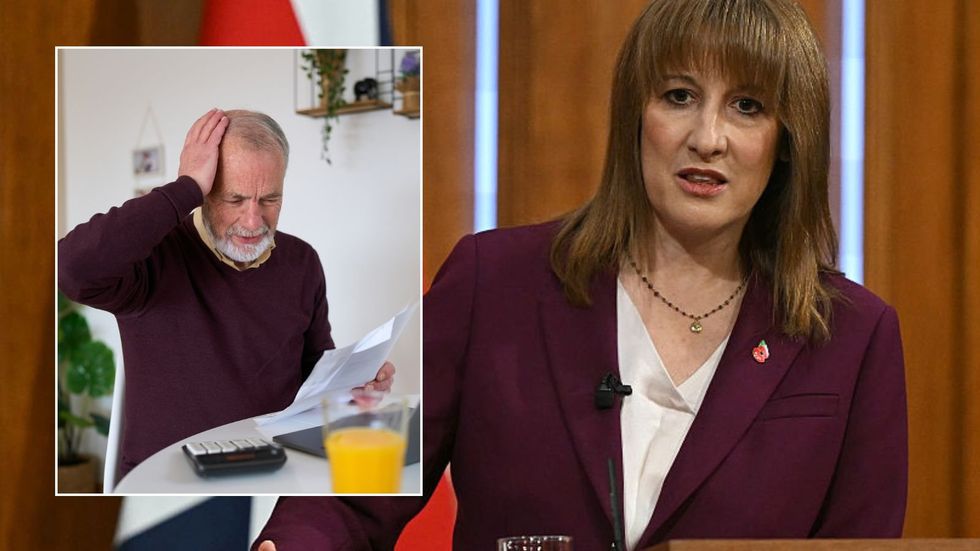

Rachel Reeves's raid on pensions set to be 'biggest tax hit in decades' as YOU could lose £214k to HMRC

Pensioners and landlords to be in Rachel Reeves' firing line after Chancellor flirts with broken promise |

GB NEWS

Pension savings will become liable for inheritance tax by 2027 under plans drawn up by the Chancellor

Don't Miss

Most Read

Labour's inheritance tax raid (IHT) on pension pots could cost you £214,000, representing the "biggest tax hit in decades", analysts warn.

Financial specialists have warned that planned reforms to IHT rules for retirement savings unveiled by Chancellor Rachel Reeves last year could deliver an unprecedented financial blow to countless British households.

During last year's Budget, Ms Reeves confirmed plans to bring pension savings into the inheritance tax net starting in April 2027, ending their current exemption status.

Industry professionals are calling this potential reform the most significant immediate tax burden to affect such a broad spectrum of citizens in recent memory.

Financial analysts have done the math on the Chancellor's tax raid on pensions

|GETTY

Speaking to Newspage, Scott Gallacher, who heads Rowley Turton financial advisory firm, has revealed the personal impact these reforms would have on his own finances.

He calculated that the changes would result in an immediate tax liability of approximately £214,000 if he were to die before his partner.

The financial adviser has created a complimentary inheritance tax calculator to help individuals assess their potential exposure to the new rules.

"Looking across our client base, the combined impact could exceed £40million in additional IHT without proactive planning," Mr Gallacher stated.

