Rachel Reeves faces calls to launch wealth tax in Autumn Budget to address 'the big inequality opening up'

Britain's trade union movement has intensified its campaign for higher taxes on the wealthy as Rachel Reeves prepares her autumn financial statement on November 26

Don't Miss

Most Read

Latest

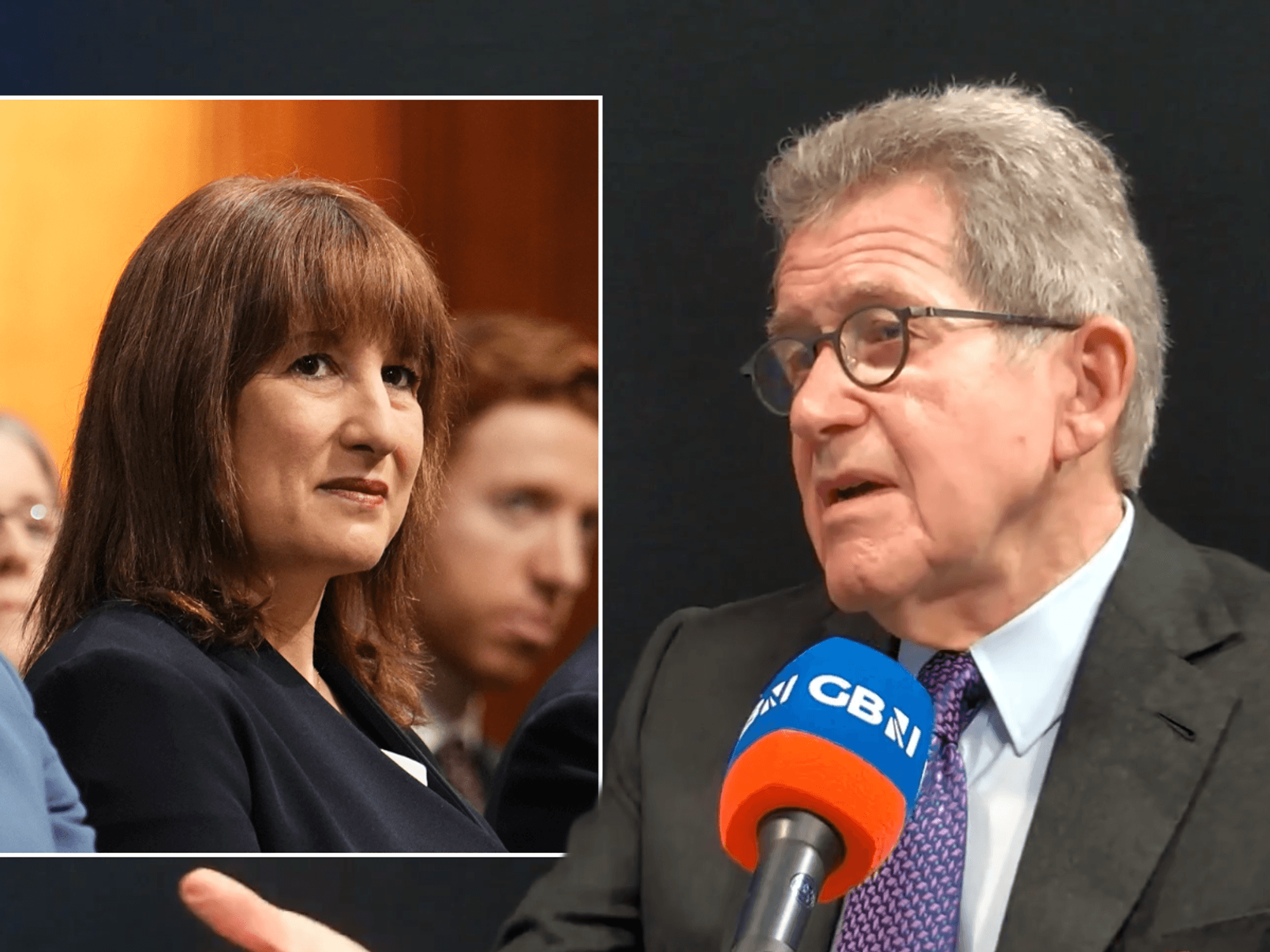

Chancellor Rachel Reeves is facing calls to launch a wealth tax in her upcoming Autumn Budget to address "the big inequality opening up" in British society.

The Trades Union Congress (TUC) has pressed for significant reforms to address what it describes as an imbalanced system that burdens workers whilst allowing the affluent to escape their fair share.

Paul Nowak, the TUC's general secretary, has advocated for measures including equalising capital gains tax with income tax rates and introducing "a wealth tax itself" in broadcast interviews.

He pointed to Spain's experience, noting it maintains such a levy whilst enjoying robust economic growth.

The Trades Union Congress has pressed for the chancellor to address the UK's wealth imbalance

|GETTY

The union leader argued that Britain's tax framework excels at extracting revenue from employment but fails to capture wealth effectively, creating what he termed "the big inequality" seen in Britain.

