HMRC alert: One million people yet to claim £473 tax refunds

Tax authorities warn workers and pensioners to act before November deadline to recover unclaimed money

Don't Miss

Most Read

HM Revenue and Customs (HMRC) have alerted the public to a significant opportunity for financial recovery, with around one million people yet to collect refunds averaging £473.

HMRC posted on social media platform X, stating: "Received a letter saying you have a tax refund to claim? There could be an average of £473 waiting for you."

These uncollected funds relate to P800 Tax Calculation correspondence sent to taxpayers who have either overpaid or underpaid their tax obligations.

The documents outline discrepancies in tax calculations and explain how to reclaim excess payments or settle outstanding amounts.

TRENDING

Stories

Videos

Your Say

Crucially, these reimbursements require active claims from recipients.

Those who ignore the correspondence forfeit their entitlement to the money.

HMRC began sending P800 correspondence in June, with around four million letters expected to be issued throughout the summer period.

Final notifications are scheduled for delivery by November 30.

These communications apply only to people in employment or those drawing pensions.

Self-employed taxpayers registered for Self Assessment receive automatic adjustments to their tax calculations instead.

Around one million people are still owed tax refunds averaging £473, HMRC has warned

|GETTY

Some recipients may find their letters indicate automatic cheque dispatch, removing the need for manual claims.

Such payments usually arrive within two weeks of the correspondence date.

Historical claims remain possible, with taxpayers able to pursue reimbursements dating back four years.

This means P800 recipients from 2021 onwards may still be eligible to recover funds, potentially amounting to thousands of pounds in some cases.

Taxpayers frequently overpay due to changes in their employment status or income.

Incorrect tax codes are a primary cause, particularly emergency codes containing 'W1', 'M1' or 'X' designations that temporarily affect deductions when people move between jobs or shift from self-employment to traditional employment.

Overpayment can also occur when workers leave one role and start another while still being paid by both employers within the same month.

Britons are already concerned about the rising tax burden

| GETTYStarting a workplace pension and receiving Government benefits, including employment support allowance or jobseeker’s allowance, can also lead to excess tax collection.

Multiple income streams, redundancy compensation, overseas earnings for UK residents, and domestic income for expatriates can all result in incorrect tax calculations.

Interest from savings accounts and payment protection insurance proceeds can similarly lead to overpayments that must later be corrected through the P800 process.

Digital claims through the Government’s online portal or mobile application offer the fastest route to reimbursement.

Taxpayers must use their Government Gateway credentials to access these platforms and make a claim.

Once logged in, eligible users will see a "claim your refund" option that starts the recovery process.

Funds are transferred directly to registered bank accounts within five working days of submission.

Physical P800 correspondence is not required to begin a claim.

The Government provides an online tool allowing taxpayers to check if they are owed refunds from previous years.

Alternative claim methods are available for those without digital access, though these take longer to process.

HMRC stresses that legitimate refund processes never require upfront payments or immediate disclosure of banking information.

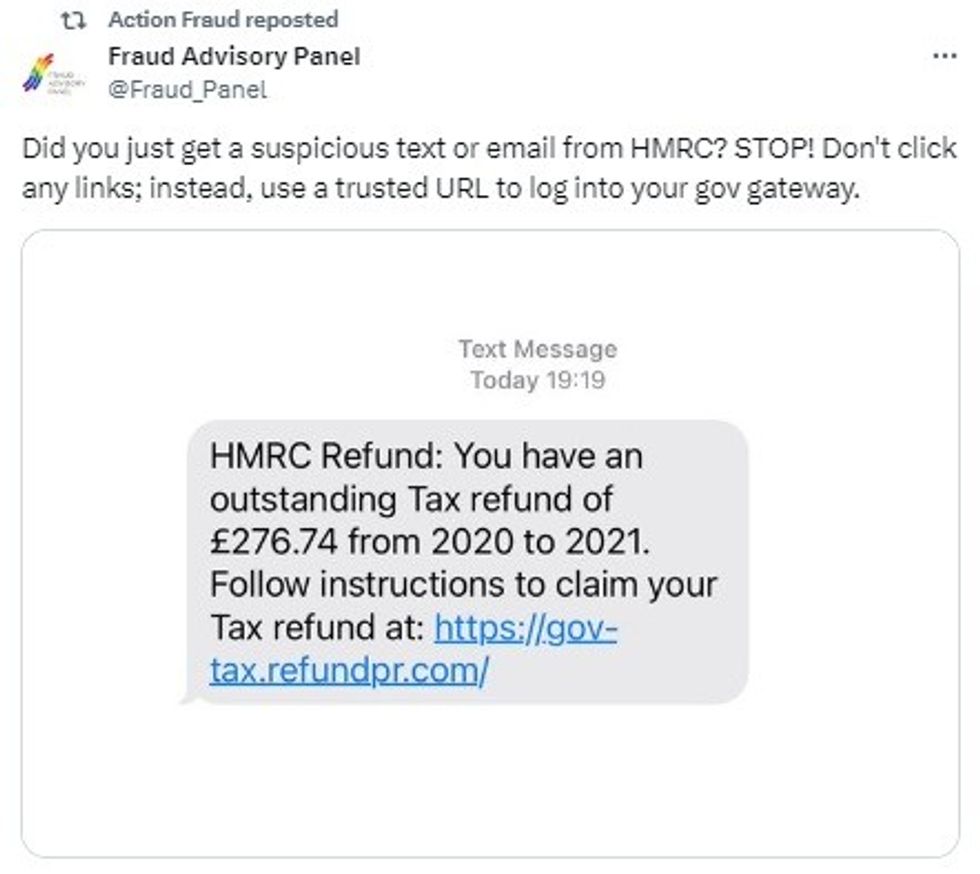

Criminals are exploiting the P800 situation through fraudulent impersonation schemes, according to consumer protection specialists.

MoneySavingExpert has warned that scammers are attempting to imitate tax authority communications via phone, text or email.

LATEST DEVELOPMENTS:

The Fraud Advisory Panel have issued warnings about bogus HMRC tax refund messages

| HMRC | X | @FRAUD_PANELAuthentic tax refund notifications are sent only through the post, not through digital channels, although legitimate claims processing does take place online.

HMRC maintains strict rules against asking for payment information or bank details through unsolicited contact.

Fraudulent messages often demand financial details or request upfront fees to release refunds.

These are clear signs of criminal activity, as genuine tax correspondence never asks for such information.

Taxpayers who receive suspicious messages are advised to verify authenticity through official Government channels before responding.

HMRC provides a dedicated fraud reporting service for those targeted by impersonation attempts.

More From GB News