Inheritance tax hike looms as Britons warned life insurance is 'one of few routes left' to avoid HMRC raid

Martin Daubney fumes at Labour's latest 'cruel' inheritance tax raid as Rachel Reeves looks to plug the UK deficit |

GB NEWS

Premiums surge 18 per cent as looming reforms push more estates above threshold

Don't Miss

Most Read

Families across Britain are rushing to shield their wealth from impending inheritance tax (IHT) reforms.

Life insurance premiums jumped by 18 per cent to reach £447million in the year ending March 2025.

The surge represents a £69million increase from the previous year's £378million, according to data from TWM Solicitors.

The rise follows last year's Budget announcement that will bring pensions, agricultural property and business assets under IHT rules, which is set to come into effect from April 2026 and April 2027.

TRENDING

Stories

Videos

Your Say

Duncan Mitchell-Innes, partner and deputy head of private client at TWM Solicitors, said: "Other than gifting assets, there are fewer and fewer ways to reduce your family's IHT bill.

"Life insurance is one of the few routes left and we have seen an increased number of enquiries for advice in this area."

The inheritance tax burden is already substantial for many estates, with nearly one in ten paying more than £500,000 in the 2021/22 tax year.

Freedom of Information (FoI) data obtained by Rathbones reveals that 2,520 estates faced tax bills exceeding half a million pounds.

British families are scrambling to protect their assets ahead of looming changes to inheritance tax rules

|GETTY

This marks a 29 per cent increase over three years. Among these, 1,630 estates paid between £500,000 and £999,999, whilst 890 estates faced bills surpassing £1million.

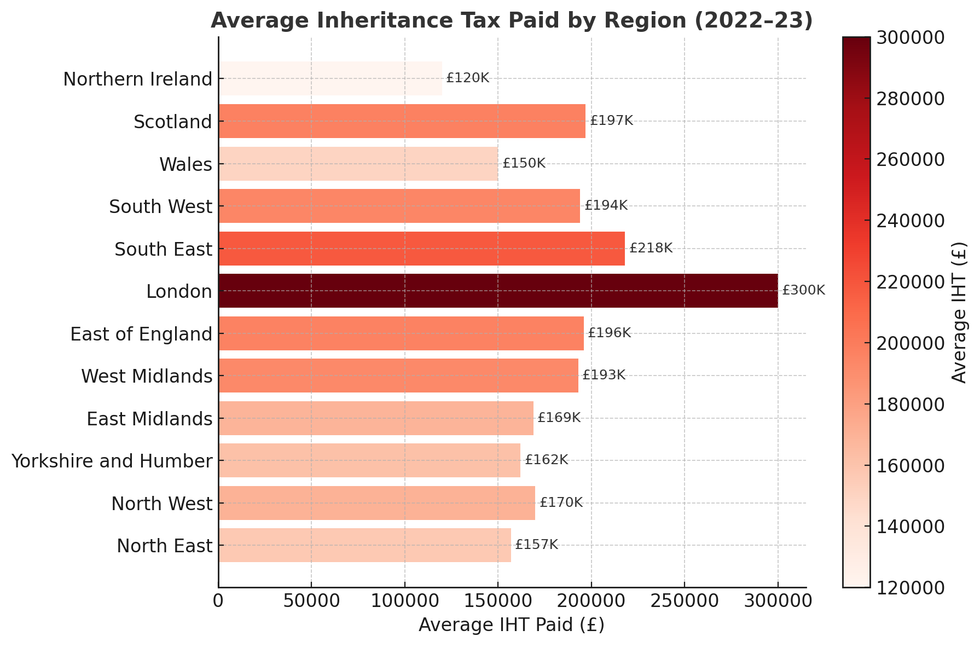

If current trends persist, projections suggest 3,524 estates could pay over £500,000 by the end of the current tax year. The overall number of estates liable for inheritance tax reached 31,500 in 2022/23.

This represented 4.62 per cent of UK deaths. Total tax liabilities climbed to £6.7billion, a 12 per cent rise from the previous year.

The forthcoming inheritance tax changes represent what tax experts are calling "seismic" reforms to the current system. From April 2026, agricultural and business relief will be limited to £1million of qualifying assets.

Average Inheritance tax paid by region

|CHATGPT/ONS

Amounts above this threshold will receive only 50 per cent relief, creating an effective 20 per cent tax rate. Listed shares previously treated as unquoted, including AIM shares, will see their relief reduced from 100 per cent to 50 per cent.

From April 2027, defined contribution pensions will lose their long-standing inheritance tax exemption and face the standard 40 per cent rate. These pension changes alone are expected to affect approximately eight per cent of estates.

This will push many families above the £325,000 nil-rate band for the first time.

Experts warn that protecting estates through life insurance requires careful structuring.

Mr Mitchell-Innes said: "Life insurance can be a powerful estate-planning tool, but only when structured correctly. If not held in trust, the policy may be taxed for IHT and tied up in probate, defeating its purpose."

The inheritance tax changes are already affecting savings behaviour.

Rathbones research revealed that 31 per cent of pension holders are deterred from making further contributions due to the upcoming reforms.

Instead, 39 per cent plan to place funds in savings accounts, whilst 25 per cent intend to invest in equity ISAs.

Property investment has emerged as an alternative for 14 per cent of those surveyed.

This comes as families seek tax-efficient ways to preserve wealth.

LATEST DEVELOPMENTS:

Reform UK have proposed scrapping inheritance tax, which could prove a popular policy among estate holders

| Getty ImagesRebecca Williams, divisional lead of financial planning at Rathbones, said: "Parents and grandparents are increasingly aware of the IHT bill they might be leaving behind and many are looking for ways to support family and loved ones during their lifetimes instead."

She highlighted the growing desire amongst clients to assist younger generations immediately.

This includes educational costs and property purchases, whilst maintaining financial security for later life.

Ms Williams said: "The Bank of Mum and Dad is under pressure, clients are walking a line between supporting children today, having enough for later life care tomorrow and not wanting to give the Treasury too much of their hard-earned wealth on death."

This shift towards lifetime giving reflects families' attempts to navigate the increasingly complex inheritance tax landscape.

It also highlights a growing desire to provide meaningful support when it is most needed.

More From GB News