Martin Lewis: How savers can build £92,000 tax-free before new cash ISA limits begin

Money Saving Expert founder outlines how to maximise allowances ahead of April 2027 rule change

Don't Miss

Most Read

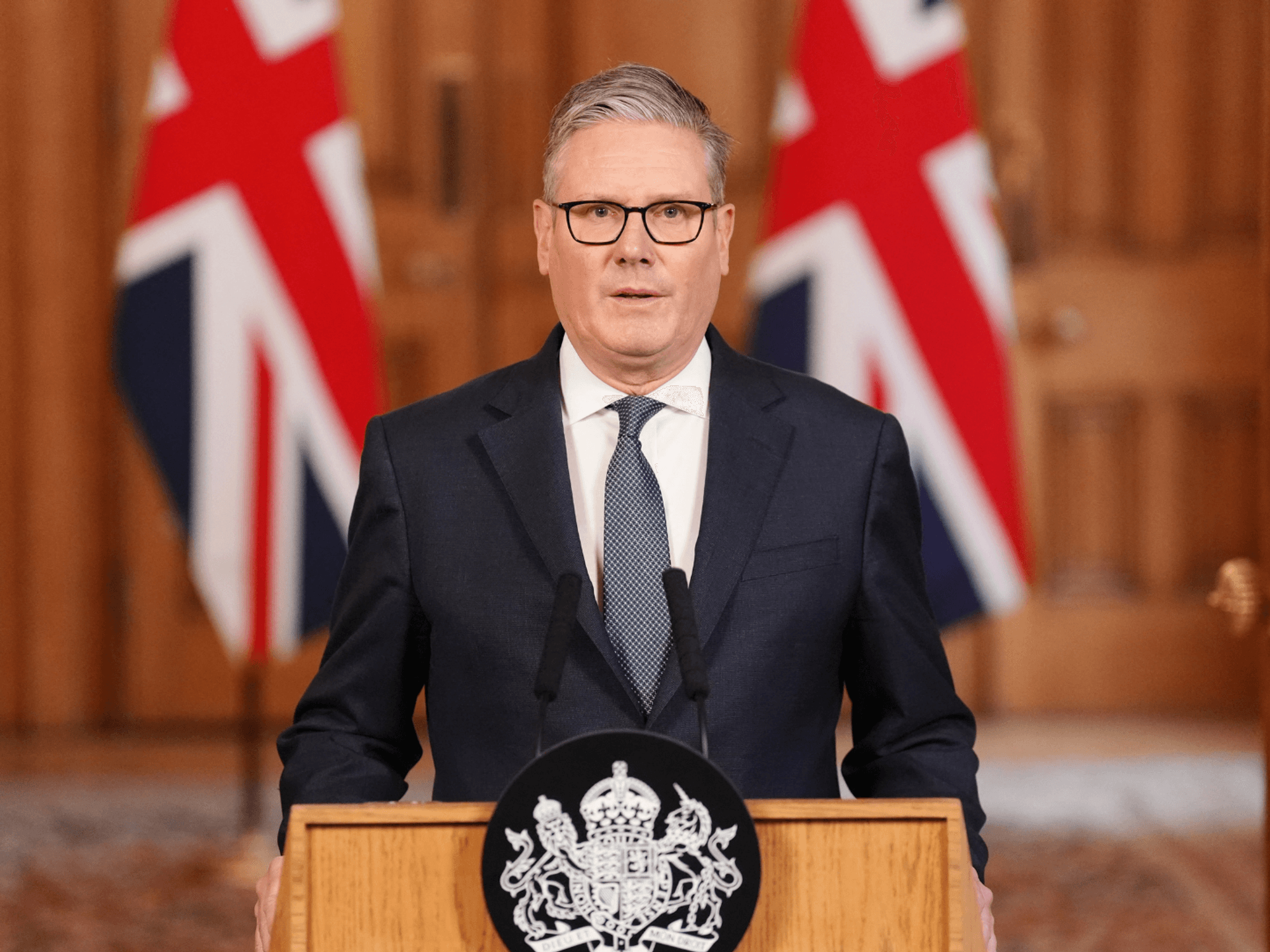

Martin Lewis has set out how savers can build up to £92,000 in a Cash ISA before new government restrictions take effect in April 2027.

The Money Saving Expert founder gave the explanation on The Martin Lewis Money Show Live on Tuesday evening.

He outlined how those who use their current annual allowance in full over the next two tax years can accumulate nearly £100,000 in tax-free cash before the contribution limit is reduced.

The reduction was announced last week in the Budget by Chancellor Rachel Reeves.

The current ISA allowance of £20,000 a year applies to every UK adult.

The allowance can be used for Cash ISAs, stocks and shares ISAs or a combination of both.

Money held within any type of ISA remains free from tax.

This means savers can build a substantial balance over time by contributing each year.

Mr Lewis said: "Once money is in an ISA it remains tax-free, so you can build up an ISA pot."

He said this is why some savers have accumulated hundreds of thousands of pounds in Cash ISAs and more than £1million in stocks and shares ISAs.

Martin Lewis explains how savers can amass £92,000 in a Cash ISA before April 2027 restrictions

| ITV/GETTYHe showed viewers how the £92,000 figure is achieved.

Mr Lewis said: "Well let's say you put £20,000 in two years ago, and then you put £20,000 in last year, that's £40,000 and then you put £20,000 in this tax year, that's £60,000, then £20,000 in next tax year that's £80,000, and then the next year it's dropping for some, to £12,000."

Savers who have made maximum contributions through to 2026–27 will therefore have £80,000 in their Cash ISA.

A final £12,000 contribution in 2027 under the new rules brings the total to £92,000.

None of these figures include any interest earned, which would increase the total further.

The Budget confirmed from April 2027 those aged under 65 will only be able to place £12,000 a year into a Cash ISA.

LATEST DEVELOPMENTS

From April 2027, annual cash ISA contributions will be capped at £12,000, in a major shake‑up savers are being warned to prepare for | GETTY

From April 2027, annual cash ISA contributions will be capped at £12,000, in a major shake‑up savers are being warned to prepare for | GETTYThe overall ISA allowance will remain at £20,000 a year.

This means younger savers will still be able to put up to £20,000 into ISAs, but no more than £12,000 of that may be in cash.

Mr Lewis explained: "The ISA limit is £20,000 and will remain £20,000 even for under-65s after 2027. Which means you could put £20,000 in shares ISA, you could also choose to put some in cash."

Savers will therefore be able to split their allowance, for example by paying £12,000 into cash and £8,000 into stocks and shares.

They will also be permitted to leave part of the £20,000 allowance unused.

Mr Lewis emphasised the restriction applies only to fresh contributions from April 2027.

Mr Lewis said: "But the key to this rule is it only impacts new money paid in. Any money remember all those years, all that, that's already in an ISA, that doesn't impact the allowance, it doesn't change that at all."

Existing ISA balances will remain protected and unaffected by the rule changes.

Savers will also continue to be able to transfer their existing ISA balances between providers.

This allows individuals to move their money to accounts offering higher interest rates without affecting their eligibility under the new rules.

The changes follow months of speculation about the future of Cash ISA limits.

The new contribution rules are expected to affect millions of savers under 65.

Mr Lewis urged viewers to consider using the current allowance while it remains at £20,000 for all adults.

The revised rules come into force at the start of the 2027/28 financial year.

Our Standards: The GB News Editorial Charter