Nationwide Building Society cuts mortgage rates after Bank of England decision

The Bank of England reduced the base rate from four per cent to 3.75 per cent earlier today

Don't Miss

Most Read

Nationwide Building Society has confirmed it will be cut mortgage rates following today's Bank of England base rate announcement in a win for Britons looking to remortgage and get on the property ladder.

Earlier this afternoon, the central bank's Monetary Policy Committee (MPC) reduced interest rates from four per cent to 3.75 per cent, offering much-needed relief to borrowers.

This appears to be being passed onto consumers immediately with Nationwide revealing customers on the building society's standard mortgage rate will see a similar 0.25 per cent decrease in their current deals.

According to the high street financial institution, this will be applied from January 1, 2026 with the new SMR being 6.49 per cent in beginning of the New Year.

Nationwide is cutting mortgage rates

|GETTY / NATIONWIDE

Interest rates attached tot racker mortgages held by existing Nationwide customers automatically decrease when Bank of England's base rate is reduced, so these will decrease to reflect the change from January 1 also.

Reacting to today's news, Jenny Ross, the editor of Which? Money said: "The Bank's decision to cut interest rates is great news for home buyers and those coming to the end of their fixed-rate mortgage deals.

"Though many banks have already made preemptive cuts to their rates in recent weeks, this decision will hopefully mark the beginning of a continuing downward trend in 2026.

"If you're a saver, now is the time to take stock of your accounts. Our recent analysis found many of the big banks are failing to offer competitive returns, and will likely be quick to slash their rates further in the wake of this latest cut. There are good deals out there - but you'll likely need to look beyond the high street to find them."

The Bank of England cut the base rate earlier today

| GETTYHowever, markets are pricing in only base rate reduction from the Bank's MPC in 2026 which means the cost of borrowing will remain at 3.25 per cent for the majority of next year.

Lorna Hopes, mortgage specialist at the chartered financial advisers Smith & Pinching, warned that households should not expect dramatic cuts from the central bank in the months ahead.

Ms Hopes shared: "The Bank of England has delivered the Christmas present that thousands of homebuyers, and anyone about to remortgage, was hoping for.

"Not that it was much of a surprise mind; the wrapping paper has been virtually transparent for weeks.

"Britain’s slowing economy, and the spike in unemployment to its highest level in nearly five years, had left the Bank’s ratesetting committee no choice but to cut the base rate. With inflation cooling, the Bank had no reason to hold back.

"Expectations of today’s cut were so nailed on that a mini price war has already broken out between lenders, with banks and the bigger building societies cutting their fixed rates and fighting hard for market share.

"Many borrowers can now get a fixed rate of well under four per cent, and there are some eye-catching deals available to some remortgagers and buyers with a big deposit.

"Anyone with a variable rate mortgage will see their monthly payments tick down automatically as a result of today’s decision, but the biggest winners might be the thousands of people due to come off a two-year fixed rate deal in 2026; they should be able to remortgage onto a much lower rate.

LATEST DEVELOPMENTS

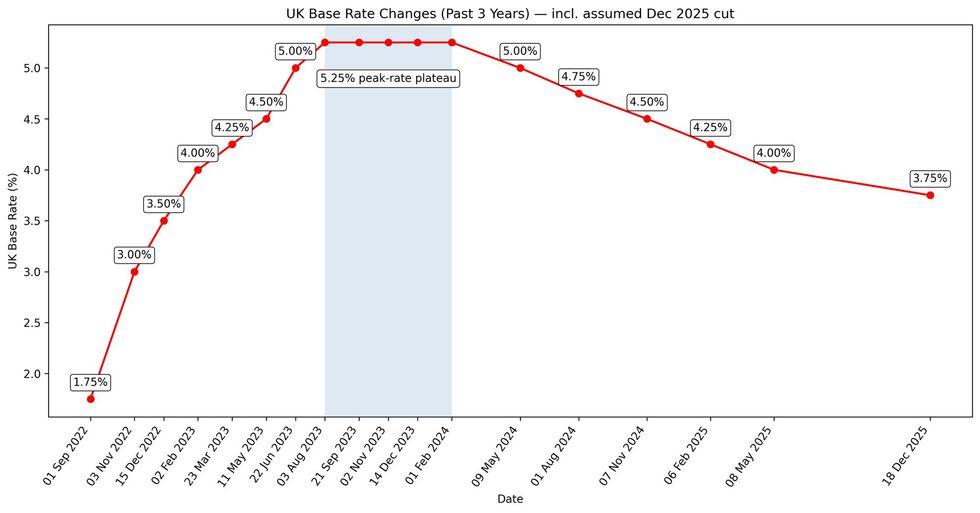

The Bank of England has made changes to the base rate in recent years | CHAT GPT

The Bank of England has made changes to the base rate in recent years | CHAT GPT "The mortgage markets now expect there to be at least one more cut to the Bank’s base rate in 2026, with the next one perhaps coming in February. But if you’re holding out for mortgage rates to get even lower, don’t expect them to keep falling all year. We may already be close to the bottom of the interest rate cycle.

"So if you have a mortgage with a fixed rate that’s due to expire in the first half of 2026, it’s worth shopping around and talking to a broker now.

"You can reserve a new rate up to six months before the end of your current deal, and doing so will ensure you don’t lose out if rates start creeping back up before your current deal ends."

The Bank of England's next MPC meeting to discuss the UK base rate is scheduled to take place on February 5, 2025.