Income tax hike 'least damaging' option for Rachel Reeves at Budget, think tank warns

Chancellor Rachel Reeves refuses to rule out extending freeze on income tax thresholds |

GBNEWS

Experts have said it's "the most reliable option" for putting the economy

Don't Miss

Most Read

Families could be hit with higher income tax bills as experts warn it is the "least damaging" way for Chancellor Rachel Reeves to plug a huge £30billion hole in the nation’s finances.

The respected National Institute of Economic and Social Research (NIESR) looked at three main tax options the Government could use to raise the cash – income tax, VAT and corporation tax.

Its analysis suggested that while none of the choices would be painless, lifting income tax rates would cause the least disruption to the economy compared with hiking VAT on everyday spending or taxing businesses more heavily.

The study assumes ministers will need to find an extra £30billion a year by 2029-30 to balance the books. Other ways of raising money, NIESR said, would be more damaging both for households and for growth.

NIESR's modelling demonstrates that VAT increases would inflict the most severe economic damage, reducing real personal disposable income by almost three per cent and shrinking real GDP by approximately one per cent within the initial year of implementation.

Such a move would also fuel inflation more significantly than other options due to its direct effect on retail prices.

Corporation tax increases, whilst having a more modest immediate effect, would create lasting economic harm by deterring business investment, the research indicates.

In stark contrast, adjustments to income tax would result in a GDP reduction of merely 0.05 per cent during the first year following implementation.

The think tank characterised the income tax option as the "least bad" choice available to the Chancellor for her upcoming Budget.

Such a move would also fuel inflation more significantly than other options due to its direct effect on retail prices

|PA IMAGES

The research highlights a significant political challenge for Labour, as implementing income tax increases would contradict the party's manifesto commitment to avoid raising taxes on working people.

NIESR noted that this pledge has become broadly understood to encompass income tax, VAT, employee national insurance contributions and corporation tax.

The think tank's authors argued that whilst alternative revenue sources exist, pursuing them would create far greater economic distortions and damage long-term growth prospects.

"We would argue that they could find other ways to raise tax revenue but doing so would be much more distortive, harming the economy in the longer run," the report's authors stated.

LATEST DEVELOPMENTS:

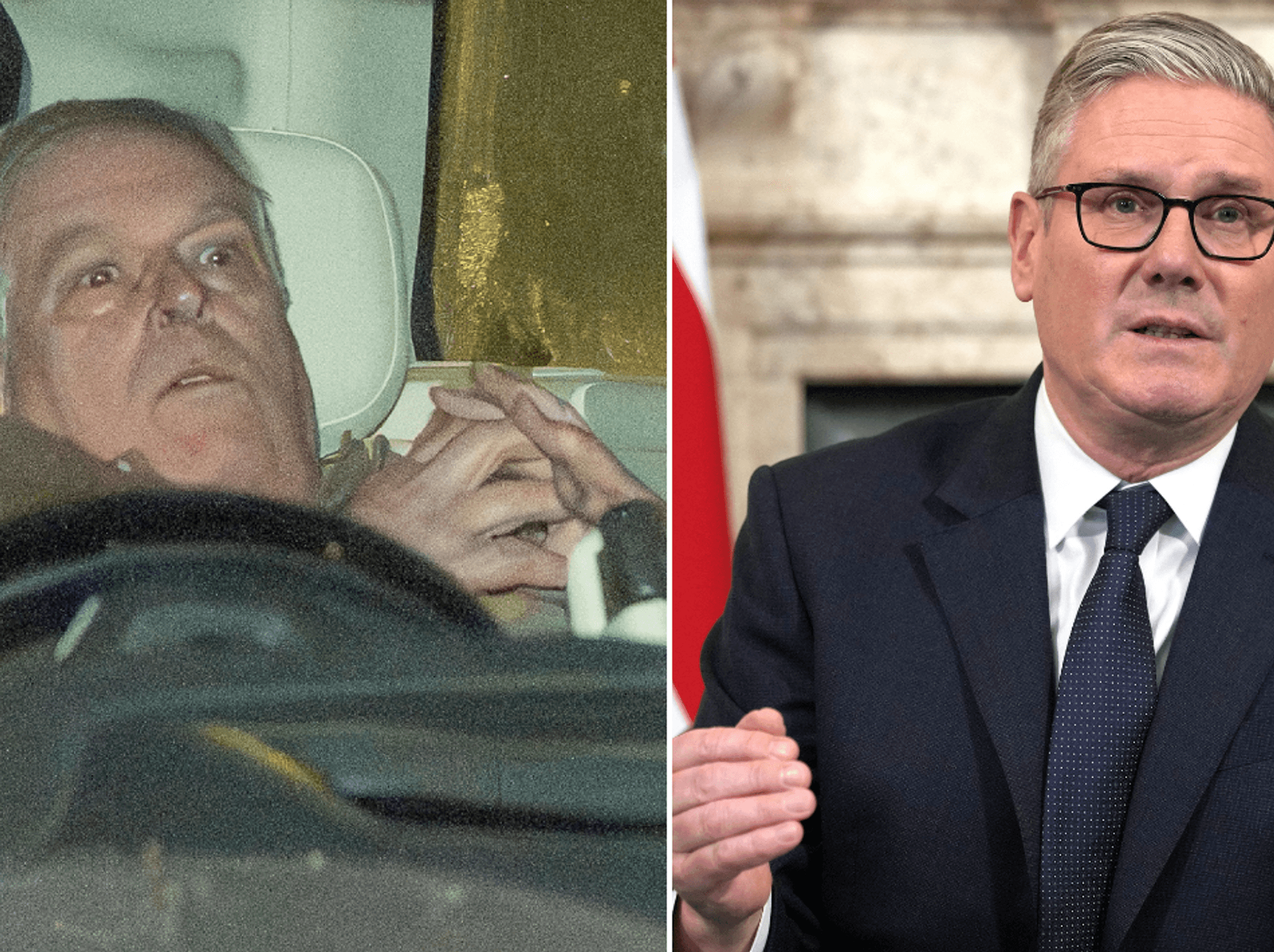

The research highlights a significant political challenge for Labour

| GETTYThis places the Government in a difficult position between honouring electoral promises and selecting the most economically prudent path forward.

Ed Cornforth, the NIESR economist who led the research, stressed that income tax increases represent the Chancellor's most dependable and least harmful route towards fiscal stability.

"Our analysis clearly shows that a rise in income tax is the Chancellor's least damaging, most reliable option for putting the economy on a sustainable, secure footing," Cornforth stated.

Further business taxation would undermine investment incentives when employer national insurance contributions have already affected business confidence

| GETTYHe cautioned that VAT rises would exacerbate price pressures at a time when inflation expectations remain concerning, whilst further business taxation would undermine investment incentives when employer national insurance contributions have already affected business confidence.

Mr Cornforth acknowledged the political challenges but warned that sidestepping income tax adjustments would compel the Chancellor towards inferior alternatives.

"Although it is politically unsavoury, avoiding raising income tax will force the Chancellor's hand into worse options – tinkering around the edges simply won't shift the dial," he said.

More From GB News