Nationwide Building Society mortgage overhaul as interest rates cut for thousands of buyers - full list

Lenders, including Nationwide, are offering competitive mortgage deals following the Bank of England's recent decision to cut interest rates

Don't Miss

Most Read

Nationwide Building Society is slashing its fixed-rate mortgage offerings from tomorrow (January 15), bringing welcome news for those looking to get onto the property ladder or relocate to a new home.

The lender's reductions of up to 0.20 percentage points will see its cheapest deal drop to 3.50 per cent, targeting both first-time purchasers and existing homeowners seeking to move.

Carlo Pileggi, Nationwide's head of Mortgage Products, said: "Our first set of rate cuts this year will particularly support first-time buyers onto the property ladder as well as those looking to move to their next home.

"Rates starting at 3.50 per cent for new and existing home movers will come as great news to those looking to move home in 2026." The rate reductions span two, three and five-year fixed products, giving borrowers flexibility in how long they wish to lock in their repayments.

Nationwide is cutting mortgage rates once again

|GETTY / NATIONWIDE

As well as this, first-time homebuyers completing their mortgage with Nationwide Building Society will pocket £500 in cashback as an additional incentive attached to these rate cuts.

Those purchasing properties with strong energy efficiency credentials can access further savings through the lender's Green Reward scheme, which offers up to £500 cashback for both first-time buyers and home movers.

The headline 3.50 per cent interest rate applies to a two-year fixed deal for those moving home, available at up to 60% loan-to-value with a £1,499 arrangement fee attached.

This marks Nationwide Building Society's first rate adjustment since early December, signalling renewed appetite for competition in the mortgage market as 2026 gets underway.

2026 could be a good year to buy experts suggest | GETTY

2026 could be a good year to buy experts suggest | GETTYHere is a full list of the mortgage rate cuts from Nationwide Building Society:

Existing and new customers moving home: reductions of up to 0.20 per cent across two, three, and five-year fixed rate products up to 95 per cent loan-to-value (LTV,) including:

- Two-year fixed rate at 60 per cent LTV with a £1,499 fee is 3.50 per cent (reduced by 0.08 per cent)

- Three-year fixed rate at 60 per cent LTV with a £999 fee is 3.62 per cent (reduced by 0.13 per cent)

- Three-year fixed rate at 90 per cent LTV with no fee is 4.43% (reduced by up to 0.20 per cent)

- Two-year fixed rate at 85 per cent LTV with no fee is 3.90% (reduced by 0.11 per cent).

First-time buyers: reductions of up to 0.17 per cent across two, three, and five-year fixed rate products up to 95 per cent LTV, including:

- Two-year fixed rate at 85 per cent LTV with a £999 fee is 3.75 per cent (reduced by 0.17 per cent)

- Two-year fixed rate at 60 per cent LTV with a £1,499 fee is 3.67 per cent (reduced by 0.16 per cent)

- Five-year fixed rate at 90 per cent LTV with a £999 fee is 4.22 per cent (reduced by 0.07 per cent)

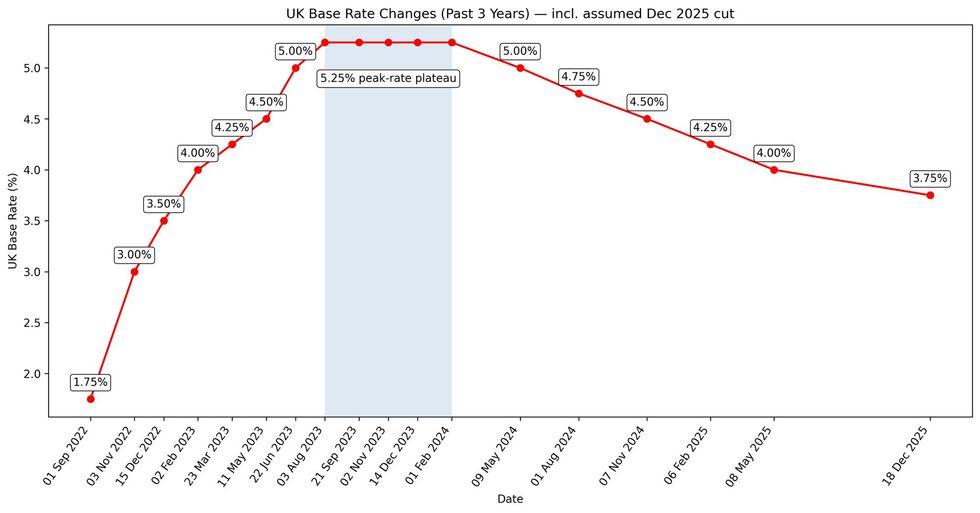

The Bank of England recently cut the base rate

| PALATEST DEVELOPMENTS

Industry observers are characterising the move as the opening salvo in what could become fierce competition among major lenders throughout the next year.

Darryl Dhoffer, the founder at Bedford-based The Mortgage Geezer, told Newspage: "Nationwide just fired their starting gun for the 2026 property market.

"The UK's biggest building society has slashed rates by up to 0.2%, unveiling a headline-grabbing 3.50% 2-year fixed deal for homemovers up to 60% loan-to-value with a £1,499 fee. This is a massive statement."

He added that breaking through the 3.5% threshold demonstrates lenders are "hungry for volume and willing to squeeze margins to get it", predicting a "domino effect across the Big Six".

The Bank of England has made changes to the base rate in recent years | CHAT GPT

The Bank of England has made changes to the base rate in recent years | CHAT GPT Andrew Montlake, CEO at London-based Coreco, said borrowers will benefit from what is now a mortgage rate war. He continued: "Rates are moving in the right direction again." However, several mortgage specialists urged borrowers to look beyond the headline figures when assessing these products.

Shaun Sturgess, the director at Swansea-based Sturgess Mortgage Solutions, said: "The headline rates come with very steep fees, which means they won't be suitable or accessible for a lot of borrowers. They look great on paper, but they have to be judged on total cost, not just the rate."

Katy Eatenton, the mortgage and protection specialist at St Albans-based Lifetime Wealth Management, echoed this sentiment, noting the 3.5 per cent rate comes with restrictions including a maximum 60% loan-to-value.

She continued: "But this does show the direction rates are headed, which is down. When a lender like Nationwide makes a move, others tend to follow." Samuel Mather-Holgate, the founder of Mather and Murray Financial expects rival lenders to announce their own reductions within days.

More From GB News