HMRC warning: Savers risk losing £100s as 'crucial' tax deadline is only days away - do you need to pay?

Should the Government reduce the personal savings allowance? |

GB NEWS

The deadline for filing paper Self Assessment tax returns is this Friday

Don't Miss

Most Read

Latest

Millions of savers face an urgent deadline on October 31 as paper Self-Assessment returns must reach HM Revenue and Customs (HMRC) by October 31, with higher interest rates pushing everyday households into unexpected tax bills on savings interest.

The combination of elevated savings rates and unchanged tax-free thresholds has created a perfect storm for ordinary savers in recent years.

Analysts are sounding the alarm that the many Britons discover they owe tax on their interest earnings for the first time.

As such, savings experts are warning that missing Friday's deadline triggers automatic financial penalties from HMRC.

Savers have days left to meet an important tax deadline

| GETTYThe surge in those affected stems from interest rates climbing sharply since 2021, while the personal savings allowance remains frozen at levels set when rates hovered near zero.

As it stands, the personal savings allowance permits basic-rate taxpayers to receive £1,000 annually in interest without paying tax, whilst higher-rate taxpayers receive only £500.

Additional-rate taxpayers receive no allowance whatsoever. These limits appeared substantial when interest rates approached zero.

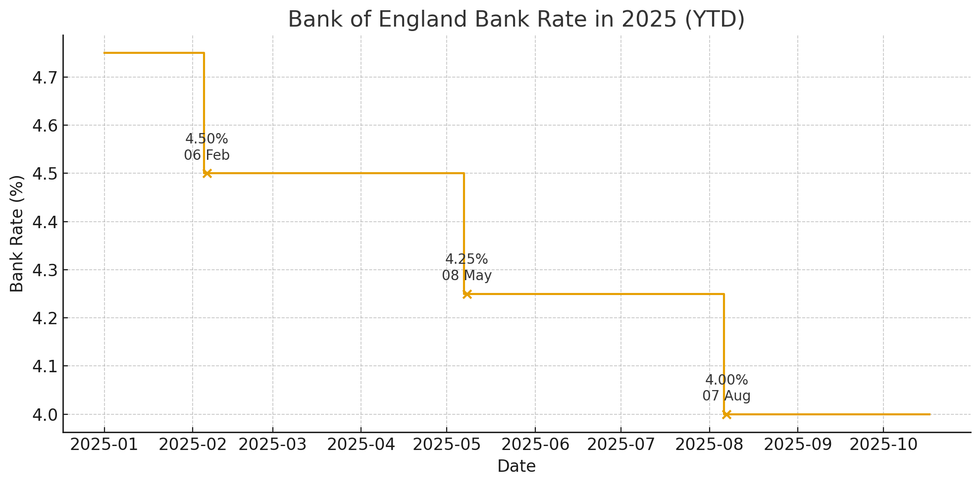

Prior to the Bank of England's base rate increases beginning in 2021, someone paying basic-rate tax could maintain more than £150,000 in leading easy-access accounts without incurring tax liabilities.

The Bank of England base rate has fallen in recent months | CHAT GPT

The Bank of England base rate has fallen in recent months | CHAT GPT However, the landscape has transformed dramatically due to soaring interest rates and frozen tax thresholds.

With premier accounts now offering approximately five per cent interest, merely £19,600 in savings exhausts a basic-rate taxpayer's allowance. Higher-rate taxpayers reach their limit with just £9,800.

The number of people paying tax on savings interest has quadrupled, rising from 647,000 in 2021/22 to an anticipated 2.64 million in 2025/26.

This affects one in every 25 basic-rate taxpayers and one in eight paying higher-rate tax.

Government coffers will receive more than £6billion from savings interest taxation this year, representing a fourfold increase over five years.

The dramatic shift means basic-rate taxpayers breach their £1,000 allowance with savings exceeding £19,600 at five per cent interest.

Higher-rate taxpayers face tax on amounts above £9,800, whilst those in the additional-rate bracket must pay tax on all interest earned, regardless of the amount saved.

Kevin Mounford, the personal finance expert and co-founder of Raisin UK, warned: "The October 31 paper filing deadline is a crucial date for anyone submitting a paper Self-Assessment return. Missing it can mean automatic penalties from HMRC."

LATEST DEVELOPMENTS:

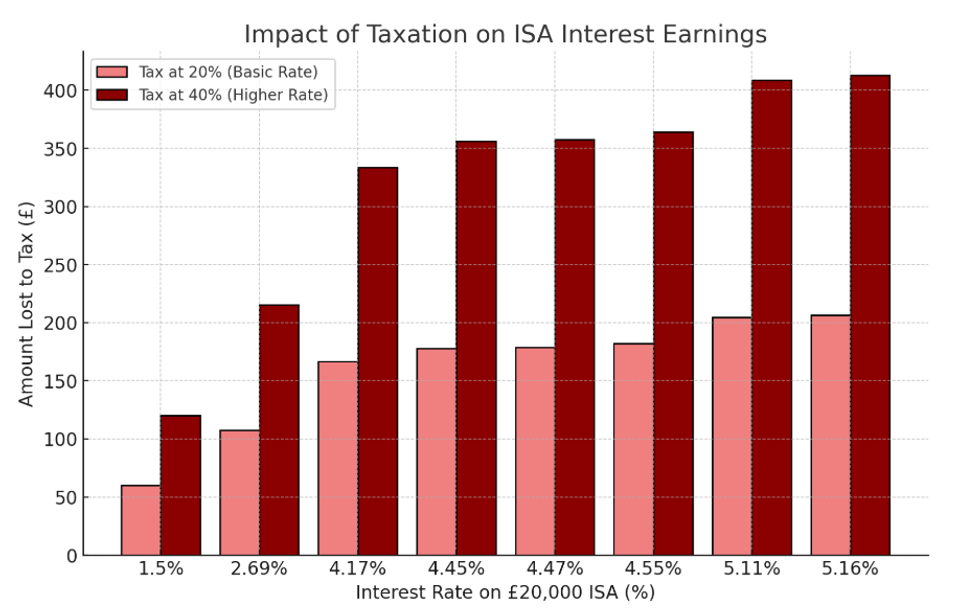

How much you could lose if Isa earnings were subject to income tax, broken down via interest rate and tax bracket | GBN

How much you could lose if Isa earnings were subject to income tax, broken down via interest rate and tax bracket | GBNHe emphasised the changed landscape: "What's different now is that higher savings rates have completely changed the picture.

"You no longer need a six-figure nest egg to breach your allowance. A basic-rate taxpayer with less than £20,000 in a competitive account could already be paying tax on their interest. For higher-rate taxpayers, the threshold is closer to £10,000."

Mr Mounford cautioned that many savers remain unaware of their obligations: "Many people simply will not realise they need to register until HMRC comes knocking. That can lead to nasty surprises like a reduced pay packet or pension payment when your tax code is adjusted."

He stressed the widespread impact: "This is no longer just an issue for wealthy savers - everyday households are now at risk of handing over part of their hard-earned savings to the taxman. Making use of ISAs and reviewing where your money is held is more important than ever."

More From GB News