Inflation falls to 3.2% in win for economy and Rachel Reeves

The ONS' inflation figures come one day before a major interest rate decision from the Bank of England

Don't Miss

Most Read

Latest

The consumer price index (CPI) rate of inflation for November has fallen to 3.2 per cent, from 3.8 per cent, according to the latest figures from the Office for National Statistics (ONS).

This comes as welcome relief to Chancellor Rachel Reeves who has been forced to contend with a slip in gross domestic product (GDP) growth and a rise in unemployment over the past week.

Notably, the fall to 3.2 per cent marks the lowest CPI rate since March of this year and a bigger drop than the 3.5 per cent that most economists were expecting for the month.

Today's dip in the CPI inflation rate comes a day before the Bank of England's next Monetary Policy Committee (MPC), which will determine the cost of borrowing for interest rates.

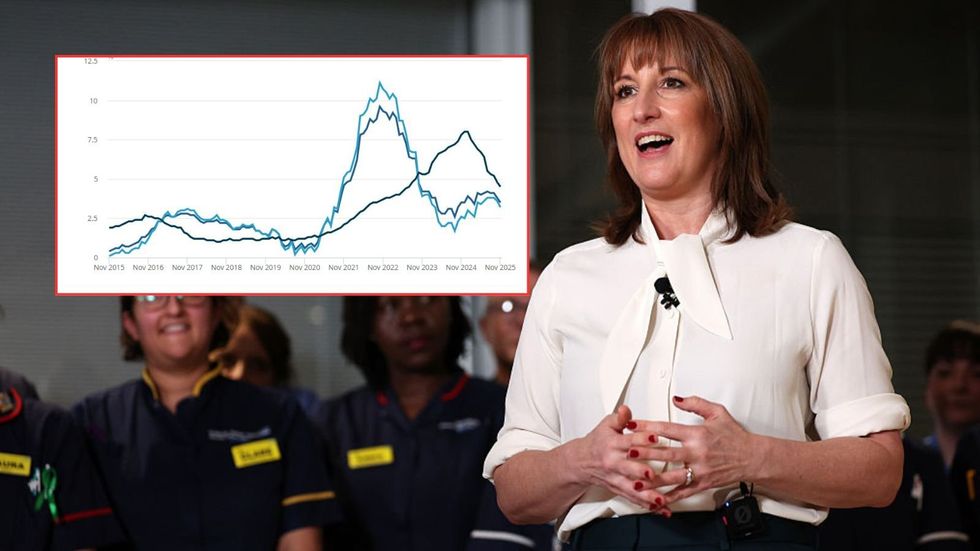

The Chancellor has had to deal with inflation over the past year

|GETTY / ONS

Analysts note the chance of a base rate is nearly certain as financial markets were already pricing in a 90 per cent probability of a quarter-point reduction before the release of the latest inflation snapshot.

Multiple factors in the economy contributed to the downward inflationary trend, including changes in housing, clothing and food and non-alcoholic beverages in a boon for everyday consumers.

Last month, food and non-alcoholic beverages prices jumped by 4.2 per cent in the 12 months to November 2025, down from 4.9 per cent in October. On a monthly basis, food and non-alcoholic beverages prices fell by 0.2 per cent in November 2025, compared with a rise of 0.5 per cent a year ago.

As well as this, the 12-month inflation rate for housing and household services came to 4.8 per cent last month, down from five per cent in October. On a monthly basis, prices rose by 0.4 per cent in November 2025, compared with a rise of 0.6 per cent a year ago.

Furthermore, clothing and footwear prices dropped by 0.6 per cent in the 12 months to November 2025, compared with a hike of 0.3 per cent in the 12 months to October. The low November rate was matched in February 2025. The rate was last lower in March 2021, when prices fell by 3.8 per cent on the year.

In reaction to today's larger than expected drop in the CPI rate, ONS chief economist Grant Fitzner shared: "Inflation fell notably in November to its lowest annual rate since March.

"Lower food prices, which traditionally rise at this time of the year, were the main driver of the fall, with decreases seen, particularly for cakes, biscuits and breakfast cereals.

"Tobacco prices also helped pull the rate down, with prices easing slightly this month after a large rise a year ago. The fall in the price of women’s clothing was another downward driver.

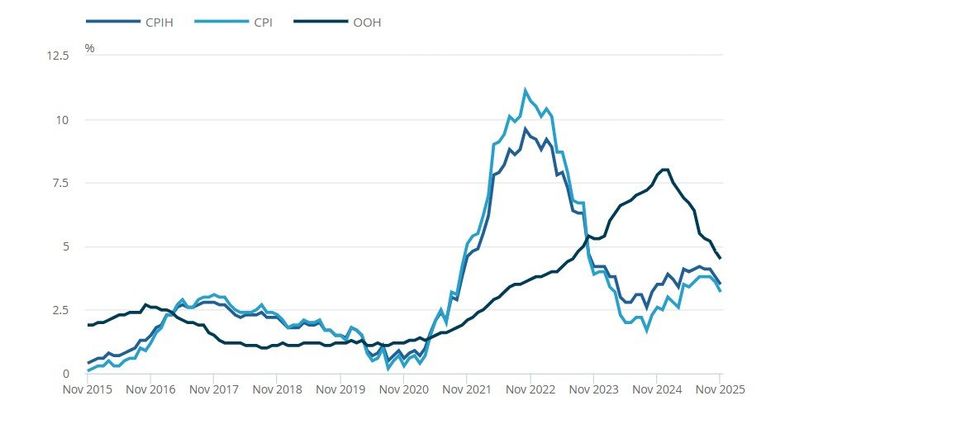

How has the CPI inflation rate changed?

|ONS

LATEST DEVELOPMENTS

"The increase in the cost of goods leaving factories slowed, driven by lower food inflation, while the annual cost of raw materials for businesses continued to rise."

