Labour set to announce biggest overhaul of major UK business rule in decades this week

Government prepares sweeping changes to Competition and Markets Authority powers

Don't Miss

Most Read

Ministers are reportedly poised to unveil a sweeping transformation of how corporate mergers and takeovers are examined in Britain, marking what insiders describe as the most substantial regulatory shake-up in decades.

The Department for Business and Trade is preparing to announce far-reaching changes to the Competition and Markets Authority's operations, fundamentally altering the watchdog's approach to scrutinising deals.

Business Secretary Peter Kyle, who is attending the World Economic Forum in Davos this week, may use the gathering to reveal the reforms as part of the Government's drive to stimulate economic growth, according to Sky News.

The proposed overhaul follows last year's removal of former CMA chairman Marcus Bokkerink by ministers, including Chancellor Rachel Reeves, amid efforts to cut red tape and address Britain's sluggish growth figures.

TRENDING

Stories

Videos

Your Say

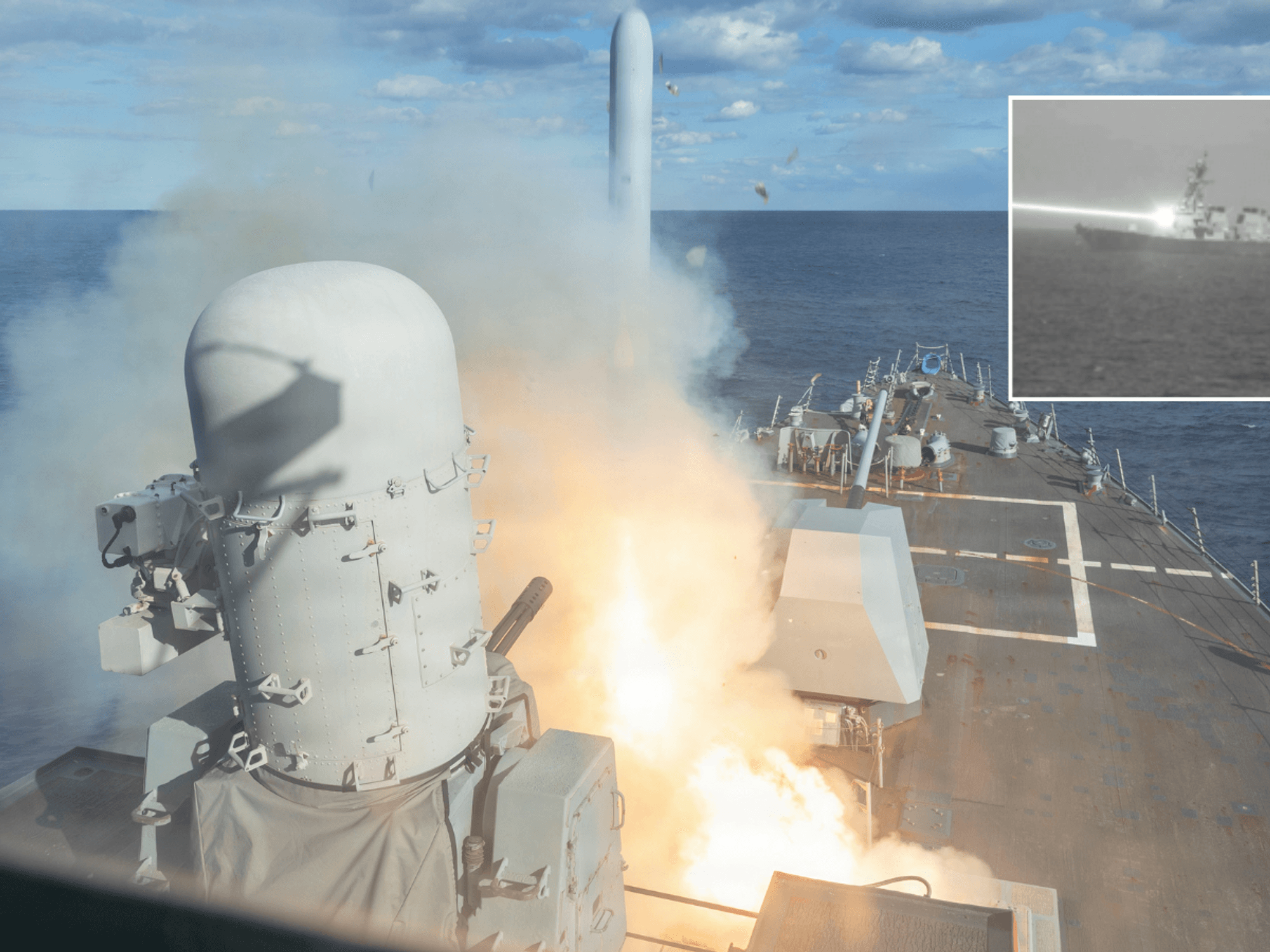

Competition and Markets Authority powers are set to change

|GETTY

Central to the reforms is the abolition of the CMA's panels system, which currently brings together independent experts to assess whether corporate transactions pose serious competition concerns.

The Government is also considering restricting the regulator's jurisdiction over certain deal types, particularly mergers between two overseas companies.

Officials have been examining whether to remove the right for parties affected by merger rulings to challenge decisions on their merits, though the option to pursue judicial review would remain available.

These changes, according to Government sources, aim to speed up decision-making and offer businesses greater certainty when pursuing transactions.

Current Phase-2 investigations include the proposed combination of bread manufacturers Hovis and Kingsmill, alongside an ongoing examination of the veterinary services sector.

The regulator's market studies and market investigations processes will be consolidated into a single streamlined procedure lasting between six and twelve months.

Two new board sub-committees will be established to oversee the CMA's work, with one focusing on detailed Phase-2 merger examinations and another supervising broader market studies.

Significantly, CMA chief executive Sarah Cardell would be permitted to sit on at least one of these sub-committees, a move that observers say would substantially enhance her influence over the cases the authority investigates.

LATEST DEVELOPMENTS

Chancellor Rachel Reeves will attend the Davos summit where the announcement is expected to be made

| GETTYThe mergers sub-committee is expected to include external expert figures, though critics may contend this arrangement merely recreates the existing panels system in a diminished form.

Despite the Government's insistence that these reforms will accelerate regulatory processes, ministers face scrutiny over whether the changes compromise the independence of merger investigations.

"There is a risk in relation to what an interventionist politician could do as it makes the system more vulnerable to political influence and gives far more discretion to the CMA's CEO and board to be more or less interventionist," one regulatory lawyer warned.

The timing of these proposals, coming a year after the chancellor's intervention to remove the CMA's previous chairman, will inevitably fuel concerns about political encroachment into competition oversight.

Neither the Department for Business and Trade nor the CMA responded to enquiries about the planned overhaul.

The Government maintains the reforms will provide the certainty businesses require whilst supporting its growth agenda.

More From GB News