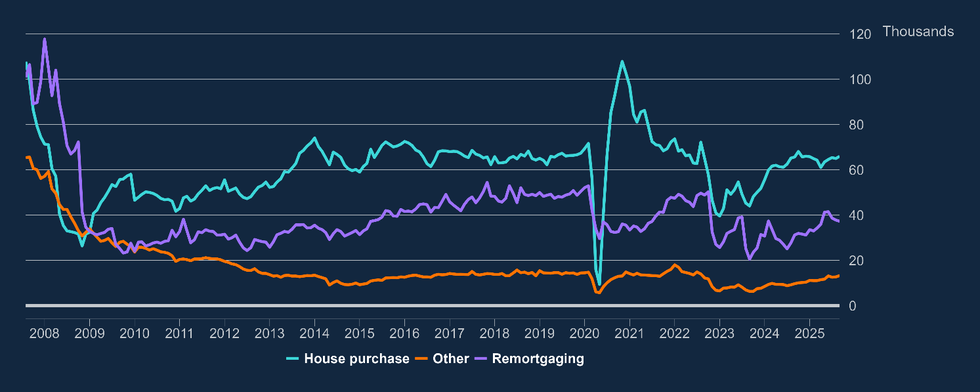

Net mortgage approvals increased by 1,000, to 65,900 in September | BANK OF ENGLAND

Net mortgage approvals increased by 1,000, to 65,900 in September | BANK OF ENGLANDMr Hollingworth said these payments would often be considered discretionary rather than essential spending.

He said: "These are costs that someone could theoretically stop paying, so they may not always be treated in the same way as fixed commitments".

However, he acknowledged there is still a possibility that lenders could question the spending.

Nicholas Mendes, mortgage technical manager at John Charcol, said high monthly outgoings of any kind can prompt further scrutiny during the mortgage process.

"If the spending is significant, it could lead to questions from an underwriter," he said.

"Ultimately, it is something that could be cancelled, but lenders will still want to understand the full financial picture."

The warnings come as weight loss injections continue to grow in popularity across the UK.

The drugs have been promoted for their effectiveness in helping people lose weight, but their ongoing cost can place pressure on household budgets.

Mortgage brokers said borrowers planning to apply for a home loan should be aware that all regular spending, including health-related costs, may influence affordability assessments.

Our Standards: The GB News Editorial Charter

More From GB News