Liam Halligan delivered his analysis on the Chancellor's tax cuts in his Autumn Statement.

He said: "For a government that was saying weeks ago, tax cuts would be irresponsible, even impossible.

"There's certainly been a change of heart here. As you say, the biggest tax cuts is very significant on a permanent basis, though nothing's ever permanent in politics, or at least until someone changes the law again. Businesses are going to be able to offset 25% of the cost of any investment or approved investments that they make in factory plant, technological upgrades and so on against their corporation tax bill.

"That will be a major incentive for firms to invest. What I would say, that's going to benefit big firms more than small firms, because small firms often don't have, as we say, they don't have the balance sheet to invest, they can't raise the funding, they haven't got the spare cash to invest.

"But still a lot of people in business will massively welcome that.

At the same time, there's going to be a cut in National Insurance, the base rate of National Insurance, from 12 to 10%. That's quite a major change.

"Why is the chancellor gone for National Insurance? He's gone from National Insurance because National Insurance is cheaper.

"Because pensioners don't pay National Insurance. If you cut the basic rate of income tax by two percentage points, it will cost you the thick end of £15 billion. This will cost less, but he still gets roughly the same headline. What does it mean for people at home?

"Well, if you're lucky enough to be earning 35 grand a year, which is above the national average wage, the national average wage is more like £32,500. If you're earning 35 grand a year, that's worth £450 in your pocket and in a little extra flourish rather than waiting for a Finance Bill to kick in the new tax year in April 2024.

"The Chancellor's you know, we all know that you spend Christmas and then the the credit card bills start hitting the mat in January. Well, this will apply from January.

"This lower rates of National Insurance for employees. And there was another little kicker on National Insurance. The type of National Insurance that the self-employed pay that's also going to come down from 9 to 8%.

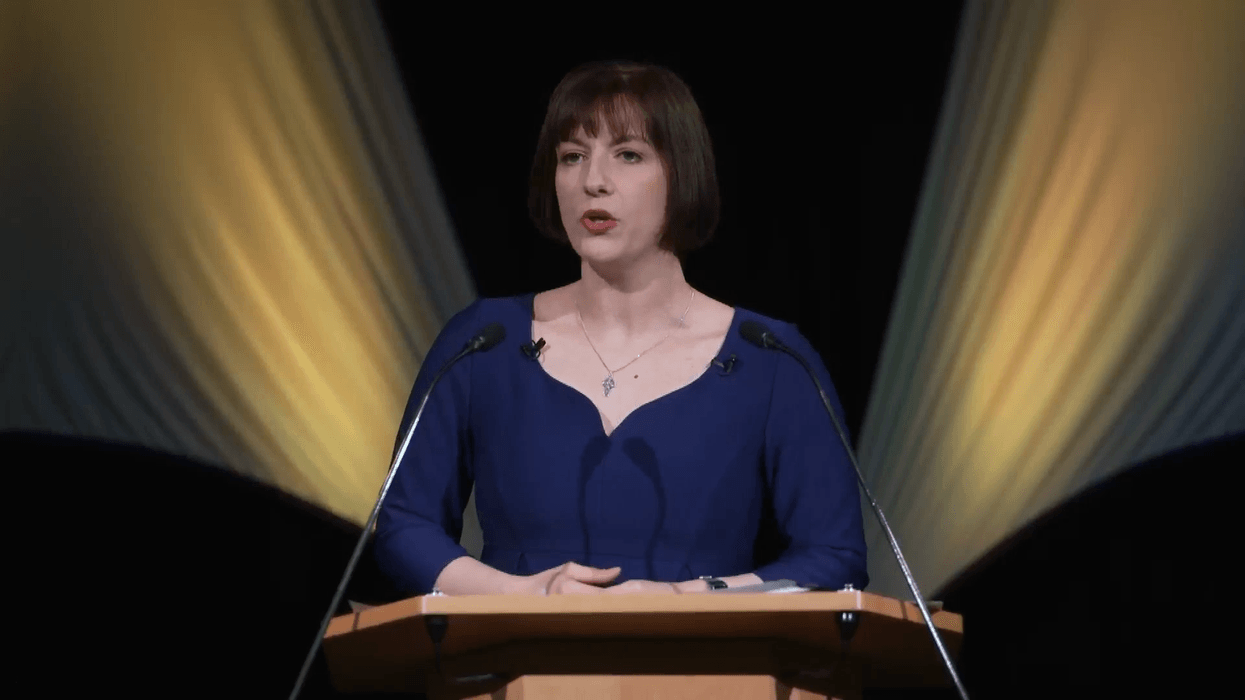

Emily Carver asked: "Yes, and now of course it is the job of the Shadow Chancellor Rachel Reeves to stick the boot in and criticise of course. But did she make a good point when she said that this cut in National Insurance.

This rabbit out of the hat, this 2p cut that you talk about, won't be enough to compensate for other tax increases that have come before, not least those tax thresholds?"

Liam replied: "Well, I think Rachel Reeves is not to be underestimated. I mean, in my experience with her talking to her over many years, you know, she has a very analytical mind and she was certainly thinking on her feet there.

"The convention will be there will be in some notice of the main measures in a budget or an Autumn Statement for Her Majesty's or His Majesty's Opposition, but she won't have had long to think that through."

Have you been affected by fiscal drag? If you'd like to share your story, get in touch by emailing money@gbnews.uk.