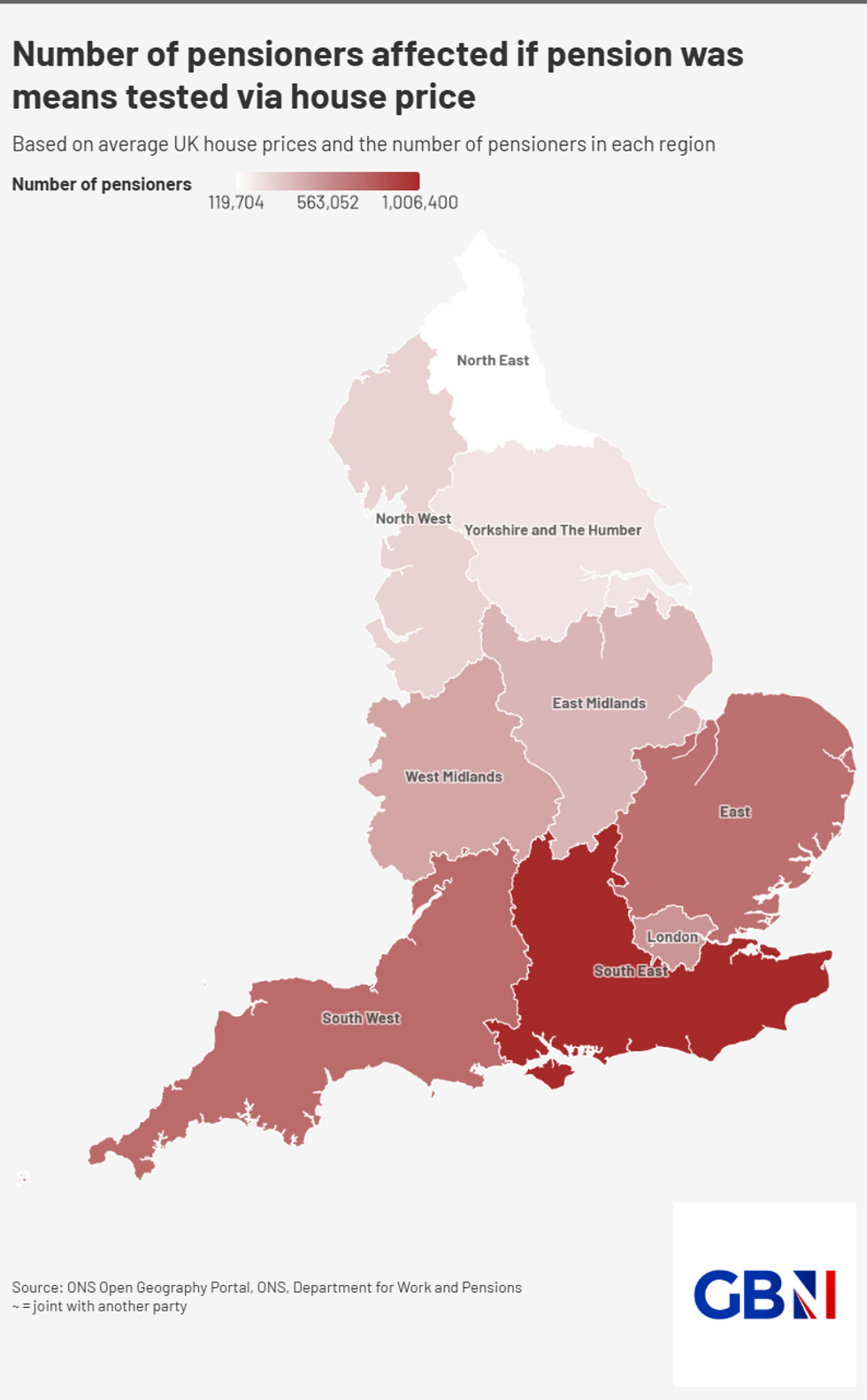

Number of pensioners affected if pension was means tested via house price | GBN

Number of pensioners affected if pension was means tested via house price | GBNHe added: "Have we ever seen a single tax change that could have such a dramatic and immediate impact on so many ordinary families?"

Luke James, who serves as Tax Director at Gravitate Accounting, concurred that the proposed legislation would impose an enormous financial burden.

"This could be the biggest overnight tax hit on the widest group of people in decades," Mr James stated.

He explained that while the measures aim to prevent wealthy individuals from exploiting pensions as tax-efficient wealth transfer vehicles, they would ensnare countless regular savers who had no intention of avoiding taxation.

Mr James highlighted how responsible individuals who accumulated substantial retirement funds but died before accessing them would be affected.

