Inheritance tax U-turn 'early Christmas present' for farmers but Labour accused of 'not going far enough'

Inheritance tax is a levy on the estates of individuals who have passed away

Don't Miss

Most Read

The Labour Government's inheritance tax (IHT) U-turn has been hailed as an "early Christmas present" for farmers with the HM Revenue and Customs' (HMRC) levy's threshold to be raised from £1million to £2.5million.

Ministers have confirmed the revised tax policy, which is set to take effect from April6 in the new year, will be formally introduced to Parliament through the Finance Bill in January.

Under the new provisions, spouses and civil partners will be permitted to transfer unused allowances to one another, potentially allowing couples to pass on agricultural assets worth up to £5 million without incurring inheritance tax.

Ministers stated they had responded to concerns raised by the farming community regarding the additional financial burden posed by higher inheritance tax obligations.

The Government's tax U-turn has been hailed an 'early Christmas presents'

|GETTY

Robert Salter, a director at audit and advisory firm Blick Rothenberg, welcomed the announcement as "an early Christmas present for farmers and family-owned businesses".

He noted the changes were particularly unexpected given that most observers had assumed no further amendments would follow the November Budget, which had only addressed spousal transfer provisions.

However, Mr Salter expressed disappointment at how long the Government had taken to reach this decision, pointing out that the original rules had drawn heavy criticism from both affected parties and professionals in the sector.

The prolonged uncertainty over the Labour Government's policies for thousands of farmers across the country had caused considerable stress for those impacted, he added.

Rachel Reeves unveiled £26billion of tax hikes in her most recent Budget

| UK PARLIAMENT/PANFU president Tom Bradshaw acknowledged that ministers had accepted its initial proposals contained flaws, but maintained the amendments fell far short of what was needed.

"This change goes nowhere near far enough to remove the devastating impact of the policy on farming communities," Mr Bradshaw said.

The NFU mutual noted that while widowed farmers would benefit from the new provisions, the measures failed to ease the burden placed on elderly and vulnerable members of the agricultural community.

He called on ministers to introduce additional measures to address these outstanding concerns, warning that the current changes left significant problems unresolved for many farming families.

LATEST DEVELOPMENTS

Environment Secretary Emma Reynolds affirmed the Government's dedication to supporting British agriculture, describing farmers as central to the nation's food security and environmental protection.

"We have listened closely to farmers across the country, and we are making changes today to protect more ordinary family farms," she stated.

HM Treasury and the Department for Environment, Food and Rural Affairs confirmed that the transferable allowance provisions would extend to widows and widowers, including cases where the first spouse died many years prior to 6 April 2026.

Officials said the changes would simplify inheritance tax rules for those holding agricultural and business assets while making the system fairer.

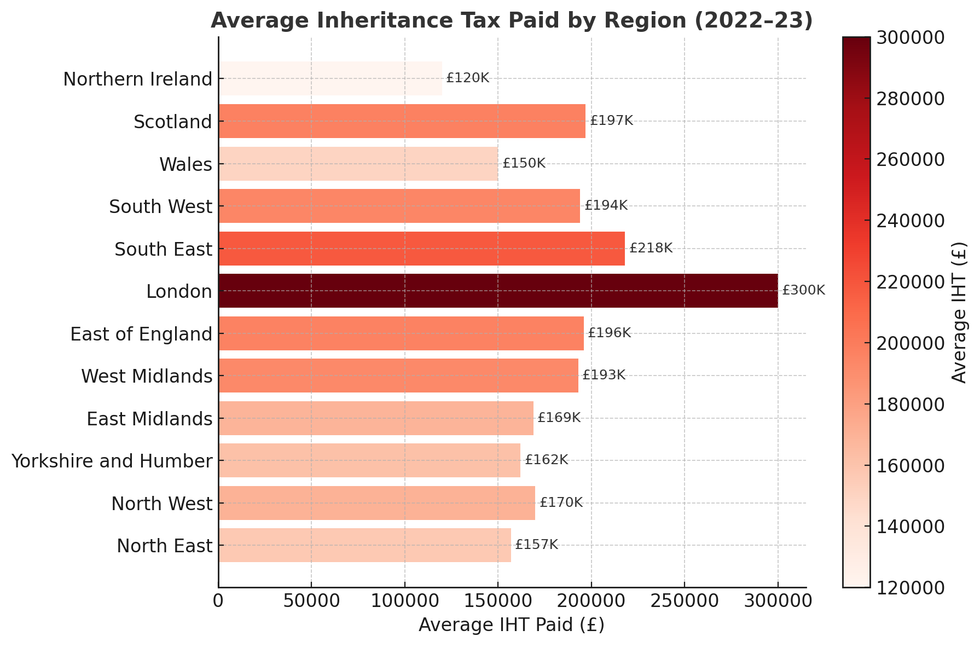

Average Inheritance tax paid by region | CHATGPT/ONS

Average Inheritance tax paid by region | CHATGPT/ONSWhat are the latest inheritance tax changes?

Originally, Chancellor Rachel Reeves's 2024 Budget proposed from April 2026 that agricultural and business property over £1million would start to face IHT, which is a 20 per cent rate on the value above that, ending long-standing reliefs on family farms.

With this week's U-turn, ministers agreed to raise the relief threshold from £1million to £2.5million per estate. That means a couple could pass on up to £5million tax-free under these relief rules.

Qualifying assets above £2.5million still attract a 20 per cent IHT charge, which is half the regular 40 per cent tax rate, and 50 per cent relief applies above the new cap.

It should be noted that the nil-rate band attached to inheritance tax will remain at £325,000 and the residence nil-rate band at £175,000, with both frozen for several years.

More From GB News