Families fall into unnecessary inheritance tax bills by missing 'straightforward' step as HMRC rake in £5.8bn

Rising house prices are dragging more families into inheritance tax, leaving loved ones facing potentially large bills

Don't Miss

Most Read

Latest

Families could end up paying unnecessary inheritance tax bills by overlooking a simple step that experts say many households are still unaware of.

With rising property values pushing more estates above the inheritance tax (IHT) threshold, advisers warn that a lack of forward planning is leaving families exposed to avoidable financial strain.

Official HMRC figures reveal that IHT receipts reached £5.8billion during the first eight months of the current tax year, representing an £84million increase compared to the same period last year.

This rise forms part of a two-decade trend driven by frozen thresholds and escalating asset values, particularly property. Although fewer than four per cent of estates currently face IHT, the proportion is expected to grow.

The Office for Budget Responsibility forecasts the tax will generate a record £9.1billion in 2025/26, climbing to more than £14billion by 2029/30.

For those seeking to shield heirs from substantial tax demands, life insurance offers a relatively straightforward approach to building funds that can cover the liability without forcing the sale of property or other assets.

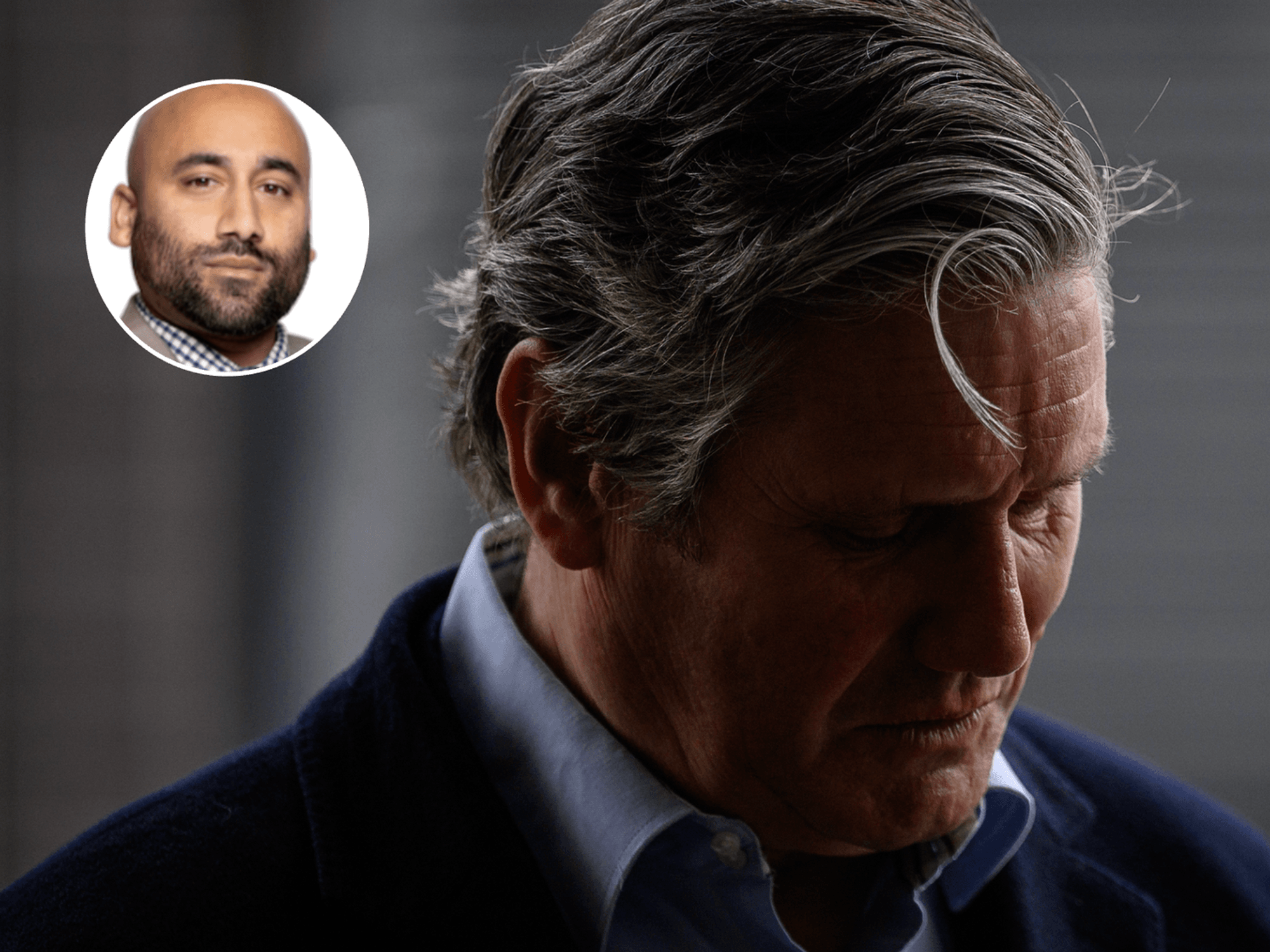

Chris Ball, chief executive of financial advisory firm Hoxton Wealth, said: "We are definitely seeing a marked increase in interest around life insurance and estate planning.

"Rising property values have pushed more families into the inheritance tax net, and people are realising that their loved ones may face a significant bill.

"Insurance provides a relatively straightforward way of creating a pot of money to meet that liability, without having to sell assets or disrupt long-term plans."

While such policies do not reduce the actual tax owed, they provide immediate cash for beneficiaries to settle bills with HMRC. Crucially, policies must be written into trust to ensure proceeds fall outside the estate and bypass probate.

There has been a marked increase in interest around life insurance and estate planning

| GETTYTwo principal forms of life cover are commonly employed for inheritance tax planning purposes. Whole of life insurance remains active until the policyholder dies, guaranteeing that funds will be available when needed, making it particularly suitable for covering a known IHT liability.

Term assurance serves a different function, specifically protecting gifts made during a person's lifetime. When someone transfers a substantial sum, the gift may become exempt from inheritance tax provided the donor survives for seven years.

