ISA tax raid in Budget risks 'holding savers to ransom', Rachel Reeves warned

Analysts are urging the Chancellor to avoid cutting the tax-free allowance linked to ISAs

Don't Miss

Most Read

Chancellor Rachel Reeves is being warned that a tax raid on ISAs, which is rumoured to be policy under consideration for the upcoming Budget, risks "holding savers to ransom".

Speculation is rife ahead of the Chancellor's fiscal statement on November 26, with reports suggesting the Treasury is floating cutting the savings product's annual tax-free allowance from £20,000 to £10,000.

Fresh survey data has exposed widespread resistance among British savers to potential Treasury plans for reducing the cash ISA allowances, with seven out of ten respondents declaring it unjust to face pressure towards riskier investment options.

The research, conducted by savings platform Flagstone with Opinium, questioned 4,000 UK adults including approximately 1,650 Cash ISA holders during the third quarter of 2025.

The Chancellor is being told to avoid implementing changes to ISAs which could hurt savers

|GETTY / PA

Nearly half of cash ISA holders expressed doubts about their capacity to make sound investment choices, while 59 per cent feared losing access to invested funds when needed.

The Flagstone research undermines Treasury aspirations for channelling savings into UK equities, revealing that fewer than one in five Cash ISA holders would transfer excess funds to stocks and shares ISAs following any reduction.

A mere nine per cent indicated they would pursue investments outside ISA wrappers entirely.

Instead, savers demonstrated preferences for alternative uses, with 11 per cent each planning to address household expenses and repairs, reduce mortgage balances, or boost pension contributions.

Savers are looking for the best ways to make their money go further | GETTY

Savers are looking for the best ways to make their money go further | GETTYThe data highlights that UK adults remain nearly twice as likely to hold Cash ISAs, at 41 per cent, compared with stocks and shares ISAs at 22 per cent.

MPs on the Treasury Committee cautioned the government yesterday against reducing Cash ISA allowances, following months of speculation about a possible £10,000 annual cap.

The committee's report emphasised that two-thirds of ISA contributions during the 2023-24 tax year went into cash products, totalling £360billion in holdings.

Committee chairwoman Dame Meg Hillier stated: "This is not the right time to cut the cash ISA limit.

"Instead, the Treasury should focus on ensuring that people are equipped with the necessary information and confidence to make informed investment decisions."

The committee highlighted potential damage to building societies, which depend on Cash ISA deposits for mortgage lending.

Simon Merchant, chief executive of savings platform Flagstone, criticised the Treasury's approach as fundamentally misguided, arguing that "pitting saving and investing against one another in this way is a fool's errand".

He warned that restricting cash deposits would not automatically drive savers towards equities, stating: "Just because an individual won't be able to deposit as much into their ISA anymore is not going to prompt them to opt for investing instead."

LATEST DEVELOPMENTS:

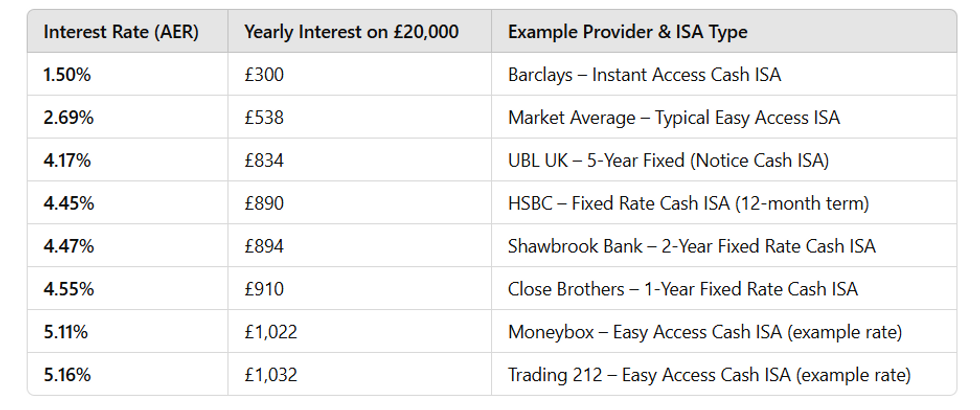

Examples of tax free Isa earnings in the UK if you had £20,000 in the Isa | GBN

Examples of tax free Isa earnings in the UK if you had £20,000 in the Isa | GBNMr Merchant characterised the proposals as "holding savers to ransom," asserting that the Treasury wrongly assumes excessive confidence and risk tolerance amongst ordinary savers.

He instead called for Government protection rather than pressure on savers to make financial decisions beyond their comfort zone.

As it stands, the tax-free ISA allowance is £20,000 per tax year for adult ISAs, which can be separated across different types of accounts like cash ISAs, stocks and shares ISAs, and Lifetime ISAs.

Notably, there is a different allowance of £9,000 annually for Junior ISAs and the maximum contribution to a Lifetime ISA is £4,000 per tax year.

More From GB News