Bank of England cuts base rate to 'almost three-year low' - what does it mean for your mortgage and savings?

Mortgage and debt repayments will be impacted by the Bank of England's latest interest announcement

Don't Miss

Most Read

Latest

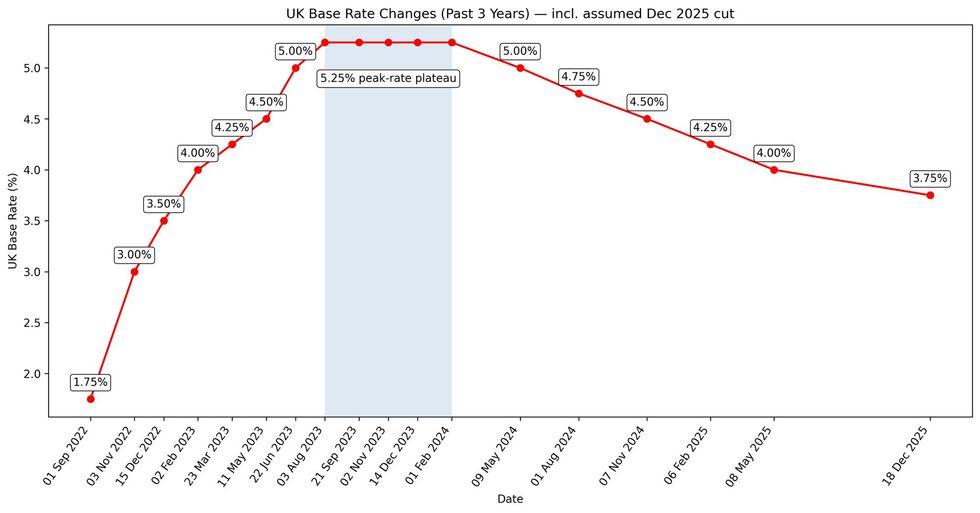

The Bank of England has confirmed it has cut the UK's base rate from four per cent to 3.75 per cent in a win for mortgage holders, businesses, the Government and borrowers.

Markets had priced in a 0.25 percentage point reduction from the central bank after the consumer price index (CPI) inflation rate for the 12 months to November 2025 eased to 3.2 per cent, based on the latest Office for National Statistics (ONS) figures.

The base rate is the cost of borrowing the Bank charges commercial financial institutions which is passed onto consumers via savings accounts, mortgage products, loans and credit cards.

In recent years, the Bank of England's Monetary Policy Committee (MPC) has voted to raise interest rates to as high as 5.25 per cent in an effort to bring down inflation during the ongoing cost of living crisis.

The Bank of England has cut the base rate to 3.75 per cent

|GETTY / CHAT GPT

Today's decision appears to have divided committee members with the nine-person MPC only voting five-to-four to cut the base rate to 3.75 per cent.

The five members included Bank of England governor Andrew Bailey, Sarah Breeden, Swati Dhingra, Dave Ramsden and Alan Taylor.

Mr Bailey said the UK has “passed the recent peak in inflation and it has continued to fall”, allowing the MPC to cut borrowing costs for the fourth time this year.

He added: "We still think rates are on a gradual path downward. But with every cut we make, how much further we go becomes a closer call.”

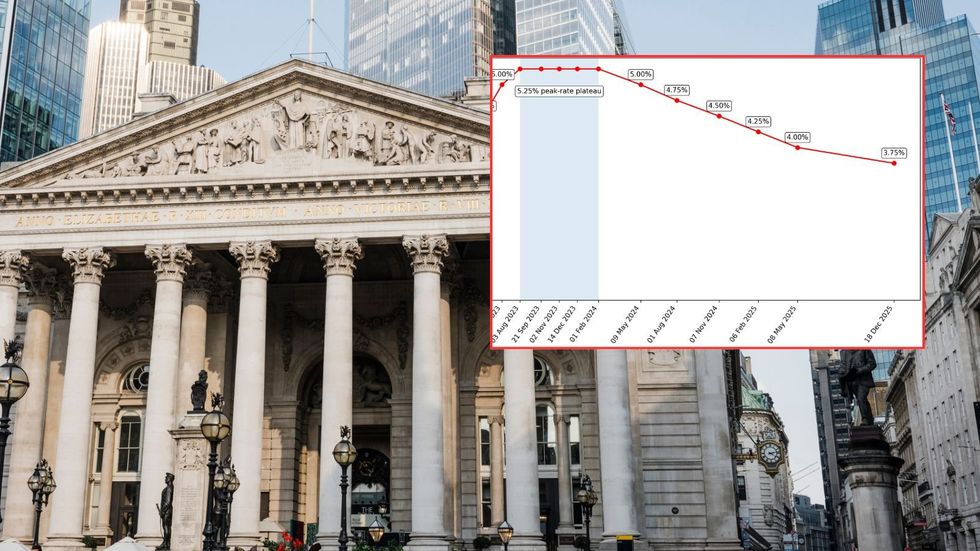

The Bank of England has made changes to the base rate in recent years

|CHAT GPT

This comes after official data showed a 0.1% contraction in October, which was weaker than it had been expecting.While savers have benefited from this period of competitive interest rates, mortgage holders and debt borrowers have been saddled with higher repayments.

In response to interest rates falling, Chancellor Rachel Reeves said: "This is the sixth interest rate cut since the election - that's the fastest pace of cuts in 17 years, good news for families with mortgages and businesses with loans.

"But I know there's more to do to help families with the cost of living. That's why at the Budget we froze rails fares and prescription charges, and will be cutting £150 off the average energy bill next year."

Ahead of today's announcement, AJ Bell's head of investment analysis Laith Khalaf said: "A cut would take base rate to its lowest level in almost three years. The last time base rate began with a ‘three’ was on February 2, 2023, just before the Bank hiked rates to four per cent in the face of a brutal inflationary storm.

LATEST DEVELOPMENTS

"The market is now expecting just one interest rate cut in the UK next year, which would be a step-change from the metronomic quarterly cuts we have seen in 2025.

"Of course, market expectations can be pretty sensitive to prevailing sentiment, and much can change in the economic data which would move the dial in either direction. But this isn’t an isolated case of the end of the rate cutting cycle moving into view."

Wander Rutgers, the CEO of investment platform Lightyear, said:: "While a base rate cut is positive news, inflation means there is still pressure on household budgets. Major high-street banks like Barclays, HSBC and Lloyds are already offering interest rates on savings well below the base rate, and more banks are sure to follow.

"As we head into the New Year, savers should assess if their money is really working hard enough for them. With more than three months left to use up this year’s ISA allowance, now is a good time to start building confidence with investing so savers can head into the new financial year in an even stronger position, ready to grow their wealth long-term - rather than have it chipped away with inflation and low interest."

More From GB News