Nationwide Building Society overhauls mortgage deals in win for borrowers - what you need to know

Reform UK Spokesperson Ann Widdecombe reacts to GB News' analysis revealing that the UK economy is currently in a worse position than in the 1970s |

GB NEWS

Lenders, including Nationwide, are making big changes after the Bank of England's recent interest rate decision

Don't Miss

Most Read

Nationwide Building Society has introduced new lending criteria that could enable remortgage customers to secure significantly higher loan amounts starting from today.

The UK's second-largest building society will implement alternative affordability calculations for borrowers choosing five or ten-year fixed-rate mortgages, potentially increasing maximum borrowing capacity by as much as £33,600 for eligible applicants.

These modifications replicate similar measures the society implemented for home purchasers in December 2024.

The initiative aims to assist homeowners seeking new mortgage arrangements who have demonstrated consistent payment histories but may have previously faced borrowing limitations under standard affordability assessments.

**ARE YOU READING THIS ON OUR APP? DOWNLOAD NOW FOR THE BEST GB NEWS EXPERIENCE**

Nationwide Building Society is overhauling its line of mortgage products | NATIONWIDE BUILDING SOCIETY

Nationwide Building Society is overhauling its line of mortgage products | NATIONWIDE BUILDING SOCIETYTo qualify for the enhanced assessment, single borrowers must demonstrate annual earnings of at least £40,000, whilst couples need a combined income minimum of £70,000. The scheme applies to both salaried workers and those who are self-employed.

Nationwide emphasises that comprehensive affordability evaluations remain mandatory for all applications to maintain responsible lending standards.

The building society notes that qualifying customers benefit from established mortgage repayment histories and enhanced payment stability through extended fixed-rate periods.

For borrowers not seeking additional funds, the existing option to access up to 6.5 times annual income remains available, with loan-to-value ratios reaching 95 per cent.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

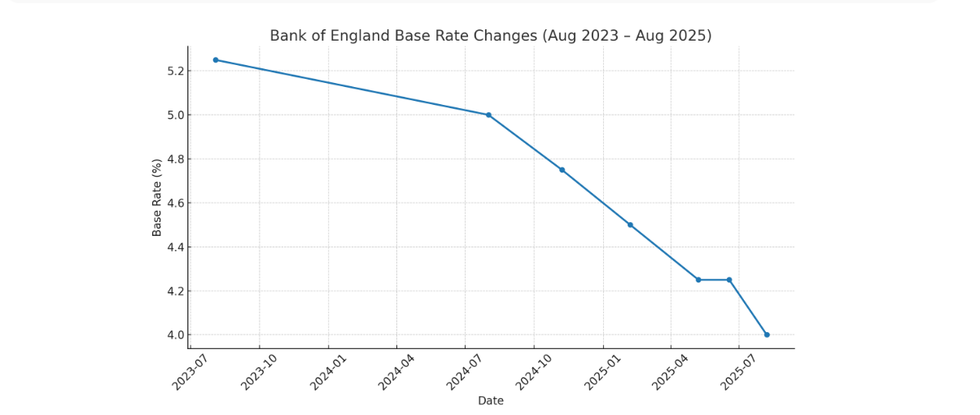

How has the UK base rate changed over the last two years? | CHAT GPT

How has the UK base rate changed over the last two years? | CHAT GPT The building society has provided illustrative calculations demonstrating the enhanced borrowing potential.

For remortgage applications requiring additional funds, a couple earning £70,000 annually with a 20-year mortgage term could see their maximum loan increase from £280,700 to £314,300 - representing a £33,600 uplift.

This raises their loan-to-income ratio from 4x to 4.5x.

For straightforward remortgages without additional borrowing, applicants with £50,000 income over a 40-year term could access loans up to £325,000, compared to £308,900 previously.

This £16,100 increase elevates the loan-to-income multiple from 6.2x to 6.5x.

The enhanced remortgage criteria follow comparable adjustments introduced for property purchasers in December 2024, demonstrating Nationwide's broader strategy to assist various borrower categories.

LATEST DEVELOPMENTS:

There are many mortgage deals on the market | GETTY

There are many mortgage deals on the market | GETTYHenry Jordan, Nationwide's Director of Home, said: "The ability to borrow enough can be a barrier when people look to remortgage, even when they can demonstrate a clean payment history.

"We're pleased to be able to help them by making this change, which should put Nationwide front of mind for those wanting a new mortgage deal."

"With our Helping Hand for first-time buyers as well as the enhanced affordability for home movers and now for those looking to remortgage, we are demonstrating that the country’s second largest lender remains committed to supporting all borrowers across the mortgage market."

This move from Nationwide Building Society comes after the Bank of England's decision to slash the UK's base rate to four per cent, down from 4.25 per cent the month before.

More From GB News