LATEST DEVELOPMENTS:

- State pension warning as payment rise could push retirees into higher inheritance tax

- Inheritance tax U-turn 'early Christmas present' for farmers - what you need to know

- Inheritance tax U-turn 'doesn't go far enough' as calls for even higher threshold grow

A straightforward seven-year term policy can cover this interim risk, ensuring beneficiaries remain protected should the donor die within that window.

For gifts where the tax liability reduces gradually over time, a specialist product called Gift Inter Vivos insurance mirrors this tapering effect.

When selecting a policy, families face important decisions around premium structures. Whole of life cover provides guaranteed protection but comes with higher costs, requiring a choice between guaranteed premiums that offer long-term certainty at a higher initial rate, or reviewable premiums that start lower but may increase substantially in later years.

From April 2027, pension pots will fall within the scope of inheritance tax for the first time. | GETTY

From April 2027, pension pots will fall within the scope of inheritance tax for the first time. | GETTYTerm cover for gifts proves considerably more affordable but only addresses that specific liability for a fixed duration.

Mr Ball emphasised the critical importance of proper structuring: "Crucially, all such policies should be written in trust, otherwise, the payout may end up in the estate and increase the very tax liability they were meant to solve."

Professional guidance is essential, as the appropriate arrangement depends on estate value, gifting strategy, family circumstances and long-term affordability.

The pressure on families is set to intensify further in coming years. From April 2027, pensions will be included in estate calculations for inheritance tax purposes, significantly broadening the tax base while thresholds remain unchanged.

HMRC rake in £5.8bn in inheritance tax receipts

| GETTYShaun Moore, tax and financial planning expert at Quilter, said: "For many households, pensions now represent one of the largest components of wealth, meaning future liabilities could be far larger than people expect."

The 2024 Budget also introduced restrictions on business relief, agricultural relief and alternative investment market holdings, with caps on agricultural and business property reliefs taking effect from April 2026.

Mr Ball cautioned that without proper advice, there is a genuine risk of paying excessive premiums for unsuitable cover, or leaving heirs with a policy that fails to achieve its intended purpose.

More From GB News