Britons could save £4k in mortgage payment hack after Bank of England interest rate cut

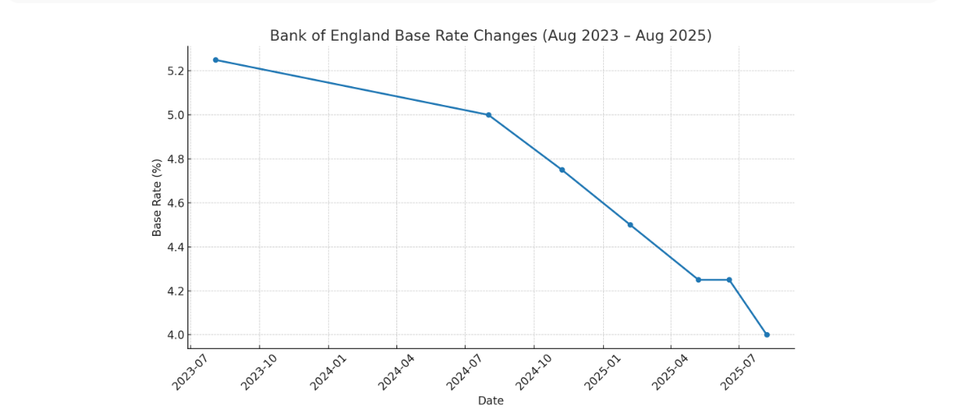

The Bank of England is forecast to slash interest rates to four per cent later today

Don't Miss

Most Read

Latest

Homeowners with variable rate mortgages could benefit significantly by maintaining their current payment levels when the Bank of England reduces interest rates, financial experts suggest.

Rather than pocketing the monthly savings from lower rates, borrowers are being encouraged to direct these funds towards overpaying their mortgages.

Approximately 17 per cent of mortgage holders currently have variable rate products, meaning their monthly payments automatically decrease when the central bank lowers rates.

Financial specialists argue that continuing to pay the original amount could dramatically reduce both the total interest paid and the length of the mortgage term, potentially saving borrowers thousands of pounds.

Britons could save £4,000 thanks to this savings hack

|GETTY

A practical illustration demonstrates the potential benefits. For a borrower with a £150,000 mortgage at 4.25 per cent over 25 years, monthly payments currently stand at approximately £812.

Should the Bank of England implement a 0.25 per cent rate reduction to four per cent, these payments would decrease to £791.

This represents a monthly saving of £21, or £252 annually. However, by maintaining the original payment amount and directing the £21 difference towards overpayments, the borrower could achieve substantial long-term savings.

This approach would reduce total interest payments by £4,280 and shorten the mortgage term by one year and one month.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

The Bank of England is forecast to slash the base rate cut later today

| GETTYJinesh Vohra, chief executive of mortgage overpayment app Sprive, emphasises that overpayments represent "one of the most powerful ways to become mortgage-free faster".

He notes that "even small, regular overpayments can knock years off the term and save thousands in interest – helping mortgage holders reach financial freedom sooner, without stretching their budget".

The Sprive application offers homeowners a free platform to facilitate overpayments. Users can shop through more than 85 retailers via the app, earning cashback that transfers directly to their mortgage with a single tap.

Additionally, the app's Auto Save function examines spending patterns and allocates manageable weekly amounts towards mortgage overpayments.

Christopher Lynch, 31 from Croydon in South London, demonstrates the practical impact of consistent overpayments.

Since beginning to use Sprive in summer 2023 for his £190,000 mortgage taken out in late 2022, he has already reduced his term by two and a half years.

LATEST DEVELOPMENTS:

The Bank of England has brought interest rates down in recent years

|CHAT GPT

Lynch typically spends £30 to £40 weekly through the platform's cashback feature, primarily on Deliveroo and Amazon purchases.

He supplements this with monthly autosave contributions of at least £50, adjusting based on other financial commitments.

"I've already saved 2.5 years off my mortgage and I'm on track to save a good 3-4 more years, hopefully," Lynch said.

The Bank of England's Monetary Policy Committee (MPC) will announce any changes to the UK's base rate later today at 12pm.

More From GB News