Fears of recession fade after record Nvidia earnings in defiance of AI bubble

Donald Trump declares America will ‘win the AI race’ as he unveils radical action plan |

GB News

Investors warned the stock market could 'sink significantly'

Don't Miss

Most Read

Latest

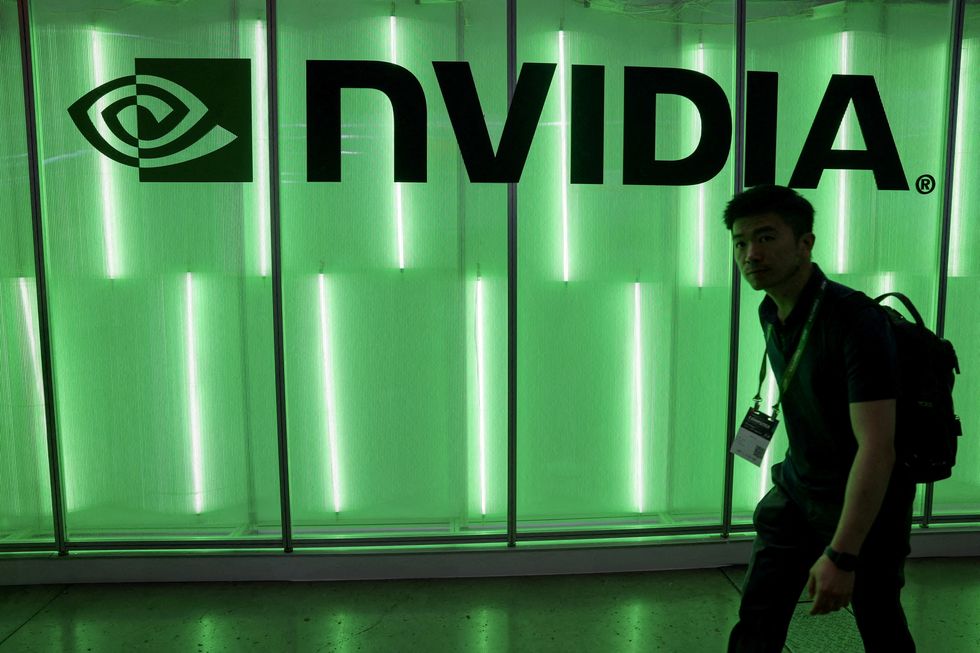

Recession fears have been cooled after technology giant Nvidia posted record reveneues.

Investors warned the stock market could "sink significantly" following Nvidia's latest earnings report, but the company managed to register $59.19billion revenue for Q3.

The artificial intelligence (AI) chipmaker posted a 22 per cent boost in earnings on Q2, despite widespread fears of the AI bubble bursting, which some experts had warned could be worse for households than the 2008 financial crisis.

The Nasdaq giant posted revenues $1.82billion above estimates in what will come as a relief for AI investors.

Nvidia calmed investor nerves after a bruising week for tech stocks, posting blockbuster results that signal the AI surge is far from over.

The chipmaker, once valued at $5 trillion, has shed more than $500billion in recent sell-offs but saw shares jump 4 per cent in post-market trading.

Boss Jensen Huang hailed “off the charts” demand for its new Blackwell processors, with cloud GPUs sold out and $500billion in revenues already booked over the next 15 months.

Nvidia smashed forecasts with $57billion in quarterly sales, up 62 per cent, and expects $65billion next quarter — underscoring its role at the centre of the AI boom.

Investors expect the share price to move by an average of 6.4 per cent when trading resumes on Thursday.

Such a shift would equate to roughly $280billion being gained or lost in market capitalisation.

Traders have had to navigate concerns over the overvaluation of AI, with the Nasdaq's value growing by nearly 90 per cent over the last five years.

TRENDING

Stories

Videos

Your Say

Nvidia reached a record $5trillion valuation in late October. Its shares have since fallen 11 per cent amid a wider sell-off in technology stocks.

Julian Emanuel, chief equities strategist at Evercore ISI, said: "The angst around 'peak AI' has been palpable."

His assessment comes as major technology indices experience sharp declines. The Nasdaq Composite has dropped more than four per cent across the past five trading sessions.

Key Silicon Valley firms have been particularly affected, with Meta down 19 per cent and Oracle falling 20 per cent in the past month.

