Mortgage warning: How earning over £100,000 could slash what lenders will offer you

Mortgages Richard Blanco |

GB News

Experts warn 60 per cent tax band leaves professionals struggling to borrow despite rising salaries

Don't Miss

Most Read

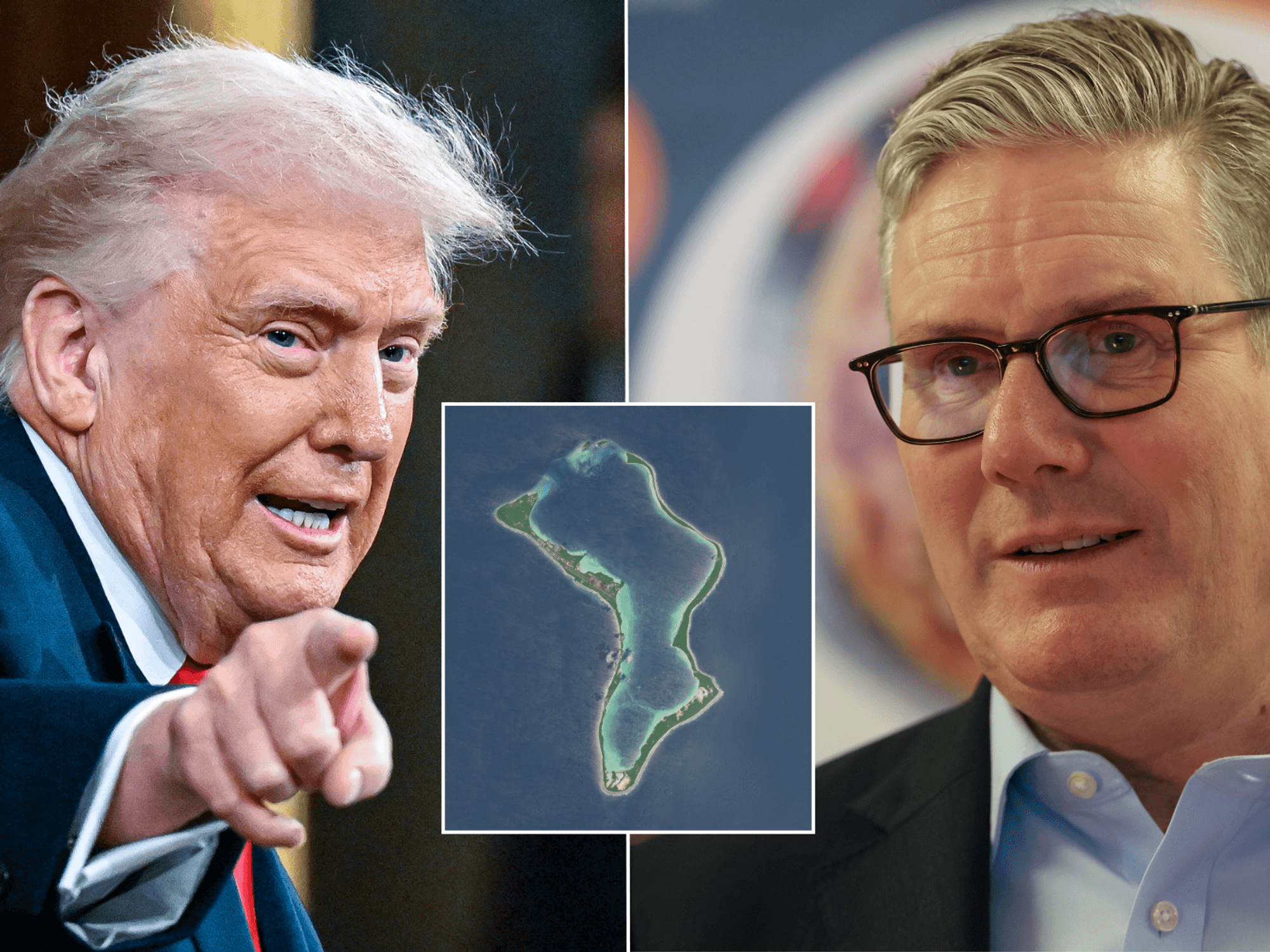

Britain's higher earners face an unexpected financial squeeze that extends beyond their tax bills.

