Mortgage WIN for 900,000 households as interest rates fall to pre-Liz Truss Budget levels: 'Turning point!'

Nearly one million households are coming to the end of a fixed-rate mortgage deal and will now have the option of lower interest rates

Don't Miss

Most Read

Latest

British homebuyers have been awarded a win as typical two-year fixed mortgage rates haven fallen below five per cent for the initial occasion since the financial crisis triggered by former Prime Minister Liz Truss's mini-Budget.

Financial data provider Moneyfacts reported that Wednesday's average rate for two-year fixed homeowner mortgages reached 4.99 per cent, declining from five per cent on the preceding business day.

This marks the first instance since September 29 2022 that such rates have breached this psychological barrier, when they registered 4.87 per cent

The development arrives as approximately 900,000 households face the conclusion of their fixed-rate agreements during the latter portion of 2025.

**ARE YOU READING THIS ON OUR APP? DOWNLOAD NOW FOR THE BEST GB NEWS EXPERIENCE**

Mortgage rates have fallen to pre-Liz Truss levels

|GETTY / PA

Under the Conservative mini-Budget, delivered by then-chancellor Kwasi Kwarteng in September 2022, an unprecedented disruption in the economy was unleashed across Britain's financial markets.

The announcement, which formed part of a broader economic growth strategy, incorporated £45billion worth of tax reductions without corresponding funding measures.

Financial markets responded with immediate volatility, driving borrowing costs sharply upward. By October 20 2022, typical two-year fixed mortgage rates had soared to 6.65 per cent, representing their zenith during this period of instability.

This dramatic surge in lending rates forced numerous prospective buyers from the market whilst existing homeowners faced substantially higher repayment costs when remortgaging.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Britons have been concerned about rising mortgage and debt costs in recent years | GETTY

Britons have been concerned about rising mortgage and debt costs in recent years | GETTY Adam French, the head of news at Moneyfactscompare.co.uk, described the development as "a symbolic turning point" for the mortgage market.

He noted that whilst borrowing costs remain significantly elevated compared to the exceptionally low rates experienced in the years before the 2022 fiscal event, this threshold represents increased competition amongst lenders seeking new business.

French cautioned that borrowers anticipating more meaningful reductions might face disappointment.

Furthermore, he highlighted that inflation projections suggest a rise to four per cent during autumn, with the two per cent target potentially remaining elusive until 2027 or later.

MEMBERSHIP:

- POLL OF THE DAY: Would shutting all migrant hotels put an end to the protests? VOTE NOW

- Reform 48 hours away from locking horns with Labour in two key battlegrounds as Rachel Reeves joins the fight

- MAPPED: The 'sanctuary cities' supporting asylum seekers - and how many are Labour-run - do YOU live in one?

- I was hit by 'anti-racist' campaigners at a migrant protest, but the hate-filled mob won't silence GB News - Sophie Reaper

- Trump just took a sledgehammer to the Kremlin and exposed Starmer's hand. This changes everything - Lee Cohen

Based on this outlook, the mortgage expert noted that the base rate will likely maintain its present position for an extended period.

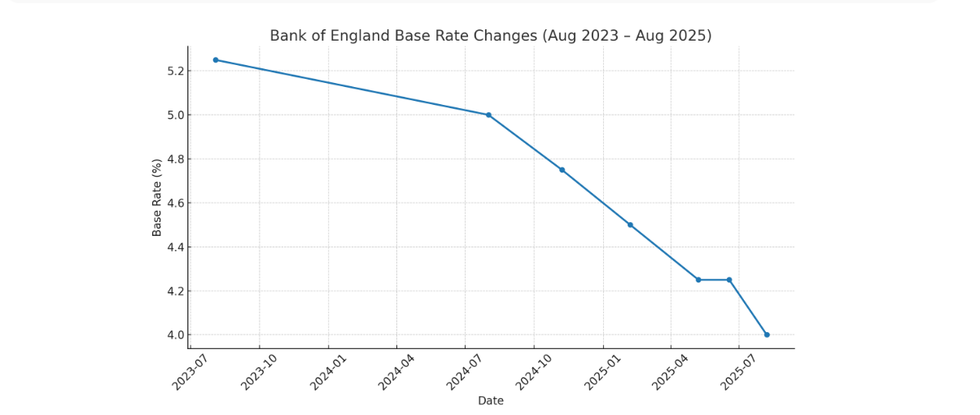

The recent reduction in the Bank of England's base rate from 4.25 per cent to four per cent last week may provide some relief for borrowers facing renewed mortgage arrangements.

LATEST DEVELOPMENTS:

How has the UK base rate changed over the last two years? | CHAT GPT

How has the UK base rate changed over the last two years? | CHAT GPT UK Finance data indicates that throughout 2025, approximately 1.6 million fixed-rate mortgage agreements will reach their conclusion, with 900,000 of these terminating in the year's second half.

These households will transition from rates secured before the market upheaval to current market conditions, though the sub-five per cent threshold represents an improvement from recent peaks.

The base rate adjustments could moderate the financial pressure on borrowers negotiating new terms, although rates remain substantially above pre-2022 levels.

Earlier this month, the Bank of England's Monetary Policy Committee (MPC) voted to slash the base rate from 4.25 per cent to four per cent.

More From GB News