Debt crisis as British borrowers face 'staggering' £13k interest rate charges due to credit issue

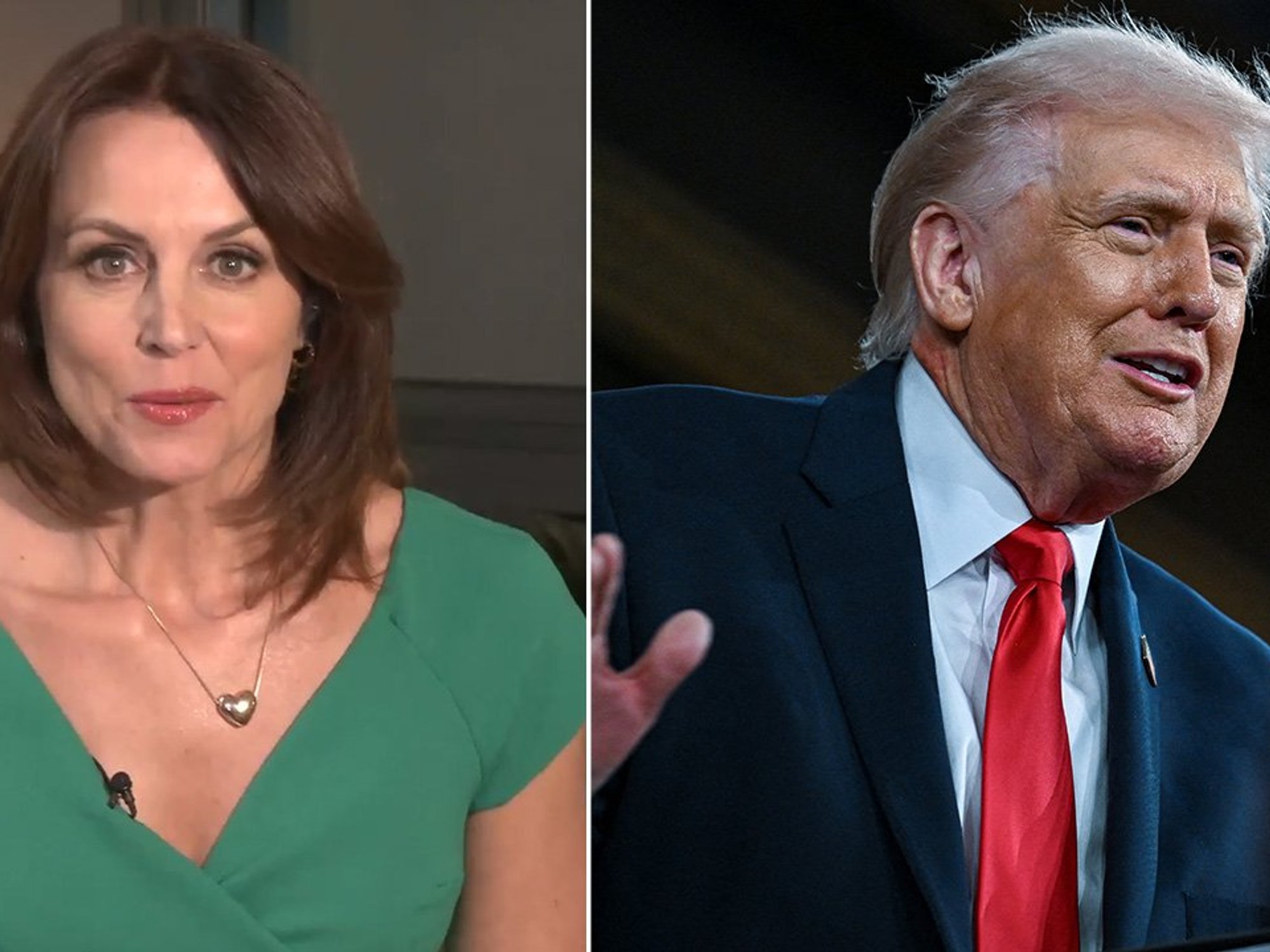

Heidi Alexander grilled by Camilla Tominey on migrant deal and shrinking economy |

GB NEWS

New research is shining light on the credit card charges being levied on households

Don't Miss

Most Read

Latest

Borrowers with poor credit ratings face paying thousands more in interest charges on personal loans, according to new research into Britain's lending market and debt crisis.

Analysis by TotallyMoney reveals that someone with a poor credit score seeking a typical £5,000 loan could end up paying an additional £6,678 in interest over three years compared to a borrower with an excellent rating.

