Britons urged to take advantage of 'little-known mortgage tip' that could save you £5k

Are Trump’s Tariffs a Threat to the Economy or a Master Negotiation Tactic?

|GB NEWS

Mortgage expert Sam Fox is revealing how GB News readers can make big savings when shopping for deals

Don't Miss

Most Read

Latest

Thousands of Britons are preparing to pay more towards their monthly mortgage repayments as their fixed-rate deal comes to an end, however analysts are breaking down how many households can secure lower costs.

Speaking exclusively to GB News, Mortgage Centre's founder Sam Fox is sharing how a "little-known mortgage tip" could result in savings of up to £5,000.

Mr Fox said: "There was good news for those looking to take out a new mortgage this week, with the announcement that low-deposit choices have hit a 17-year high.

"Barclays increased its cheapest deals on five-year and two-year fixes, while Halifax decided to cut its lowest two-year offer even further.

Analysts are sharing how you can slash your mortgage costs

|GETTY

"It means the average rate for a two-year fixed mortgage has eased to 4.71 per cent, down from 4.74 per cent while the average five-year fixed deal was unchanged at 4.94 per cent.

"For those looking to remortgage, locking your rate in early is vital because interest rates can change quickly - and even a small increase can add up to thousands of pounds over the life of a mortgage.

"By locking in your new rate as soon as possible, you can also protect yourself against any unexpected rises while your application is being processed.

"Securing a rate early doesn’t mean you’re stuck with it if the market moves in your favour. If rates fall before you complete, and you meet the lender’s criteria, a broker can often switch you onto the lower deal so you benefit either way.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Has your mortgage been impacted by rising interest rates?

| GETTY"But there’s another trick that can also offer a real benefit, and it’s a tip that’s all too often overlooked. Timing. Time your completion date around your mortgage product’s 'ERC window' If you can.

"Most fixed-rate mortgages have early repayment charges (ERCs) that apply if you leave before the deal ends. But here’s the hidden detail many mortgage holders may not be aware of.

"Many lenders structure ERCs so they only apply up to the day before your deal anniversary ends.

"For example, a two-year fix that started October1, 2023 technically ends September 30, 2025.

MEMBERSHIP:

- MAPPED: Where Channel migrants could head next as dozens of asylum hotels to be closed - is YOUR area vulnerable?

- Reform UK braces for six crunch by-election battles as Nigel Farage eyes up breakthroughs across Britain

- It took one phone call to defeat Keir Starmer. Nothing does it quite like a reshuffle rejection - Kelvin MacKenzie

- Our new Home Secretary's record on crime should be in the welcome pack for small boat arrivals - Carole Malone

- POLL OF THE DAY: Was Israel justified in attacking Hamas leaders in Qatar? VOTE NOW

"If you complete your house move and need to switch products just days before the ERC window ends, you could get hit with thousands in fees unnecessarily.

"By aligning your move or completion date with the exact day the ERC drops off, you can:

- Avoid a hefty charge

- Access the whole mortgage market for your new property

- Potentially roll straight into a cheaper remortgage deal rather than being tied to an expensive port/top-up option.

LATEST DEVELOPMENTS:

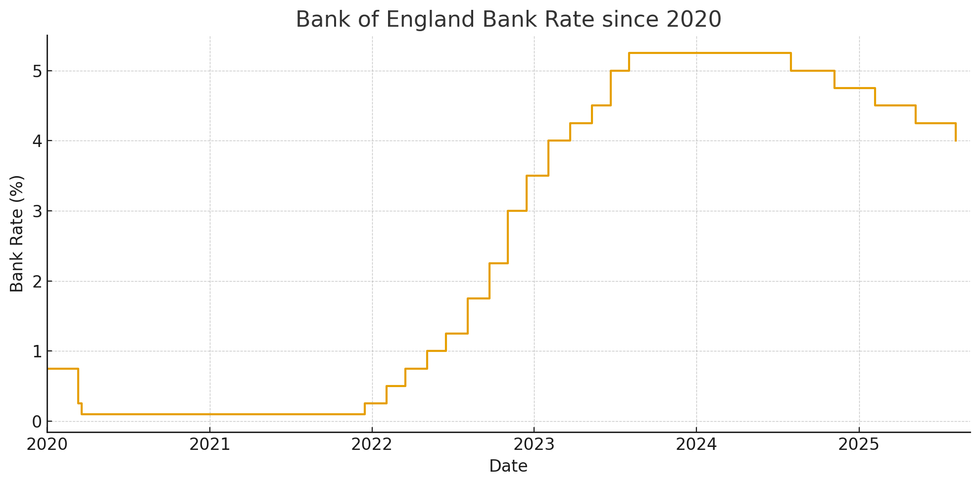

How has the base rate changed since 2020? | CHAT GPT

How has the base rate changed since 2020? | CHAT GPT "Even shifting completion by a week or two can mean saving one per cent to five per cent of your balance in ERCs, that’s £5,000 or more on a £250,000 mortgage.

"By working with a mortgage broker for your move, they’ll be able to tell you if this is possible, guide you through the process and find the most suitable deal for you."

Sam Fox is the founder of the Mortgage Centre. For more information visit www.ukmc.co.uk

More From GB News