Inheritance tax warning: 'Double blow' to grandparents if Rachel Reeves launches HMRC raid

Inheritance tax is a levy on the estates of individuals who have passed away, but some relief is currently available

Don't Miss

Most Read

Chancellor Rachel Reeves could eliminate or restrict a valuable inheritance tax (IHT) loophole in her upcoming Autumn Budget, according to financial advisers.

The exemption for regular gifts from surplus income currently permits wealthy individuals to transfer unlimited amounts without IHT consequences.

It is understood that the Government is exploring methods to increase inheritance tax revenue by restricting gift allowances.

The exemption has become increasingly popular as families seek to reduce their tax liabilities following last year's announcement that unspent pensions will fall under inheritance tax rules from April 2027.

The Chancellor is preparing for this year's Budget

| PA/GETTYThe exemption permits individuals to transfer money from their excess income through regular payments without any ceiling on the amount.

To meet the requirements, these transfers must come from income rather than capital, form part of a consistent giving pattern, and leave the donor with adequate funds to sustain their lifestyle.

Unlike other inheritance tax reliefs, these transfers immediately escape tax liability regardless of when the donor dies. The exemption's unlimited nature makes it particularly attractive to high-income earners who can transfer substantial sums whilst maintaining their living standards.

Affluent grandparents frequently utilise this provision to cover their grandchildren's private education costs, while others establish trusts or contribute to younger relatives' pensions.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Farmers have been protesting against the inheritance tax raid | PA

Farmers have been protesting against the inheritance tax raid | PASean McCann, chartered financial planner at NFU Mutual, warned: "Many wealthy grandparents use this to pay their grandchildren's school fees and so the introduction of a limit or an abolition, coupled with VAT on school fees, would be a double blow."

The exemption requires demonstrating a consistent gifting pattern, with HMRC scrutinising both frequency and amounts.

Initial gifts in a planned series can qualify even if death occurs shortly afterwards, provided evidence exists of intended regular payments.

Documentation requirements pose a significant challenge as the exemption cannot be claimed until after death, placing the burden on executors to prove eligibility.

MEMBERSHIP:

- Reform to lock horns with fellow insurgent party in just 24 hours as Nigel Farage looks to break 14-year stranglehold

- In 14 words, Keir Starmer and Yvette Cooper just gave tacit approval to open borders - Rakib Ehsan

- REVEALED: The five biggest scandals Reform's Doge unit has uncovered since crowbarring open councils

- Fresh blow for Keir Starmer as SHOCK map shows migrant hotel protests could parachute Nigel Farage into No10

- POLL OF THE DAY: Is free speech under threat in Britain? VOTE NOW

Mr McCann emphasised: "As the exemption isn't claimed until after death it's important to keep records of your income, expenditure and gifts."

HMRC provides Schedule IHT 403 for recording financial details during one's lifetime, preventing this administrative task from falling to bereaved families.

McCann recommended: "It's a good idea to send your loved ones a note with the first gift confirming your intention to gift regularly and keep a copy with your will."

Last month, HMRC figures revealed that IHT receipts for April to July 2025 came to £3.1billion, which is £200million higher than the same period last year.

LATEST DEVELOPMENTS:

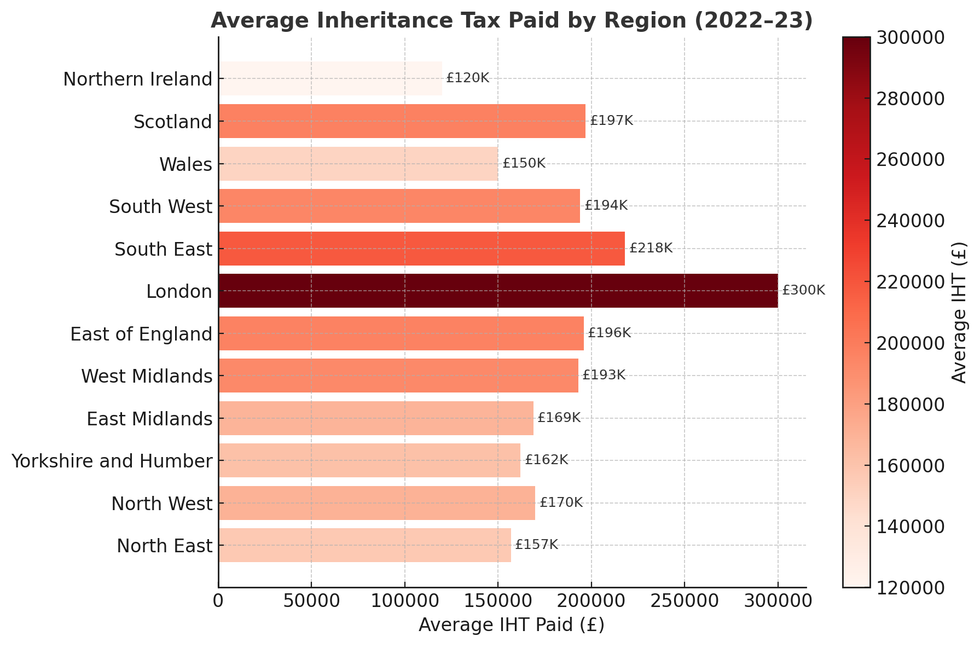

How much is London paying in inheritance tax compared to the rest of the country | GETTY

How much is London paying in inheritance tax compared to the rest of the country | GETTY On this intake, Ian Dyall, head of estate planning at wealth management firm Evelyn Partners, said: "The July figure means that Inheritance Tax revenues for this financial year so far are running about 6.9 per cent ahead of the same period last year.

"Monthly receipts data reliably shows how fiscal drag is bringing more wealth into the scope of IHT, but the numbers that really matter for wealthier households are those showing the overall state of the public finances, because that’s what prompted last year’s Budget overhaul of IHT rules, and it’s not unthinkable that the transfer of wealth will be on the table again at the next Budget.

"The dilution of business and agricultural property reliefs doesn’t come into force until next April, and the inclusion of unspent pension assets in estates doesn’t occur until April 2027, so we won’t see how much money they bring in through the Treasury door until well after those dates.

"However, it is well known that families, and especially wealthier ones, tend to take steps to mitigate significant tax increases and to change their behaviour, which raises the risk that the tax take disappoints. It’s doubtless this fear which could put, if the rumour circulated last week is to be believed, the gifting regime under the Chancellor’s spotlight this time around. One of the easiest ways for families to reduce the threat of larger IHT bills is to gift during lifetime, and as the seven-year rule allows unlimited amounts to be transferred and possibly leave the estate altogether, this is the natural escape route that the Treasury might seek to block off."

More From GB News