UK Government borrowing falls to £11.6billion but remains one of the highest on record for the month

UK government borrowing was significantly lower last month, due to an increase in tax income outweighing spending, official figures show

Don't Miss

Most Read

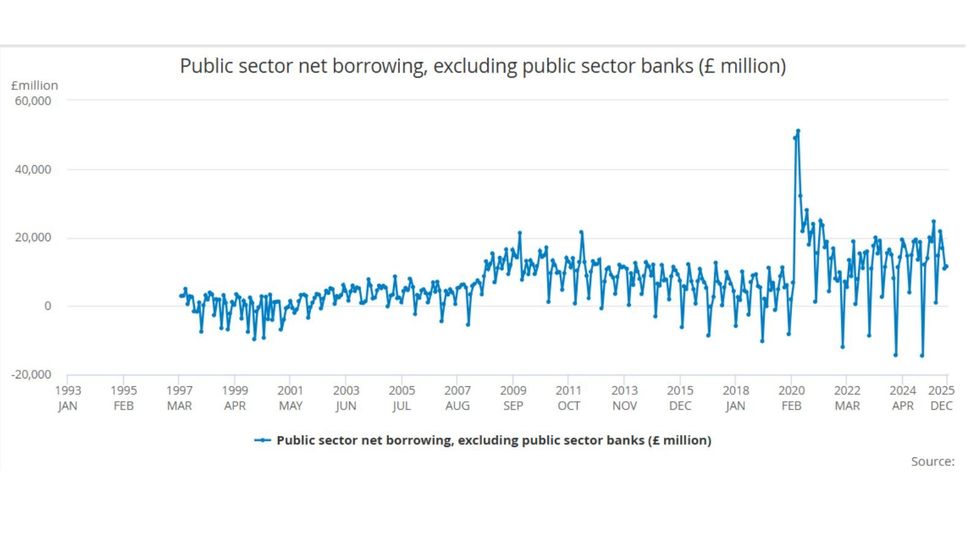

UK Government borrowing reached £11.6billion in December, according to fresh data from the Office for National Statistics released today.

The figure represents a decline of £7.1billion, or 38 per cent, compared with the same month in 2024.

Economists surveyed by Reuters had anticipated borrowing of approximately £13billion, making the actual outcome a welcome surprise for Chancellor Rachel Reeves following her tax-raising November Budget.

Borrowing over the financial year from April totalled £140.4billion, about £300 million lower than the same period in 2024, the ONS said.

Despite the annual fall, the December 2025 figure was the tenth highest for the month since records began in 1993, without adjusting for inflation.

And it remains higher than December 2023, when borrowing stood at £8.1bn.

Cumulative borrowing for the first nine months of the financial year, beginning in April, stood at £140.4billion, representing a marginal reduction of £300million from the equivalent period last year.

ONS senior statistician Tom Davies attributed the December improvement to significantly stronger receipts compared with 2024, while expenditure increased only modestly.

"Borrowing in December was substantially down on the same month in 2024, as a result of receipts being up strongly on last year whereas spending is only modestly higher," Mr Davies said.

He added that across the nine-month period, borrowing was "fractionally lower" than during the corresponding timeframe in the previous fiscal year.

Government borrowing remains one of the highest on record for the month

|GETTY/ONS

Professor Joe Nellis, economic adviser at accountancy firm MHA, offered a cautiously optimistic assessment of the public finances.

"While there is no room for complacency, fiscal sustainability is likely to become more manageable as 2026 progresses," he said.

Mr Nellis pointed to November's GDP growth of 0.3 per cent, which exceeded expectations and helped support government revenues.

Declining inflation and moderating wage growth are also easing pressure on public sector spending, particularly for items linked to inflation.

UK Government borrowing falls to £11.6billion

|ONS

For bond markets, the lower-than-anticipated borrowing should provide reassurance about the government's long-term fiscal strategy, potentially supporting more stable gilt yields alongside hopes of a spring interest rate reduction.

However, former Office for Budget Responsibility chair Richard Hughes has challenged the Chancellor's fiscal framework, describing current rules as among the most permissive in British history.

Speaking to the Lords Economic Affairs Committee two weeks ago, Hughes argued that the government was running a budget deficit of approximately five per cent of GDP, hampering efforts to build resilience against economic shocks.

"The rules we have at the moment are providing the government the capacity to run a quite significant structural deficit," he told peers.

The UK’s fiscal position is heading towards a more stable condition than many had feared

| GETTYHis criticism came as Ms Reeves promoted Britain as a "stable" destination for investors, emphasising her commitment to maintaining fiscal discipline.

Chief Secretary to the Treasury James Murray said the Government was "reducing borrowing" after official figures showed tax receipts outweighed a rise in public sector spending last month.

He said: "Last year we doubled our headroom and we are forecast to cut borrowing more than any other G7 country with borrowing set to be the lowest this year since before the pandemic.

"It cannot be right that £1 in every £10 we spend goes on debt interest – which could be better spent on our nurses, police officers and teachers – that’s why we’re tackling it.

"We are stabilising the economy, reducing borrowing, rooting out waste in the public sector and making sure that public services deliver value for taxpayers’ money."

More From GB News