Home repossessions hit five-year high as mortgage pressures mount across England and Wales

GB News

Latest Ministry of Justice figures show rising arrears and joblessness driving an increase in repossessions

Don't Miss

Most Read

Latest

Home repossessions across England and Wales have risen to their highest level in five years, with provisional Ministry of Justice (MoJ) data showing 3,497 mortgage repossessions by county court bailiffs in the first nine months of 2025.

It marks the steepest January to September figure since 2019, when 3,780 properties were repossessed during the same period.

The current numbers remain far below the peak recorded after the financial crisis, when 25,481 repossessions took place in the first nine months of 2009.

However, the upward trend has prompted concern, bringing an end to the long decline in repossessions that had been seen since 2008.

Banking industry representatives stress that repossession continues to be a last resort for lenders.

Around 2,000 homes were repossessed in the first quarter of 2025, compared with 13,000 in the same period in 2009.

Economic experts point to a combination of rising joblessness and higher interest rates as key drivers behind the increase.

Andrew Goodwin, chief UK economist at Oxford Economics, said: "What we've been seeing over the past couple of years is that both of those factors got worse.

"Unemployment has risen and there's been a steady increase in debt-servicing costs."

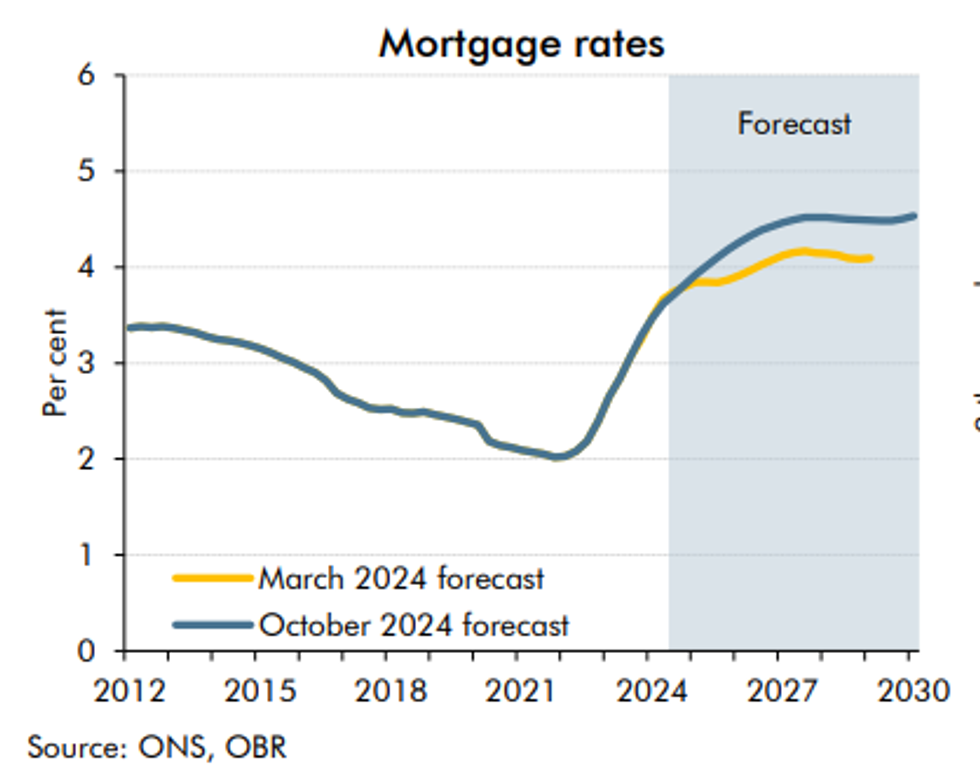

Mr Goodwin noted that many homeowners have seen their mortgage rates rise from two per cent to between four per cent and six per cent.

Repossessions are at a five-year high

|GETTY

He said elevated living expenses had added further pressure on households.

"It's been a bit of a perfect storm homeowners have had to deal with over the past few years," Mr Goodwin said.

His comments reflect growing concerns among analysts about the affordability pressures facing borrowers.

Individual cases underline the financial strain behind the latest figures.

Henry Sabati McRae, a 51-year-old software developer from Croydon, narrowly avoided losing his two-bedroom flat after building up £13,000 in mortgage arrears.

His difficulties began following the deaths of his brother in 2020 and his mother in October 2023.

LATEST DEVELOPMENTS

There's been a sharp increase in residents approaching councils for assistance to avoid homelessness linked to repossession proceedings

|GETTY

He has been unemployed since October 2024 despite submitting hundreds of job applications.

"It doesn't matter how much you have in savings," Mr McRae said.

"Within a few months it is wiped out. I managed to stretch it as far as I could, because I'd been quite conservative with how I was doing."

His bank warned repossession would go ahead unless his arrears were reduced below £8,000.

He sold possessions online and borrowed money from friends to meet the requirement.

A BBC investigation has revealed a sharp increase in residents approaching councils for assistance to avoid homelessness linked to repossession proceedings.

Freedom of Information responses from 244 local authorities across England show requests for help rose from 1,563 in 2022 to 2023 to 3,546 in 2024 to 2025.

Around three-quarters of responding councils reported increases over the two-year period. Bury in the North West recorded the highest total, with 177 people seeking help in 2024 to 2025.

Somerset experienced the largest proportional rise, going from one request for assistance in 2022 to 2023 to 150 in 2024 to 2025.

Broxbourne in Hertfordshire recorded the highest rate per head of population, with 95 people per 100,000 residents approaching the council for help to prevent homelessness. Court hearings provide further insight into the pressures behind the statistics.

Mortgage rates are set to fall in a boost for holders

| OBRAt Norwich County Court, a woman faced losing her home after falling £8,183 into arrears following the breakdown of a relationship.

The property was purchased from Norwich City Council in 2019 after she had lived there since 2005.

Although the judge granted an adjournment, her home remains at risk.

"There was a change in my life circumstances. A breakdown in a relationship," she said outside court.

"It's been a struggle."

District Judge Allan Pickup at Northampton County Court said mortgage repossessions had remained broadly stable since 2008.

He said courts were "seeing a big upturn in rent possessions due to general pressures of the cost of living, and people prioritising food over rent."