TUC is urging Chancellor Rachel Reeves to go further on wealth taxes in her November Budget, with the group saying the Government must show it is serious about change. “The big four high street banks made £46billion in profits in one year alone,” he noted.

Mr Nowak told the BBC that Ms Reeves should not take anything off the table. Among the options he listed were equalising capital gains tax with income tax, imposing windfall levies on banks, and introducing new charges on gambling companies.

A direct wealth tax should also be considered, he argued. Ms Reeves has insisted her approach to taxation is already balanced, pointing to recent measures on private jets, second homes and capital gains.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

The TUC, however, believes Labour risks losing public trust without bolder reform. Failure to act could leave voters disillusioned, Mr Nowak warned, with some turning to Reform UK.

Polling commissioned by the unions suggests that wealth tax proposals are especially popular among those who have drifted from Labour.

“The public aren’t daft, they know there are difficult choices.” Mr Nowak said. With borrowing costs at a 27-year high and Labour’s fiscal rules in place, pressure is mounting on Ms Reeves to decide who pays more.

Economist Gary Stevenson has emerged as a prominent advocate for wealth taxation, dismissing opposition arguments as "childish" in his latest online commentary.

He rose to prominence through his YouTube channel, which stands at 1.43million subscribers

|GETTY

The former trader, who profited from betting on rising inequality's economic impact, contends that Britain's wealth concentration threatens national stability.

Mr Stevenson highlights the case of Roman Abramovich to counter claims about capital flight.

Despite the oligarch's attempts to operate offshore, he potentially owes £1billion in UK taxes on hedge fund profits, with £2.5billion from Chelsea's sale frozen in British accounts.

The economist acknowledges that detailed implementation requires expert teams and political commitment, not "f*****g YouTubers", as he puts it. He supports proposals from Tax Justice UK for a two per cent levy on fortunes exceeding £10million, affecting just 0.04 per cent of the population whilst generating £24billion annually.

Business leaders have issued stark warnings about the potential consequences of wealth taxation.

Vipul Sheth, managing director of Advancetrack, has however cautioned against the proposal, telling GB News there would be "a mass exodus of capital, talent, and enterprise from the UK."

Speaking from his position overseeing partnerships with numerous firms nationwide, Mr Sheth emphasised that technology, finance and entrepreneurial small businesses would bear the brunt.

"In conversations I've had with other business leaders, too many have told me they'd give serious consideration to leaving the UK entirely if a wealth tax came in, because the risk and uncertainty would simply become too great," Mr Sheth revealed.

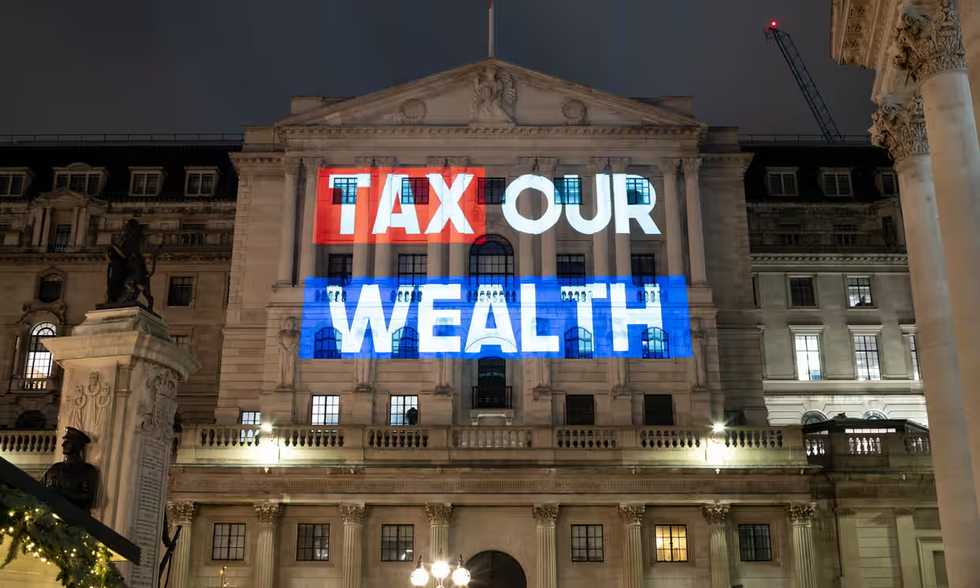

The economic stakes surrounding wealth taxation remain deeply contested. Proponents cite potential revenues of £24billion from levies on fortunes above £10million, alongside over £10billion from extending national insurance to investment income.

LATEST DEVELOPMENTS:

Patriotic Millionaires claim a 2% tax on the richest 20,000 people in Britain would fill the £22bn black hole | Patriotic Millionaires UK

Patriotic Millionaires claim a 2% tax on the richest 20,000 people in Britain would fill the £22bn black hole | Patriotic Millionaires UKThese figures suggest substantial funds for public services without burdening ordinary taxpayers.

Yet critics warn of unintended consequences that could undermine Britain's tax base.

Mr Sheth argued that wealthy individuals already contribute significantly, with the top one per cent providing 29 per cent of income tax revenues whilst creating skilled employment and paying corporation taxes.

More From GB News