Savings disaster: Cash ISA returns 'eroded' in low interest rate accounts as inflation eats away at wealth

Britons are being urged to consider investing and ditch low interest savings accounts to boost their finances

Don't Miss

Most Read

Savings are being "eroded" by low interest rate accounts from high street banks and building societies, financial analysts have warned ahead of a major Bank of England announcement.

In recent years, Britons have enjoyed a period of relatively high savings rates thanks to the central bank's decision to raise the base rate in an effort to ease the consumer price index (CPI) rate of inflation.

The Bank's Monetary Policy Committee (MPC) will announce any changes to the cost of borrowing later today at 12pm with the base rate currently sitting at four per cent.

Earlier this week, the Office for National Statistics (ONS) confirmed the CPI rate for the 12 months to November 2025 eased to 3.2 per cent. Markets are pricing in a 0.25 percentage point reduction in interest rates to 3.75 per cent.

Britons are seeing their savings 'eroded'

|GETTY

Despite this period of competitive savings rates, new analysis suggests bank customers could have received better returns over the years if they invested their money instead.

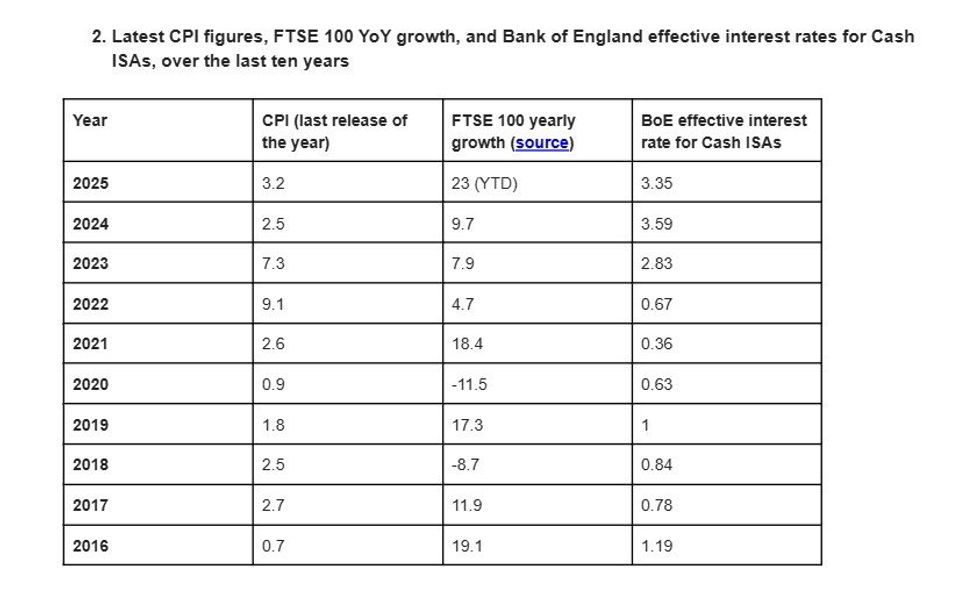

Wander Rutgers, the CEO of investment platform Lightyear, warned that savers are losing out in real terms by keeping their money in cash or in sluggish cash ISAs, while the FTSE outperformed the CPI for seven of the last 10 years.

While inflation has eased, interest rates attached to high street banks’ easy-access cash ISA and savings accounts have remain under the CPI to as low as one per cent.

As a result, people choosing to save their money are finding their cash "eroded" over time when greater returns could have been accrued through investing.

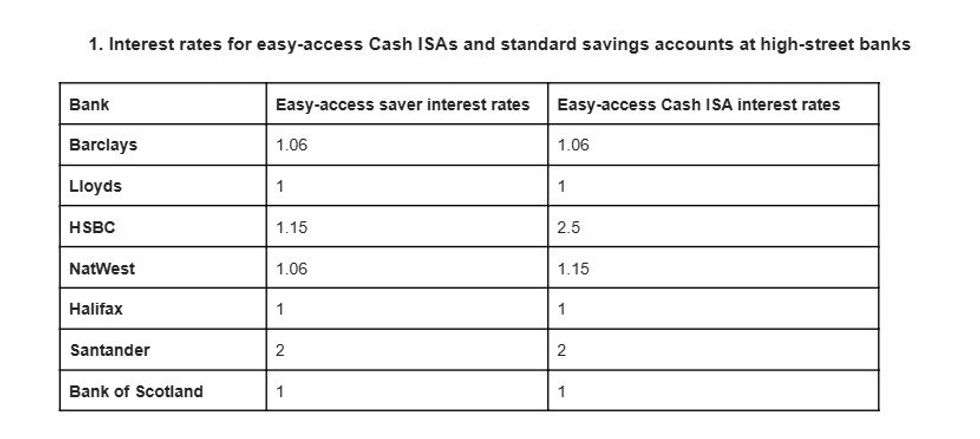

What are the major banks offering savers?

|LIGHTYEAR

Mr Rutgers said: "[Yesterday's] CPI figures are yet another reminder that millions of people are losing out by keeping their savings stashed in cash.

"Whether it’s Barclays, Lloyds, or HSBC, the major high-street banks are offering interest rates well below the rate of inflation, meaning people saving their pennies up for Christmas in cash products are seeing their spending power steadily eroded.

"Cash alone is therefore a losing strategy for those looking to build their wealth meaningfully.

"If people want to be smart as we head into the New Year, they should consider putting their money to work by investing in stocks and shares to give them a fighting chance of outpacing inflation and achieving their long-term financial goals."

How have interest rates kept up with the Ftse's growth?

|LIGHTYEAR

Kevin Brown, a savings expert at Scottish Friendly, agreed investing could be the best option for households going into 2026 as the Bank of England preps a bare rate cut.

Mr Brown shared: "As for savers, it means the best rates won’t be around for long – so now could be the time to act.

"And for those looking to improve their chances of outpacing inflation, investing remains the more effective option to provide the potential for greater returns over the long term."

Caitlyn Eastell, a spokesperson for Moneyfactscompare, cited the impact of frozen tax thresholds on the ability of savers to generate the best returns for themselves.

LATEST DEVELOPMENTS

Britons are looking for the best savings deals

| GETTYShe added: "It’s as crucial as ever that savers now pay closer attention to how to get their money working its hardest. Inflation remains one of the biggest threats, however, fiscal drag also plays a major role.

"The income tax threshold freeze could haul millions of consumers into higher tax brackets and subsequently receiving a surprise tax bill as their personal savings allowance is halved from £1,000 to £500.

"Although the interest rates offered on cash ISAs are typically lower than their non-ISA counterparts, they may be more favourable in the long run as all interest earned is tax-free."