Pension mistake could slap millions of families with 40% inheritance tax bill

Britons are being reminded to keep track of all pension paperwork or risk falling foul of the tax man

Don't Miss

Most Read

Households are being reminded to avoid a common pension mistake to avoid being slapped with a significant inheritance tax (IHT) bill from HM Revenue and Customs (HMRC).

Millions of British families are putting themselves at risk of unnecessary hardship during bereavement because they have no idea where vital documents such as wills and pension policies are stored, according to new findings from Canada Life.

The research highlights a concerning gap in household organisation that could lead to significant stress, hold-ups in settling estates, and potential financial penalties when loved ones pass away.

With private pension wealth representing the second largest element of household assets after property, according to Office of National Statistics (ONS) data, the lack of awareness about document locations poses serious practical challenges for those left behind.

A pension mistake could result in a shock inheritance tax bill

|GETTY

The study from Canada Life found that nearly half of couples in the UK, around 47 per cent, are unable to say where their partner keeps their will.

The situaon worsens considerably when it comes to extended family members. Two-thirds of respondents admitted they would not know where to look for their parents' wills, while an overwhelming 87 per cent said they could not locate a sibling's will if required.

These figures suggest that even within close family units, conversations about the whereabouts of essential legal documents remain uncommon, leaving relatives potentially scrambling for information at the most difficult of times.

Knowledge of pension document locations proves equally patchy, with more than a third of those in relationships, or 37 per cent , admitting they would be unable to find their partner's pension paperwork.

A judge ruled Mr Ward Snr was entitled to make the changes to his will | GETTY

A judge ruled Mr Ward Snr was entitled to make the changes to his will | GETTY This figure climbs to 58 per cent for those trying to locate their parents' pension policies.

The timing of these findings is particularly significant given that pensions will fall within the scope of inheritance tax from 2027.

Personal representatives tasked with administering estates will be responsible for tracking down these policies, and failure to locate them promptly could slow payments to beneficiaries and increase the likelihood of penalties should inheritance tax bills not be settled within the required timeframes.

The research uncovered similar gaps in awareness regarding other financial documents.

Inheritance tax changes will likely impact the pension planning of Britons going forward, a new survey has found | GETTY

Inheritance tax changes will likely impact the pension planning of Britons going forward, a new survey has found | GETTY Four in 10 people would struggle to find their partner's life insurance policies, while nearly half of Britons could not locate their partner's debt and loan agreements.

When it comes to parents' paperwork, just 38 per cent felt confident they could track down life insurance policies, with only 41 per cent knowing where savings and investment details are kept.

Liz Hardie, Tax, Trusts and Estate Planning Specialist at Canada Life, said: "It's easy to put off conversations about where important documents are kept, but the consequences of not knowing can be serious.

"Whether it’s delays in accessing funds, missing out on benefits, or facing unexpected liabilities, families could be left in a difficult position simply because they didn’t have the right information at hand.

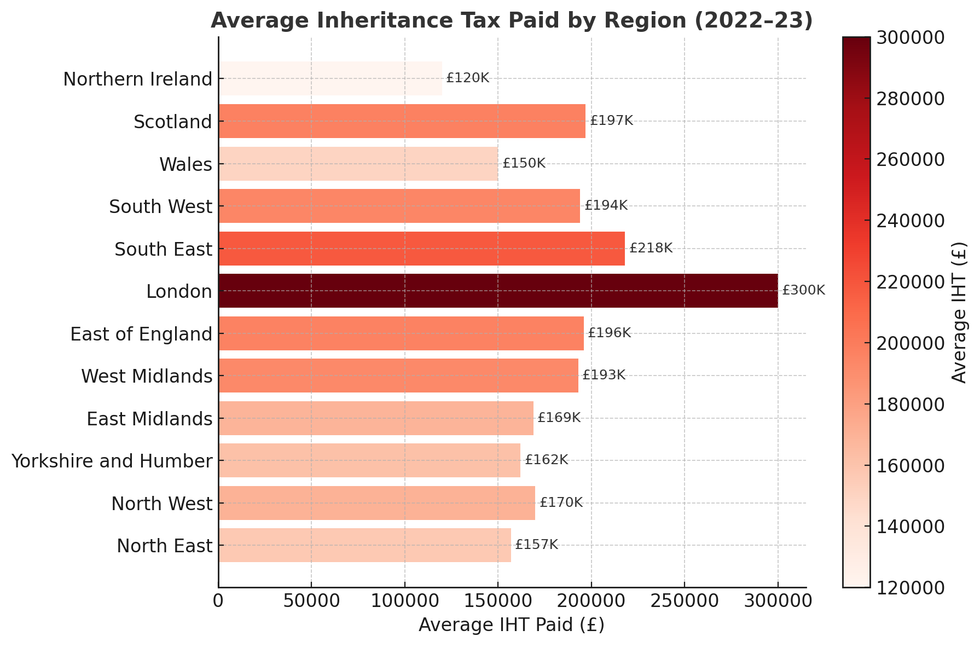

Average Inheritance tax paid by region | CHATGPT/ONS

Average Inheritance tax paid by region | CHATGPT/ONS“Make time for the conversations that matter. Knowing where key documents are kept isn’t just about being prepared for the worst; it’s about making life easier for everyone, whatever the future holds.”

IHT is a levy imposed on the estates of individuals who have passed away, including their money, possessions, and property.

The levy is currently charged at 40 per cent on estates valued above £325,000; however, relief is available to certain households depending on their circumstances.

During the 2024 Budget, Chancellor Rachel Reeves confirmed pension assets would be made liable for inheritance tax by April 2027.

More From GB News