Bank of England base rate decision: What does it mean for your pensions, savings and mortgage?

'Rinsing every drop from the British economy!' Rachel Reeves skewered by GB News guest as Chancellor branded 'desperate' |

GB NEWS

Earlier today, the central bank confirmed the UK's interest rate will remain at four per cent due to inflationary concerns

Don't Miss

Most Read

Latest

The Bank of England has maintained the UK's base rate, which is the cost of borrowing, at four per cent but what does it mean for your pensions, mortgage and savings?

Today's Monetary Policy Committee's (MPC) decision comes as policymakers navigate renewed inflationary pressures, with the consumer price index (CPI) rate for the 12 months to August 2025 coming in at 3.8 per cent.

This is nearly double the central bank's desired two per cent target target, with analysts warning further interest rate cuts from the financial institution could be postponed.

As it set the cost of borrowing, the base rate has an impact on household mortgages, savings deal and how much people could receiver from their pension pot.

How does the Bank of England's decision impact your pensions, savings and moretgage?

|GETTY

Mortgages

Peter Stimson, the director of Mortgages at the lender MPowered, warned prospective homebuyers that the property market is likely to remain harder to access as a result of today's announcement.

Mr Stimson said: "The mortgage swaps market, which is used by mortgage lenders to determine the fixed interest rates they offer to borrowers, still suggests there will be two more base rate cuts in total, albeit with the timescale stretching into the new year.

"The upshot of all this is that after months of intense competition, mortgage lenders currently have no scope to cut their interest rates any further.

"In fact we’ve even seen a few lenders allow Atheir fixed rates to creep up over recent weeks and it’s becoming increasingly clear that we’re at, or close to, the bottom of the interest rate cycle."

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Savings

The situation proves equally challenging for those with savings accounts. Kevin Brown, savings expert at Scottish Friendly, warns that numerous leading savings products fail to match current inflation levels.

Mr Brown shared: "The decision to hold rates today will frustrate borrowers hoping for some relief but offers a measure of reassurance for savers. While savings rates have drifted down over the past 12 months, today’s hold should mean they remain steady for a little while longer.

"However, even now many of the top savings deals are not beating inflation. If your money is in a low-rate account, you could actually be losing purchasing power over time, even though some interest is being paid on your money.

"That makes it more important than ever to shop around for the best home for your cash. Stability in rates is good, but a low-paying account that doesn’t outpace inflation is still a hidden loss."

MEMBERSHIP:

- Panic stations for Keir Starmer as graph shows the devastating impact of snubbing Donald Trump

- Donald Trump's royal embrace just helped topple Labour. Revenge is a dish best served cold - Lee Cohen

- I wish I hadn't read that. Rachel Reeves is about to stiff the middle class and pin it on AI - Kelvin MacKenzie

- Blocking the migrant flight sounds the death knell on democratic sovereignty and Labour's mandate - Rakib Ehsan

- POLL OF THE DAY: Can President Trump help save free speech in Britain? VOTE NOW

Pensions

Furthermore, the decision's impact extends to retirement planning, with pension savers facing continued uncertainty. Lily Megson-Harvey, Policy Director at My Pension Expert, emphasises the importance of maintaining composure during these challenging times.

"The Bank of England's decision to hold interest rates at four per cent, provides a sense of stability for pension savers, but inflation remains persistent and household budgets are stretched," Megson-Harvey stated.

"Whilst times are uncertain, it is important to stay calm and take stock of your financial situation .

"Professional financial advice can offer clarity and confidence, helping you make the most of current conditions and stay on track for the retirement you envision."

LATEST DEVELOPMENTS:

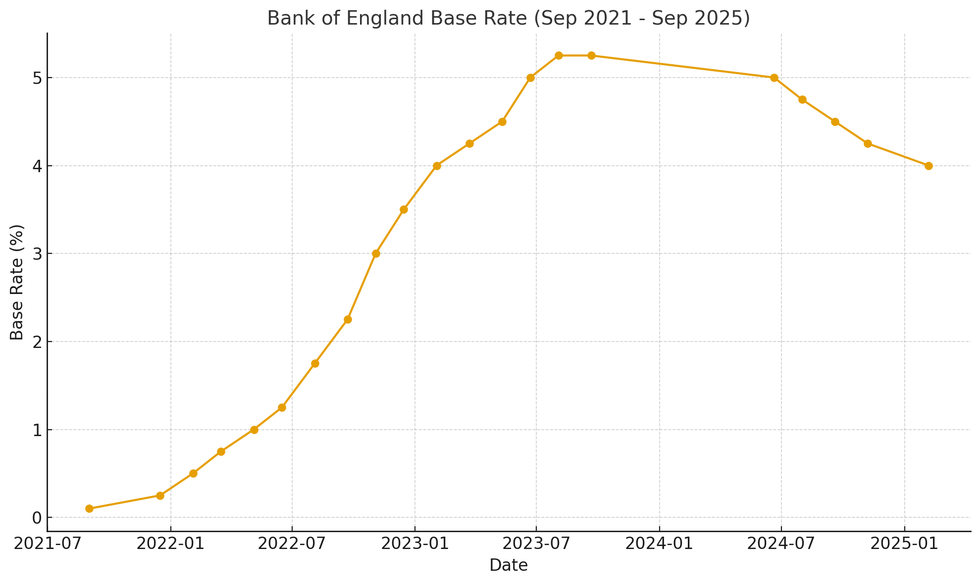

How has the Bank of England base rate changed in recent years? | CHAT GPT

How has the Bank of England base rate changed in recent years? | CHAT GPT On the wider implications of the Bank of England's decision-making, Charlotte Kennedy, chartered financial planner at Rathbones, said: “With challenges pulling from all sides, the pace of interest rate cuts remains cautious.

"Unlike the knife-edge decision last time, today’s call was far more straightforward, with policymakers largely singing from the same hymn sheet. Stubbornly high inflation - driven in no small part by rising food prices - remains a key reason why rates are being kept on ice for now.

"Even though rates haven’t shifted, it still pays to stay engaged with your personal finances. Savers can benefit from shopping around for the best deals, while those due to remortgage should plan ahead and explore their options.

"Remember: a mortgage offer typically lasts up to six months, and you’re not locked in – so you can take advantage of a better deal if one becomes available."

More From GB News