UK borrowing costs SURGE to new 27-year high as Rachel Reeves as pound continues to drop

Global borrowing costs continue to rise as investors become increasingly concerned about the debt burdens of multiple countries

Don't Miss

Most Read

Latest

The UK's long-term borrowing costs surged even further this morning as global Government bonds continue to face further pressure amid investor concern over soaring debt.

Britain's 30-year gilt, which is the interest rate demanded of by investors for the state's borrowing expenditure, reached a new 27-year high and surpassed the 5.27 per cent level.

As it stands, the British pound is at a month low against the US dollar and back to buying €1.15, down from €1.19 before President Donald Trump "Liberation Day" tariff announcement.

Chancellor Rachel Reeves is coming under renewed scrutiny as the bond market appears to be pushing back against a perceived lack of fiscal credibility when it comes to Government decision-making.

The Chancellor faces pressure from the bond markets

|GETTY

Notably, the UK is not an outlier when it comes gilt yields soaring with the the 30-year US Treasury yield close to five per cent for the first time since July 2025.

This latest sell-off in the UK comes as the Labour Government auctioned off these long-term loans yesterday (September 2) and had to pay a premium as part of the transaction.

Due to this development, the Government has to pay more to borrow money, an increase on debt interest rates could spook investor confidence in the UK being able to pay back these loans.

Analysts are sounding the alarm that Governments will need to bring down spending and encourage gross domestic product (GDP) growth in order to address these fiscal concerns.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

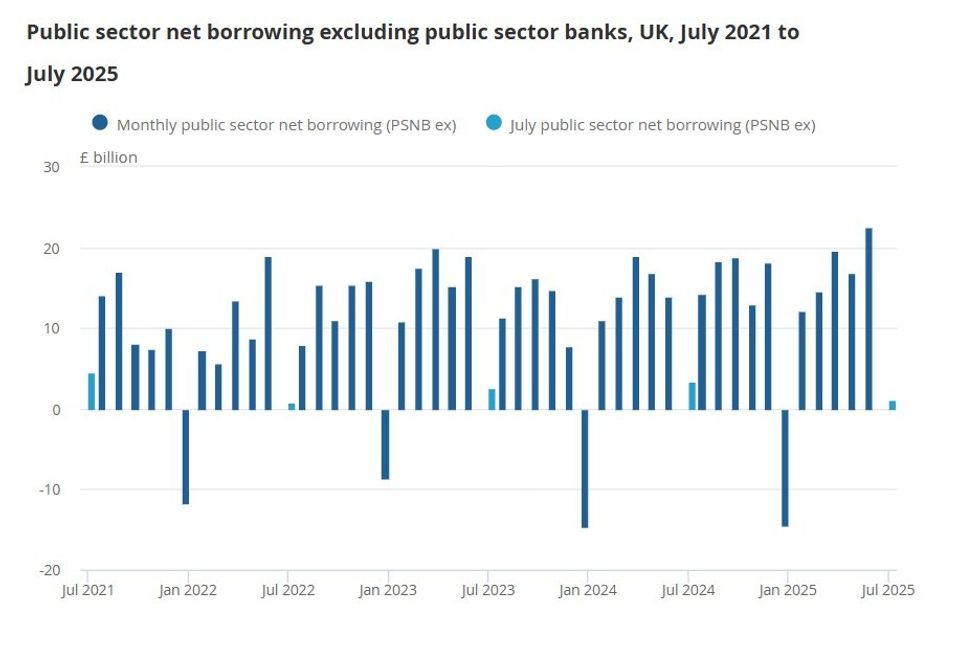

How much did Britain borrow? | ONS

How much did Britain borrow? | ONSGeopolitical tensions and President Trump's tariffs have impacted the global economy as many countries look to address the debt burden resulting from Covid-19 pandemic-era spending.

Susannah Streeter, the head of money and markets at Hargreaves Lansdown, said: "Warning lights are flashing about increasingly tricky economic conditions and geopolitical risk.

"As concerns collide about the global outlook, inflationary pressures and worrisome public finances, the FTSE 100 remains on the backfoot, with other European indices also largely in the red.

"Gold prices have jumped again, to new record levels, as the fallout from President Trump’s radical trade policy continues to unnerve investors, pushing them towards safer havens.

