Housing market hits highest level in eight years: 'The best year for property since the financial crisis'

Stock rises sharply in London and the south east

Don't Miss

Most Read

The number of properties available for purchase across Britain has reached its highest point in more than eight years, according to new research from Zoopla.

Estate agents are now holding an average of 32 homes on their books, a figure not seen in early January since 2018.

The capital experienced the sharpest rise, with listings climbing 16 per cent compared to the previous year.

The South East followed with a nine per cent increase.

TRENDING

Stories

Videos

Your Say

Chris Barry, Director at London-based Thomas Legal, told Newspage: "The market is shaping up for its best 'normal' year since the financial crisis."

A third of current listings had previously appeared on the market during 2025, as sellers return following Budget-related uncertainty.

Richard Donnell, a director at Zoopla, said: "Growing numbers of homes for sale is evidence of a strong underlying appetite to move home for many households."

He noted that buyers across Southern England now benefit from significantly more choice, though they remain price-conscious and selective.

Richard Davidson, Mortgage Advisor at Online Mortgage Advisor, pointed to falling borrowing costs as a key driver of seller confidence.

Properties available for purchase across Britain has reached its highest point in more than eight years

|GETTY

He said: "With interest rates reaching new recent lows, the increase in stock levels, including many properties that were listed last year, shows that sellers are increasingly confident that 2026 will be a good time to sell."

Mr Davidson added that affordability improvements should continue, particularly benefiting movers in the South East, where this had previously posed a significant barrier.

Elliott Culley, Director at Hayling Island-based Switch Mortgage Finance, didn't share this positive outlook.

He explained: "Properties for sale may be at their highest level for eight years, but with some of these properties coming back to the market after previously being withdrawn in 2025.

"This stat could be disguising what's really going on in the housing market at the moment."

LATEST DEVELOPMENTS

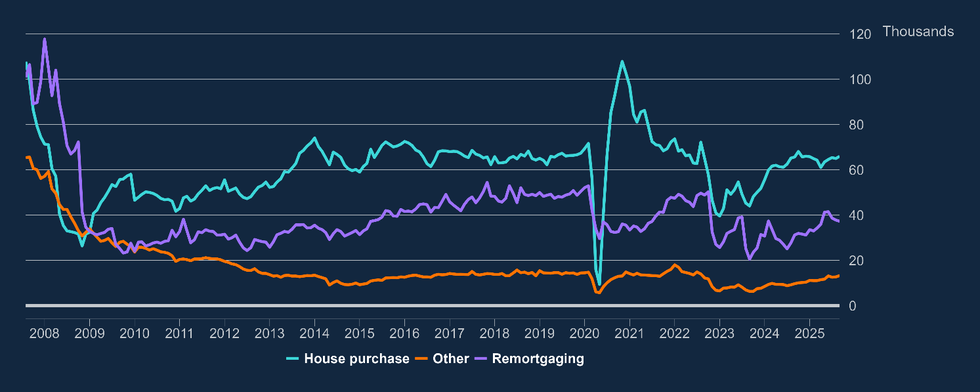

Net mortgage approvals increased by 1,000, to 65,900 in September | BANK OF ENGLAND

Net mortgage approvals increased by 1,000, to 65,900 in September | BANK OF ENGLANDMr Culley warned that demand remains weak across most regions, creating a stockpile of available homes.

Kundan Bhaduri, Entrepreneur, Investor and Landlord at London-based The Kushman Group, attributed the elevated figures to accumulated unsold stock rather than new construction.

He described the situation as "a market in stalemate" where transaction activity has stalled significantly.

Babek Ismayil, CEO at homebuying platform OneDome, added: "We're in a phase where choice has returned faster than confidence, and that's creating friction."

Michelle Lawson, Director at Fareham-based Lawson Financial, urged vendors to approach pricing with caution.

Some experts have warned that demand remains weak across most regions,

|GETTY

"Marketing too high will waste time and lose potential buyers, so pricing to sell rather than aiming for the stars is key," she noted.

Ms Lawson highlighted that first-time buyers continue to struggle with deposits, particularly in the south east, while chains are collapsing due to lengthy transaction times.

The expert recommended that sellers conduct their own property valuations alongside seeking agent advice, noting that estate agents are incentivised to secure the highest possible price.

Mr Donnell echoed this sentiment, warning that overpriced homes typically take longer to sell and risk achieving lower final prices.

He stressed that well-presented properties with realistic asking prices continue to find buyers in the current market.

More From GB News