The disparity becomes even more pronounced for larger amounts. Those with poor credit seeking a £10,000 loan over three years might pay £13,541 in interest charges, whilst borrowers with good credit would pay just £911 for the same loan.

Despite the significant financial implications, merely a quarter of people have reviewed their credit reports within the past four years.

**ARE YOU READING THIS ON OUR APP? DOWNLOAD NOW FOR THE BEST GB NEWS EXPERIENCE**

Borrowers are facing £13k interest charges

|GETTY

Most consumers utilise personal loans for vehicle purchases, representing 33 per cent of borrowers.

Debt consolidation accounts for 19 per cent, whilst home improvements make up 14 per cent of applications.

Alastair Douglas, CEO of TotallyMoney, emphasised the importance of reviewing credit information before applying for loans.

"Before applying for any loan, check your credit report, and make sure all the information is correct and up to date. If you spot an error, then raise a dispute," he advised

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Interest rates on credit cards have reached new highs in recent years | GETTY

Interest rates on credit cards have reached new highs in recent years | GETTY "Some apps will charge you to check your report, but remember that it’s your data, and you should never have to pay for it. It's also important to shop around for your best options, and that means checking comparison sites, and going direct to different lenders.

“Always look out for offers which come with pre-approval and guaranteed rates and lengths. That way you can avoid rejection, and you’ll know that you will receive the exact same loan you applied for.”

Personal finance specialist Andrew Hagger from Moneycomms.co.uk warned about the long-term consequences of damaged credit.

"It's only when you see the staggering extra costs, in terms of pounds and pence, for having an imperfect credit record, that the importance of protecting your credit file and score hits home," he stated.

“Customers faced with higher borrowing rates can easily find themselves struggling to manage a spiralling debt situation. Something that can be difficult to escape from unless you’re very disciplined with your budgeting.

“If you’ve had credit issues in the past, lenders you apply to in the future will assess you as a higher risk of defaulting and hike the price their products to reflect this – it may seem unfair but it’s the harsh reality when it comes to borrowing money."

LATEST DEVELOPMENTS:

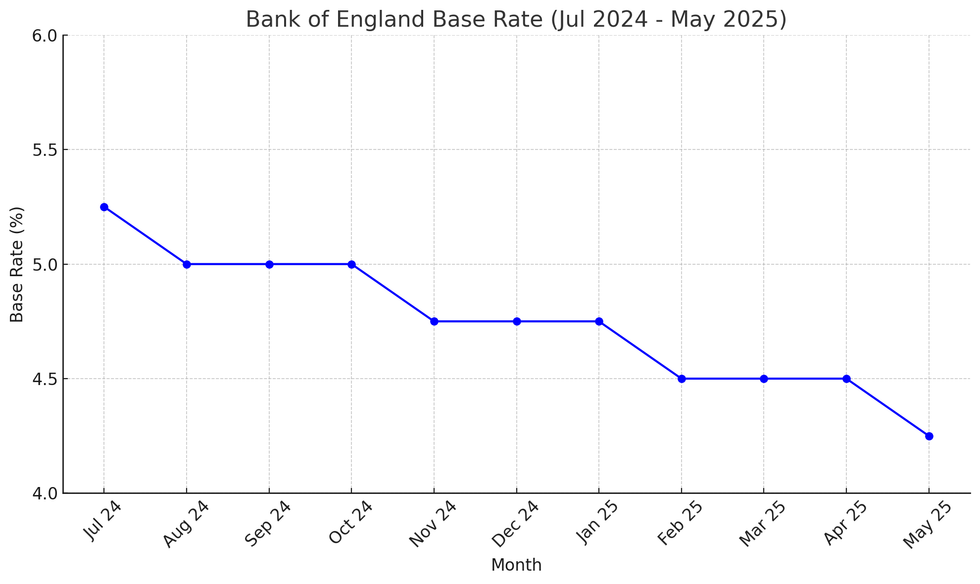

The Bank of England has held interest rates at 4.25 per cent

| MPC/GB NewsDouglas stressed that consumers should never pay to access their credit information and broke down why Britons should use TotallyMoney's services

He explained: "The TotallyMoney app is the only place where you can get your live credit score and report – for free.

"You’ll also receive a personalised plan to help you manage your money, cut borrowing costs, and improve your credit score.

“We’re also using open banking technology so personal loan providers can make smarter and more personalised offers to customers, so you can get a better, and fairer deal."

More From GB News