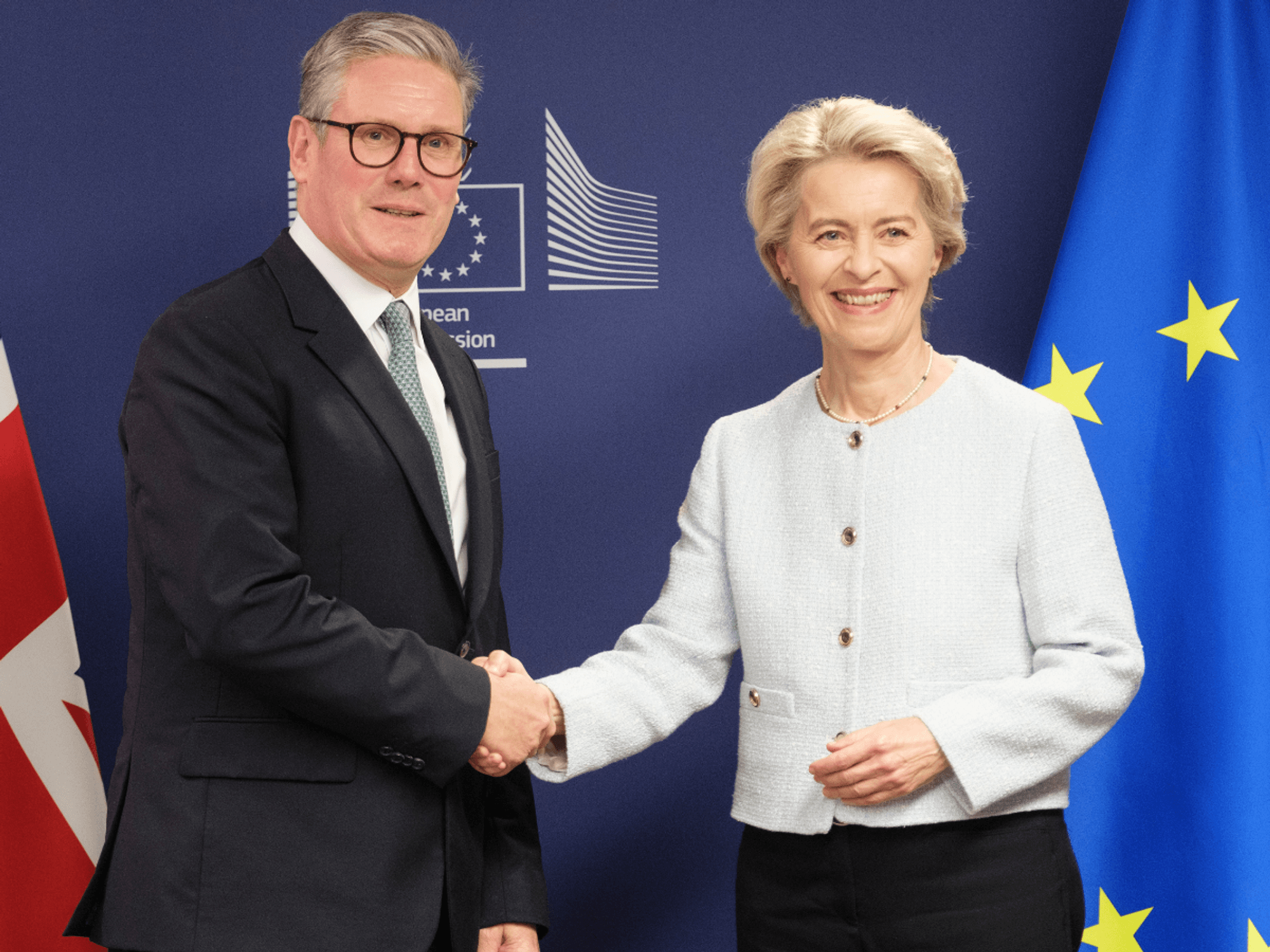

Nvidia reached a record $5trillion valuation in late October

|GETTY

Losses have extended across the artificial intelligence sector. Super Micro Computer slid seven point four per cent, while Palantir Technologies fell six point five per cent and Broadcom declined four point three per cent in recent sessions.

Mike Zigmont, co-head of trading at Visdom Investment Group, said: "In the run-up to Nvidia's earnings announcement, we're experiencing cold feet and worry that prices went too high to justify."

His comments reflect the uncertainty surrounding the upcoming earnings release.

Market analysts expect Nvidia to report revenue of around $55.5billion for the quarter, according to Visible Alpha data. That figure would exceed the company's August guidance of approximately $54billion.

LATEST DEVELOPMENTS

Donald Trump's administration has aimed to back AI

| REUTERSNvidia is also expected to issue its forecast for the current quarter. Analysts project revenue of close to $62billion, representing a year-on-year increase of approximately 58 per cent.

The company has consistently exceeded expectations in recent quarters. Its strong track record has contributed to pressure for another robust update.

Nvidia chief executive Jensen Huang said in October that the company had secured $500billion in revenue commitments for the following five quarters.

The commitments sit at the upper end of Wall Street forecasts.

Mr Zigmont said: "If Nvidia delivers disappointing guidance Wednesday, the [market] is going to sink significantly."

He highlighted the wider implications for equity markets given Nvidia's influence.

A Bank of America survey found that more than half of fund managers now view artificial intelligence equities as being in bubble territory.

Around 45 per cent identified this as the primary tail risk facing markets, ahead of inflation. These concerns followed remarks from Alphabet chief executive Sundar Pichai.

He warned a collapse in any artificial intelligence bubble would have widespread effects, saying: "I think no company is going to be immune, including us."

Mr Pichai told the BBC that there was "irrationality" within the artificial intelligence boom. His comments coincided with growing scrutiny of technology valuations linked to AI expansion.

Investors are reassessing whether substantial capital deployment into AI infrastructure can generate returns that justify elevated share prices. Many major technology companies have poured significant funding into projects reliant on Nvidia's processors.

Nvidia's performance is viewed as a key indicator for the wider artificial intelligence market. Its data centre division is particularly closely watched due to its central role in AI applications.

Recent months have seen Nvidia finalise multi-billion dollar arrangements with OpenAI, external investors and technology firms for data centre construction using its hardware. Analysts pointed to the circular nature of some of these agreements, with certain companies acting as suppliers, backers and clients at the same time.

Large technology corporations have increasingly tapped public and private debt markets to finance their AI spending

| ReutersLarge technology corporations have increasingly tapped public and private debt markets to finance their AI spending.

This marks a shift from previous reliance on cash reserves.

On Tuesday, Nvidia and Microsoft announced plans to invest up to $15billion in Anthropic, the developer of the Claude chatbot that competes with OpenAI.

The investment underscores the scale of financial commitment being directed at artificial intelligence development.

Our Standards: The GB News Editorial Charter

More From GB News