Nationwide Building Society cuts mortgage rates ahead of Bank of England decision - full list of changes

Savers urged to be careful of tax on savings interest |

The country's second-largest mortgage lender is slashing interest rates

Don't Miss

Most Read

Latest

Nationwide Building Society has announced another major change to its line of mortgage products in a significant boon for homeowners and prospective homebuyers.

From tomorrow, Wednesday July 30, the lender will be slashing rates attached to two-year, three-year and five-year fixed rates by 0.21 percentage points.

Mortgage holders have been saddled with record-high monthly repayments in recent years due to base rate hikes from the Bank of England in its fight against inflation.

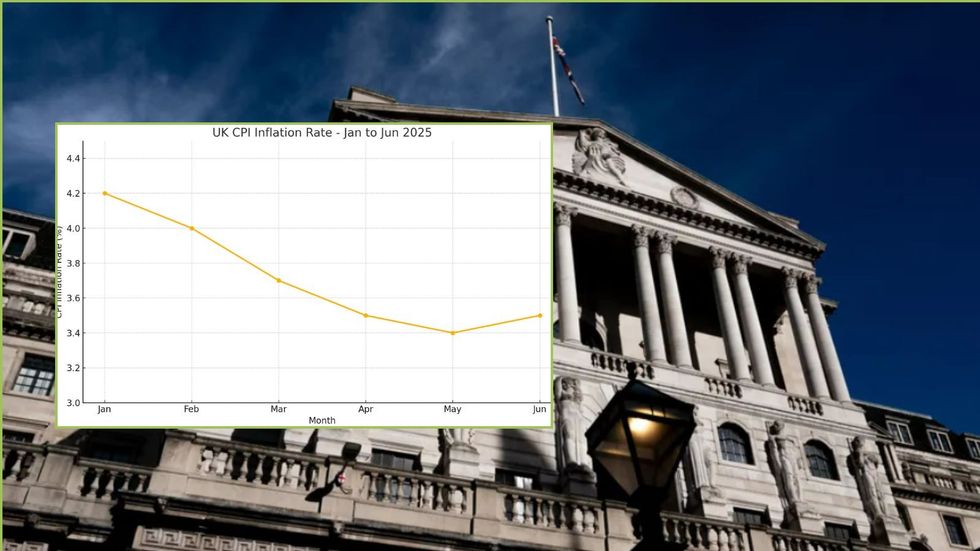

However, with inflation easing closer to two per cent, the central bank is expected to slash interest rates two more times this year, which will impact the cost of borrowing passed

Nationwide Building Society is overhauling its line of mortgage products

| NATIONWIDE BUILDING SOCIETYAccording to the financial institution, first-time buyers, home movers and homeowners looking to remortgage will benefit from these latest interest cuts.

With this latest move from the building society, Nationwide's lowest mortgage rate now sits at 3.74 per cent.

The new interest rates from Nationwide Building Society include:

First-time buyers

- Three-year fixed rate at 90 per cent LTV with no fee is 4.79 per cent (reduced by 0.21 per cent)

- Two-year fixed rate at 90 per cent LTV with a £999 fee is 4.33 per cent (reduced by 0.11 per cent)

- Two-year fixed rate at 60 per cent LTV with a £1,499 fee1 is 3.86% (reduced by 0.08 per cent).

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

The building society is being praised for its 'excellent' mortgage deal despite rates rising | GETTY

The building society is being praised for its 'excellent' mortgage deal despite rates rising | GETTY New customers moving home

- Two-year fixed rate at 60 per cent LTV with a £1,499 fee1 is 3.74 per cent (reduced by 0.07 per cent)

- Two-year fixed rate at 90 per cent LTV with a £999 fee is 4.27 per cent (reduced by 0.18 per cent)

- Five-year fixed rate at 85 per cent LTV with a £999 fee is 4.09 per cent (reduced by 0.11 per cent).

Existing customers moving home

- Two-year fixed rate at 60 per cent LTV with a £1,499 fee is 3.74 per cent (reduced by 0.07 per cent)

- Two-year fixed rate at 90 per cent LTV with a £999 fee is 4.27 per cent (reduced by 0.17 per cent)

- Five-year fixed rate at 85 per cent LTV with a £999 fee is 4.09 per cent (reduced by 0.10 per cent).

Remortgage

- Two-year fixed rate at 75 per cent LTV with a £999 fee is 3.99 per cent (reduced by 0.15 per cent).

LATEST DEVELOPMENTS:

Inflation rises to 3.5% in blow to households - but Bank of England still tipped to cut interest rates

Inflation rises to 3.5% in blow to households - but Bank of England still tipped to cut interest ratesCarlo Pileggi, Nationwide’s senior manager for Mortgages, said: “As the country’s second largest lender, we always strive to support all parts of the market with competitive rates.

"This latest round of cuts across our range move even more of our rates below four per cent and should put Nationwide front of mind of first-time buyers, those moving on to their next home and those looking for a new mortgage deal."

The Bank of England's Monetary Policy Committee (MPC) is next scheduled to meet and discuss the UK's base rate on August 7, 2025.

More From GB News