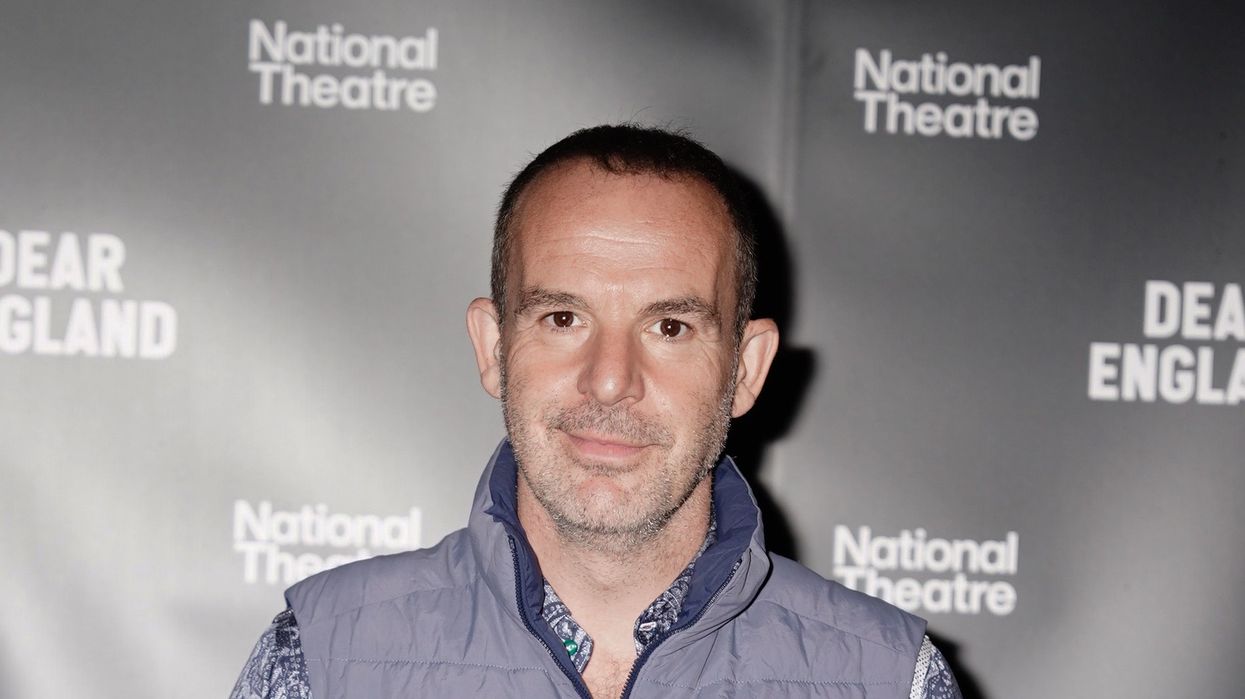

Martin Lewis urges Jeremy Hunt to shake-up ‘unfair’ ISA rules as house-buyers ‘shouldn’t be penalised’

Martin Lewis is urging Jeremy Hunt to change the Lifetime ISA rules

|PA

Martin Lewis is among a number of financial experts urging the Chancellor Jeremy Hunt to change Lifetime ISA rules

Don't Miss

Most Read

Martin Lewis has strengthened his call for Chancellor Jeremy Hunt to overhaul the Lifetime ISA (LISA) rules.

The Money Saving Expert argues young savers shouldn’t lose a chunk of their savings if they purchase a first home above the scheme’s £450,000 property limit.

Amid rising house prices, the problem leaves far more first-time buyers at risk than when Lifetime ISAs were launched in 2017.

Savers can deposit up to £4,000 in a LISA each tax year and earn a 25 per cent bonus of up to £1,000.

Jeremy Hunt will deliver his Autumn Statement on November 22

|PA

Martin Lewis, Money Saving Expert founder and chair, said: "There are rumours the Chancellor is looking to introduce new incentives to help first-time buyers.

“Yet the first port of call should be to fix the unfair scheme that’s currently in play. So I have formally contacted the Chancellor to urge him to make the system fairer.

"Many who have opened Lifetime ISAs (LISAs) with government encouragement now have not only a dead duck product – where they won’t get the promised 25 per cent boost – but one with a poisoned beak, because they’re fined to get their money out.”

The money can be withdrawn penalty-free if it’s used to buy a first – qualifying – property, they’re aged 60 or over, or they’re terminally ill with less than 12 months to live.

Otherwise, savers will pay a withdrawal charge of 25 per cent, meaning savers would need to withdraw more than the amount they need, to cover the needs and the 25 per cent withdrawal charge.

Mr Lewis has called for the rules to be changed so a LISA holder who purchases a first-time home for a property costing more than £450,000 can withdraw the savings without being fined. This could be done by reducing the withdrawal charge to 20 per cent for those in this situation.

The money saving expert added: "The fine was originally put in place to stop people using LISAs for purposes other than what they were intended for. House-buyers aren’t doing that, so they shouldn’t be penalised; they should at least get back what they put in.

"A longer-term idea would be to link and backdate the LISA maximum to national or, better still, regional house price changes. So, those who open them have a legitimate expectation they will be able to use them to buy the type of house they’re considering."

House prices have increased 33 per cent since 2017 while the LISA property cap of £450,000 has remained the same, Money Saving Expert (MSE) research shows.

Brian Byrnes, head of personal finance at Lifetime ISA provider Moneybox, said there was “no doubt that support is needed, as it has become increasingly difficult to get on the property ladder recently”.

He added: “Thinking about the next generation of aspiring homebuyers who are just starting on what is a five to eight-year deposit-saving journey, we believe the price cap should be index-linked to house prices and subject to an annual review.

“This will provide some much-needed reassurance and peace of mind to LISA savers who live and work in some of the most expensive parts of the UK and ensure the product remains fit for purpose for all those who need it most, into the future.”

LATEST DEVELOPMENTS:

The current property price cap to withdraw money from a Lifetime ISA penalty-free for a property is £450,000

|PA

Moneybox has also been campaigning for a penalty-free annual “Emergency Withdrawal Allowance” to be introduced, which would mean LISA savers aren’t penalised if they need their money in an emergency.

AJ Bell has also called for the withdrawal charge to be cut and pointed out that if the property limit for Lifetime ISAs had risen with house price inflation, it would now be £562,500.

Laura Suter, head of personal finance at AJ Bell, said: “Many aspiring homebuyers will have signed up to the accounts years ago, not realising that it would take so long to get on the property ladder and that they might fall foul of the property limit in the future.

“What makes the situation more galling for first-time buyers who have been priced out of using the Lifetime ISA is that they now face losing some of their own money when they withdraw their cash from the accounts, thanks to the onerous withdrawal penalty.

“Anyone who exceeds the £450,000 limit, even by just £1, will be hit with the 25 per cent exit charge on the Lifetime ISA, as their purchase will no longer be within the rules.”

Ms Suter added: “Ending this unfair penalty would be a simple fix for the chancellor, with the government rumoured to be looking at a range of measures to support first-time buyers. “Before they even begin to address new incentives for aspiring homeowners, the government should prioritise fixing this obvious flaw in the current system.”

A HM Treasury spokesperson told GB News: “The Lifetime ISA helped over 50,000 people get on the property ladder last year and while the average price of a first-time home has increased, it remains below the cap across the vast majority of the country.

“As ever, we keep all aspects of the savings rules, including the LISA, under review.”