"Think of unmarried couples in their 50s or 60s, not yet accessing pensions, whose estates now face a sudden and significant bill. Their pensions weren't tax dodges just sensible planning," he said.

The tax expert warned that effective rates could surpass 60 per cent when inheritance tax combines with other fiscal restrictions.

Rob Mansfield, an independent financial adviser at Rootes Wealth Management in Tonbridge, characterised the pension inheritance tax reform as a shrewd political manoeuvre.

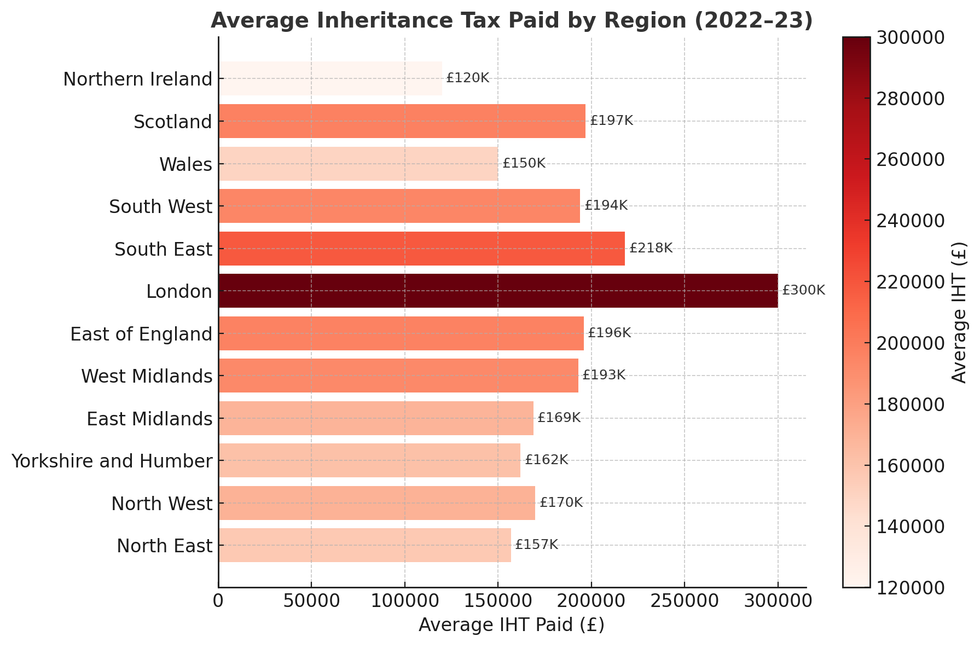

Average Inheritance tax paid by region | CHATGPT/ONS

Average Inheritance tax paid by region | CHATGPT/ONSHe suggested that the implementation date of 2027 serves dual purposes."This pension IHT change is a political masterstroke. The delay to 2027 is necessary for the systems to be updated, but it also benefits the Government by allowing the public outcry to fade until the tax is an established revenue stream," Mr Mansfield explained.

"The fundamental flaw, however, is the signal it sends to savers: that the government will penalise your family for building the fund needed for a comfortable retirement."

Dariusz Karpowicz, who directs Albion Financial Advice in Doncaster, added: "Your pension pot faces a 40 per cent tax grab from 2027. That retirement fund you've built over decades could leave your family with a six-figure IHT bill they never expected,.

He emphasised that those without married status would bear the heaviest burden due to lacking spousal exemptions, with some facing effective tax rates exceeding 60 per cent.

A HM Treasury spokesperson said: "Most estates will continue to pay no inheritance tax. The first £325,000 of any estate can be inherited tax-free, rising to £500,000 if the estate includes a residence passed to direct descendants, and £1 million when a tax-free allowance is passed to a surviving spouse or civil partner.

"We continue to incentivise pensions savings for their intended purpose of funding retirement instead of them being openly used as a vehicle to transfer wealth."

More From GB News