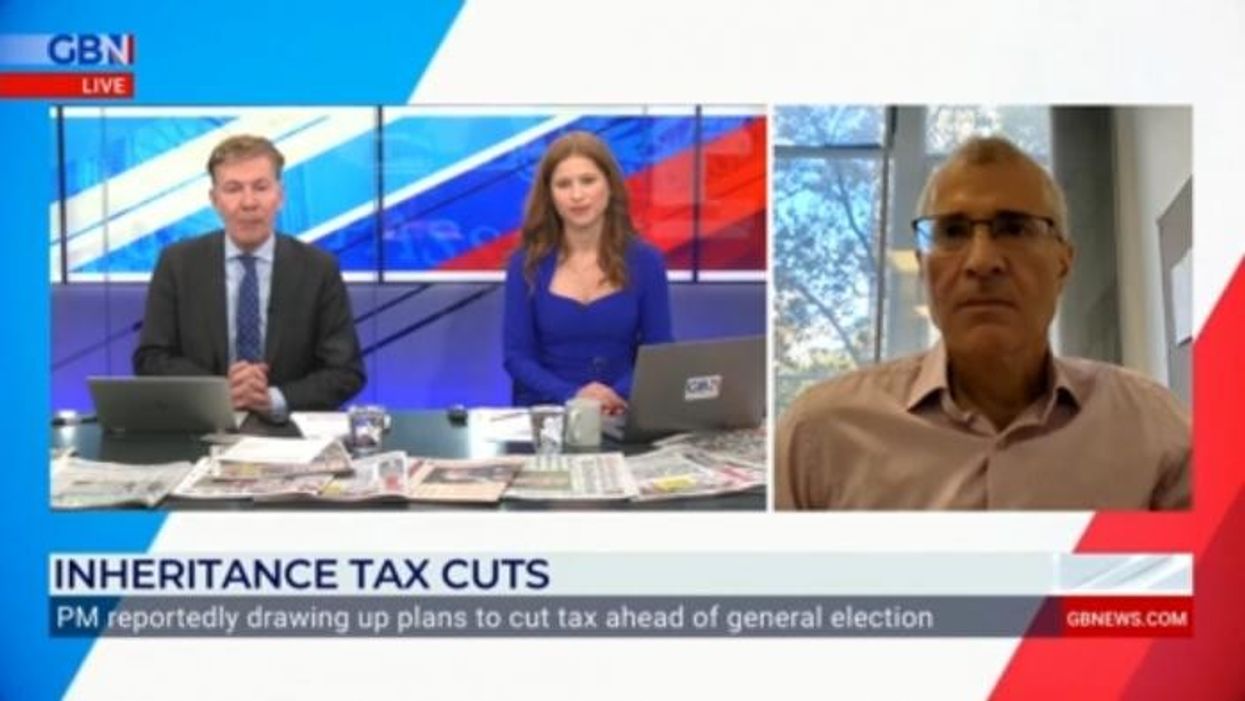

GB News presenter Emily Carver clashed with Jonathan Portes in a row over inheritance tax, following reports that Prime Minister Rishi Sunak is drawing up plans to cut tax.

The Professor of Economics and Public Policy at King's College London joined Emily Carver and co-host Andrew Pierce on Britain's Newsroom, where the pair became embroiled in a heated discussion.

Portes said: "Remember, inheritance tax, it's not a tax that's paid by the people who are dying. It's paid by those who are inheriting and it's only paid on about 4% of all estates that we are really talking about the wealthiest in our society who are getting this windfall from their parents.

"And I can sort of understand why people think, my parents want to leave it for me, why should the state take some of it? But the fact is that inheritance tax is primarily something that means that relatively well off people don't get something that they didn't earn, that their parents earned. They only get 2/3 of it or a bit more. It hardly seems to me like the priority for tax cuts at the moment."

Carver then asked: "You say only 3% of families of the state deal with this tax. But isn't that because there's the threat of inheritance tax? So a lot of people try to move their assets around, sort it before they die.

"And also 30% of people seem to think they will pay this tax, particularly as assets are growing in value, housing in particular. So do you understand why it is so deeply unpopular?"

Portes replied: "I understand it to a certain extent. But the 30% are wrong. Even the rising value of houses won't drag anything like that many people into the net. That's the first point. The second point is, yes, you're right, some people do avoid it, but it's not actually the sort of middle, well off but not super rich people who avoid it. It's the very rich and the super rich who avoid it, and there are some genuine issues there.

"It would be better to have a tax which perhaps was slightly less burdensome on some upper middle income earners but made it considerably harder for people at the top end to to avoid paying it mostly or entirely, usually through the use of trusts or other forms of ways that you can quite legally but in some ways unfairly avoid the tax."

Carver hit back, saying: "We could talk about priorities, but if you look to other countries, I don't believe Australia has inheritance tax or a death tax, you could call it. I don't believe social democracies like Norway and Sweden have one either. We are a bit of an outlier when it comes to these kind of taxes.

"And some people simply think it's immoral for, you know, the government to take away because they've already paid tax on it. You know, it's one of those funds. Sorry about that, I just wanted to go off on one!"

Watch the clash in full above.

Tune in to Britain's Newsroom, Monday to Friday from 9:30am, only on GB News.