The notorious income bracket spanning £100,000 to £125,140 subjects earners to a punishing 60 per cent marginal tax rate, created by the progressive withdrawal of personal allowances.

This now threatens mortgage prospects for thousands of higher-earning professionals.

As gross earnings rise within this band, take-home pay barely increases, creating a hidden barrier to property finance.

TRENDING

Stories

Videos

Your Say

Mortgage lenders scrutinise net income rather than headline salaries when determining borrowing capacity.

This means crossing the six-figure threshold delivers far less financial firepower than borrowers may anticipate, potentially derailing property ambitions across London and beyond.

Jo Rutland, mortgage case manager at Mojo Mortgages, explained the mechanism behind this lending squeeze.

"Disposable income is the silent driver of lending decisions," she said. "Lenders don't just look at your gross income; they assess your disposable income, after tax and essential expenditures, to determine how much they're willing to lend."

The mathematics prove sobering for affected earners.

Britain's higher earners face an unexpected financial squeeze that extends beyond their tax bills

|GETTY

"For those caught in the £100,000 to £125,000 income band, the sharp reduction in net income due to the effective 60 per cent tax rate could result in significantly lower borrowing capacity than expected," Ms Rutland said.

The paradox sees professionals earning more find themselves taking home proportionally less.

"In simple terms: you may be earning more, but you're not taking much more home, and that matters to lenders," she said.

Ms Rutland outlined three critical challenges facing borrowers within this income trap.

Refinancing existing mortgages becomes particularly problematic when net earnings are compressed, especially given today's elevated interest rates and stricter lending criteria.

Latest Development

Property upgrades face similar obstacles

|GETTY

"Borrowers in this income band may find it harder to remortgage at competitive rates if their net income is squeezed, especially under today's tighter affordability rules and high interest rates," she said.

Property upgrades face similar obstacles.

"Those aiming to upsize or take out larger loans might be surprised to find that lenders offer them less than expected, as affordability assessments reflect the reality of reduced take-home pay," Ms Rutland said. "Rising living expenses compound these difficulties."

With the rising cost of living, any unexpected erosion of disposable income, including from higher taxes, reduces financial flexibility, increasing risk in the eyes of lenders," she added.

Ms Rutland recommended decisive action for those approaching this income threshold.

Early engagement with mortgage advisers proves essential to circumvent potential lending complications and ensure smooth refinancing processes.

"The '£100,000 tax trap' is more than just something that affects people's taxes, it could potentially affect your mortgage affordability too," she said.

Comprehensive affordability reviews are also crucial.

Ms Rutland suggested using calculators or professional advisers who factor in actual net earnings rather than gross figures.

"As affordability tests become more stringent and lenders scrutinise income more closely, borrowers need to be aware that higher earnings don't always equate to higher borrowing power," she said.

Forward planning emerges as the key defence against this fiscal anomaly.

Professional mortgage guidance before reaching the £100,000 mark can prevent unwelcome surprises and preserve property purchasing power.

The intersection of tax policy and property finance creates wider implications for Britain's housing market

|GETTY

The intersection of tax policy and property finance creates wider implications for Britain's housing market.

Higher earners traditionally drive demand in premium property segments, yet this income trap constrains their purchasing power precisely when they expect financial advancement.

"Understanding the intersection between tax policy and mortgage lending will be critical for those navigating the £100,000-plus income band in today's property market," Ms Rutland said.

The phenomenon highlights how fiscal policies designed for revenue generation can produce unintended consequences in related sectors.

As more professionals enter this earnings bracket, the cumulative effect on property transactions and market liquidity warrants attention.

Britain's aspiring homeowners must now factor this hidden constraint into long-term financial planning, recognising that career progression may paradoxically limit rather than expand their property options.

More From GB News