First-time buyers borrow record £82 BILLION to access housing ladder

Typical first mortgages have hit record levels as lenders relax stress tests

Don't Miss

Most Read

First-time buyers across Britain are borrowing more than ever before to secure their first home, with the typical mortgage reaching a record £210,800 in the twelve months ending September, according to new analysis from Savills.

The figure marks the highest average borrowing level ever recorded for first-time purchasers.

Savills said the increase reflects a significant shift in the housing market, with new entrants now accounting for a growing share of overall residential spending.

First-time buyers now represent around a fifth of all spending on residential property across the UK.

TRENDING

Stories

Videos

Your Say

That proportion is the highest level recorded since at least 2007, highlighting the increased financial weight of those entering the housing market for the first time.

The trend is particularly pronounced in London, where first-time buyers are playing a dominant role in property transactions.

Research from estate agent Hamptons shows first-time buyers accounted for more than half of all property purchases in the capital this year.

Across the UK, mortgage lenders advanced a total of £82.8billion to around 390,000 first-time buyers during the period.

That figure represents an increase of around 30 per cent compared with the previous year.

Savills said several factors have combined to boost borrowing capacity among first-time buyers.

First-time buyers in Britain borrow record £210,800 average mortgage says Savills analysis

|GETTY

Stronger wage growth has enabled buyers to afford larger mortgages than in previous years.

Regulatory changes have also played a key role in expanding access to mortgage finance.

In March, the Financial Conduct Authority (FCA) issued guidance suggesting some lenders’ stress testing practices "may be unduly restricting access to otherwise affordable mortgages".

They also announced on Monday plans to overhaul mortgage regulation to ease loans for first-time buyers and the self-employed.

Reform package focuses on four areas simplifying rules for new entrants and disenfranchised groups

The regulator reminded lenders they have "flexibility to design their test in a way that is appropriate" for their customer base.

Following the guidance, most mortgage providers reduced the interest rates used in affordability stress tests.

As a result, many first-time buyers can now borrow between £20,000 and £40,000 more than under earlier criteria.

LATEST DEVELOPMENTS

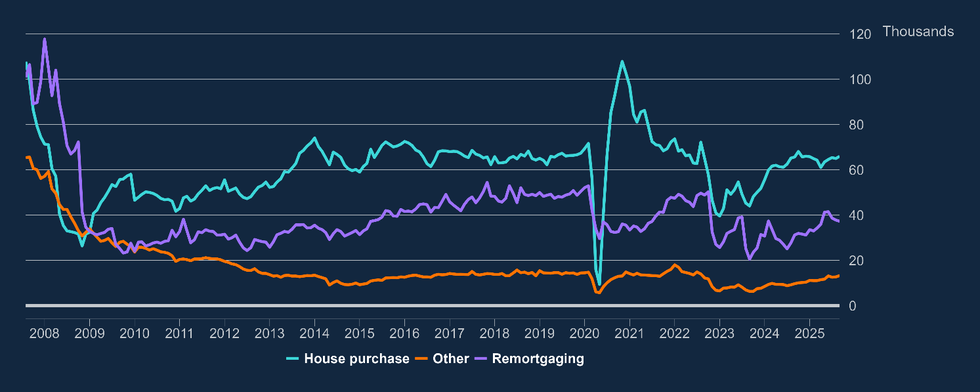

Net mortgage approvals increased by 1,000, to 65,900 in September | BANK OF ENGLAND

Net mortgage approvals increased by 1,000, to 65,900 in September | BANK OF ENGLANDLucian Cook, head of residential research at Savills, said the shift reflects a "slightly more relaxed approach" from mortgage lenders.

Changes to stamp duty also influenced buyer behaviour over the past year.

A temporary stamp duty threshold allowed first-time buyers to avoid paying tax on the first £425,000 of a property’s value.

The threshold reverted to £300,000 in April, prompting many buyers to bring forward purchases.

Savills said the higher threshold encouraged some buyers to bypass traditional starter flats.

Instead, many opted to purchase houses that better suited their long-term needs.

Data from the Mortgage Advice Bureau shows the typical first-time buyer is now aged 34.

Nearly a third of first-time buyers already have children when they purchase their first property.

Price movements have also helped support buyer activity in some parts of the country.

Falling prices in certain regions have created what analysts describe as a buyer’s market.

London has seen one of the most notable shifts, with Hamptons confirming first-time buyers completed more than half of all property sales in the capital during 2025.

Savills said this represents a significant change in the makeup of housing transactions.

Mr Cook said: "Home ownership is more accessible now than at any point in the last three years, thanks to lower borrowing costs, lower real house prices, and more accessible mortgage debt".

Mortgage rates have continued to ease, further improving affordability for new buyers.

According to Moneyfacts, the average two-year fixed mortgage rate currently stands at 4.91 per cent.

The average five-year fixed rate is slightly lower at 4.86 per cent.

Savills said first-time buyers are now better placed to compete than any stage since rates rose

|GETTY

Moneyfacts said these are the most competitive rates available since before the market disruption caused by the September 2022 mini-budget.House prices have also moderated over the past year.

Rightmove data indicates buyers can typically secure a property for around £2,000 less than twelve months earlier.

Savills said the combination of improved borrowing capacity, softer house prices and more flexible lending criteria has reshaped conditions for first-time buyers.

The firm said first-time buyers are now better placed to compete in the market than at any stage since interest rates began rising.

More From GB News