Savers could boost bank balance by £366 starting with just £1 today

HSBC UK has highlighted how people can boost their savings via the £1 savings challenge

|PA

The New Year could prove to be an opportunity to achieve new savings goals

Don't Miss

Most Read

Latest

Savings challenges can give people the kickstart they need to get into the habit of putting money away, and it can soon add up.

The £1 savings challenge is one way to get used to regular saving, and those who successfully follow it could end up with more than £350.

HSBC UK has highlighted this savings challenge, explaining those taking part put aside £1 every day for the whole year.

It would normally mean a saving of £365 in a 365-day year, although 2024 is a leap year.

There are 366 days in 2024 so savers can save a maximum of £366 via this savings challenge

|PA

It means this year, there are 366 days, so savers can save a maximum of £366 via this savings challenge.

Participants in the challenge can put the £1 away each day as cash, or they could set up a standing order, for example, which sends £7 to the savings account each week.

HSBC UK explained: “You could also do this weekly or monthly and set up a standing order to transfer the money straight into your savings account."

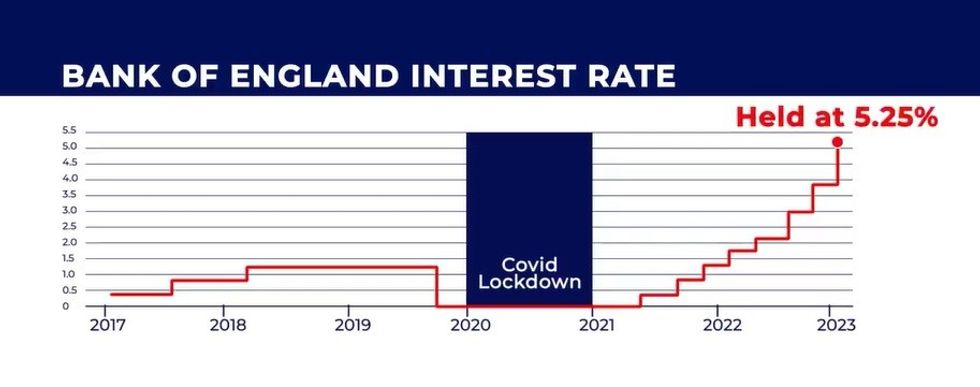

Interest rates on savings have increased significantly since the coronavirus pandemic, and savers could boost their savings further by putting the money into a competitive savings account.

The 1p savings challenge follows a similar principle of putting money away each day.

Savers start by putting away less each day compared to the £1 challenge but could end up with £671.61 by the end of 2024.

Participants start the challenge by putting one pence in the pot on day one.

This increases to two pence on day two, then three pence the following day.

LATEST DEVELOPMENTS:

The Bank of England has held interest rates at 5.25 per cent

|GB NEWS

The regular payments increase by 1p each day, meaning on day 365, the contribution will be £3.65. In a leap year, it would be £3.66.

It is possible to do the 1p savings challenge in reverse, meaning the amount put away each day decreases over time.

Under this format, savers would put £3.66 away today, as it's a leap year, then £3.65 tomorrow.

On the final day of the year, the contribution would be just one pence.