Tom Stevenson, an investment director at Fidelity International, noted that inflation still remains way above the central bank's desired target, signalling a "slowdown" in the economy.

He shared: "Britain is caught between a slowing economy and still persistent inflation. Last week we learned that the UK economy contracted by 0.1 per cent both in the month of October and for the three months to October. GDP had contracted by a similar amount in September."

Isaac Stell, an investment manager at Wealth Club added: "UK inflation undershot expectations in November, bolstering the case for interest rate cuts in the face of challenging economic conditions.

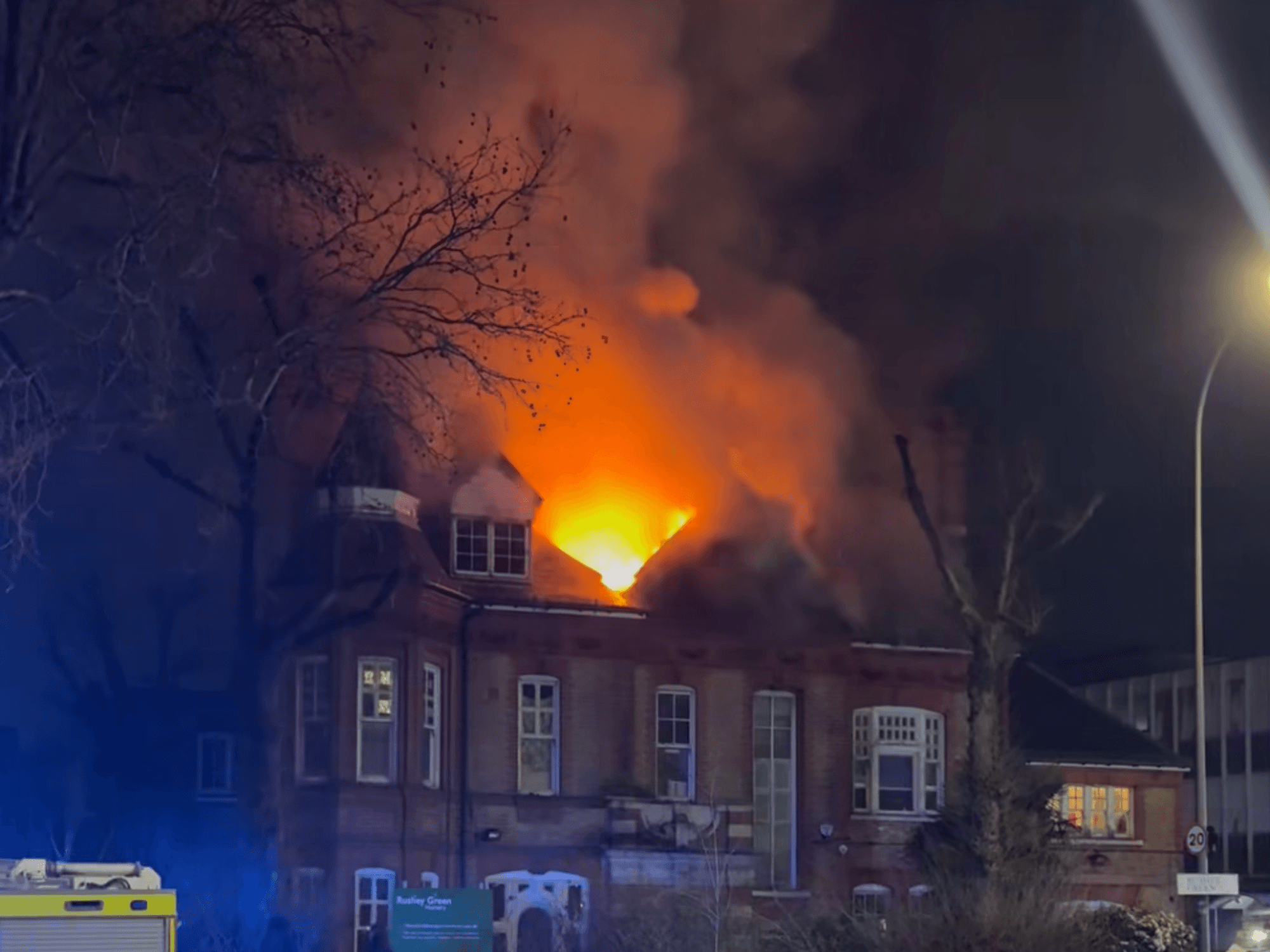

Inflation has fallen by more than expected

| GETTY"Not only did the headline rates fall far more than anticipated, but services inflation, a key concern for the Bank of England also declined to 4.4 per cent. Despite inflation falling, there is still some way to go before the headline rates fall back to the two per cent target.

"However, today’s news is a bright spot for the Bank of England, Government and consumers alike. With challenging economic conditions in the form of declining GDP and an un-employment rate nearing a five- year high, it is hoped a perfectly wrapped rate cut tomorrow will deliver some festive cheer to the UK economy."

Pieter Reynders, a partner at McKinsey & Company, shared: "UK inflation still trends above the EU, but the gap is closing with the latest UK reductions. Still our December consumer sentiment data shows that inflation remains the UK’s top economic concern.

"Yet even in a cautious climate, there’s a pulse of optimism. UK consumers plan to splurge in Q4, with groceries, dining out and travel the top treats expected this Christmas."

More From GB News