MEMBERSHIP:

- Nigel Farage 'handed golden opportunity with Britain's migrant crisis - but faces one major challenge'

- REVEALED: The five biggest scandals Reform's Doge unit has uncovered since crowbarring open councils

- While Lucy Connolly languished, a far more sinister plot was underway to capture our courts - Robert Courts

- An unlikely Washington-Rylan Clark tie-up just triggered an extinction-level event for Labour - Lee Cohen

- POLL OF THE DAY: Has the small boats crisis changed how you will vote at the next General Election? VOTE NOW

"Although spot gold has retreated after breaching £3508 an ounce, it remains highly elevated, as concerns continue to swirl about the impact of tariffs. Investors also appear rattled by Trump’s attempts to interfere with the running of the Federal Reserve, and the disputed sacking of Fed Governor Cook.

"An independent US central bank is seen as crucial for the US to maintain credible monetary policy management and so the President’s actions are shaking confidence."

Despite this trajectory in the gilt yield, London’s FTSE 100 Index edged 22.2 points higher at 9138.9 on Wednesday morning, while gold hit new record highs once again.

The safe haven asset's value above $3,530 US dollars as investors are on the search for financial security.

LATEST DEVELOPMENTS:

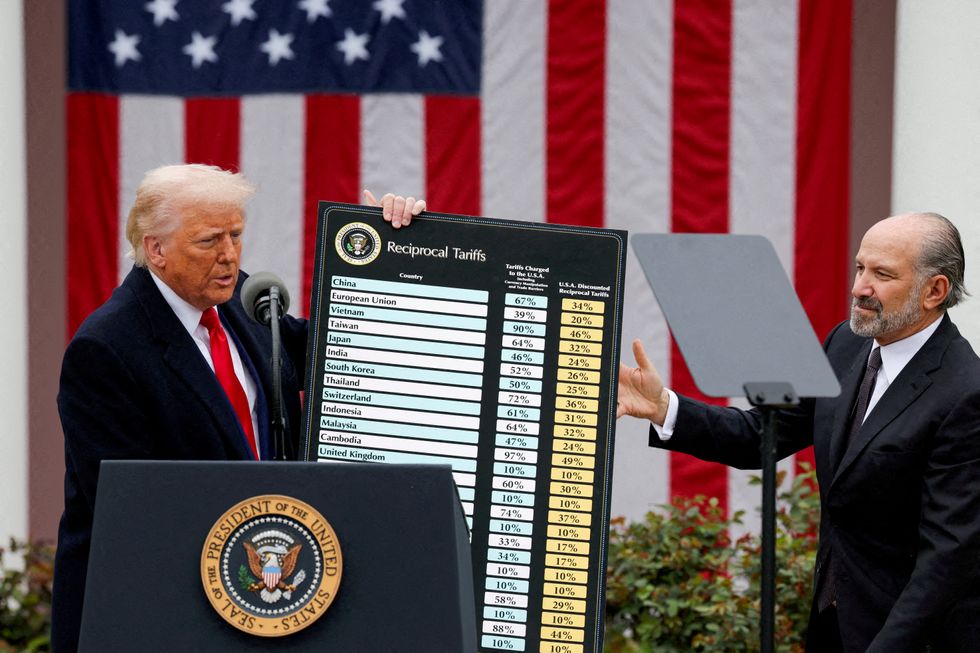

The legal to-and-fro affects Trump's 'Liberation Day' tariffs on imports from most US trading partners | REUTERS

The legal to-and-fro affects Trump's 'Liberation Day' tariffs on imports from most US trading partners | REUTERSSpeaking to Sky News this morning, Health Secretary Wes Streeting said: "The Chancellor, since she came in last year, has been determined to restore stability to our economy, to get growth back into our economy, and to create the conditions where we can get the nation’s finances back to health.”

"Britain is not out of the woods, and that is why the discipline and the focus that she has brought on cost of living, on economic growth and creating the conditions for businesses to be successful is really important, and the discipline we show as a Cabinet in terms of public spending is really important."

Kathleen Brooks, research director at XTB, added: "UK bond yields have been on an upward trajectory for most of this year and have risen significantly since Labour took office.

"The bond market will need some hefty persuading that Labour will reign in public sector spending and bring the UK’s finances under control. This is why we expect to see bouts of UK bond market volatility in the coming months."

More From GB News