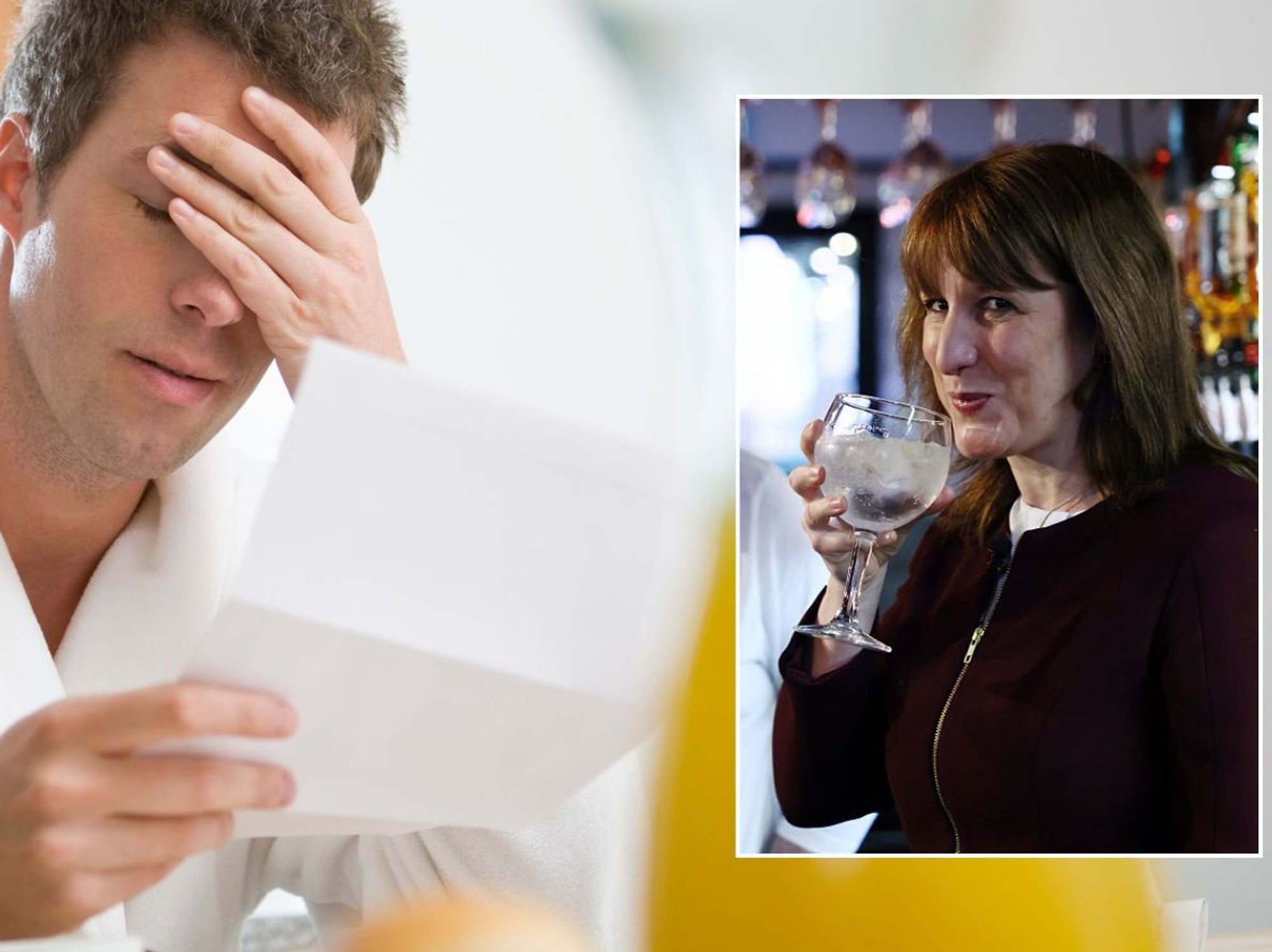

High street warning as Rachel Reeves' business tax raid 'puts 120,000 jobs at risk'

GBNEWS

The Chancellor's plans will hit 5,000 large shops, hotels and pubs with greater property taxes

Don't Miss

Most Read

Major retail and hospitality groups have warned that Rachel Reeves' planned business rates shake-up could put up to 120,000 high street jobs at risk.

The £1.7billion reform, due to take effect next April, will target around 5,000 large commercial properties worth more than £500,000, including superstores, hotels, holiday parks and restaurants.

The British Retail Consortium and UK Hospitality argue say the changes could force around 500 sites to close, as bigger businesses face higher bills, prompting 120,000 jobs at risk.

They industry bodies say that while the reforms aim to cut costs for smaller firms by shifting the tax burden, they could instead trigger widespread job losses and damage high streets already under pressure.

Trade associations have expressed alarm about the potential consequences for Britain's retail landscape. Helen Dickinson, chief executive of the British Retail Consortium, stated: "Introducing a business rates surtax would only add to inflationary pressures, leading to store closures and job losses."

The organisations are requesting that large retailers be excluded from the increased rates to protect what they describe as anchor stores. These major establishments generate footfall that benefits surrounding smaller businesses in town centres.

Kate Nicholls, chair of UK Hospitality, urged the Chancellor to "back businesses so they can develop locations where people want to live, work and invest."

Both groups warned that losing large venues such as superstores, hotels and restaurants would hit high street recovery efforts and harm the wider retail economy.

At the same time, shoppers are already facing higher grocery bills. Fresh food prices rose at their fastest annual pace of 2024, up 4.3 per cent in October compared with 4.1 per cent in September, according to the British Retail Consortium.

The biggest price rises were seen in beef, poultry and fruit, as production costs continue to climb. Supermarket bosses fear that higher business rates could make matters worse by adding further pressure to food prices.

High street closures are partly being driven by online shopping trends | PA

High street closures are partly being driven by online shopping trends | PAThere was some relief elsewhere, with overall food inflation easing slightly to 3.7 per cent in October, down from 4.2 per cent a month earlier. Shop price inflation for non-food items also slowed to 1 per cent from 1.4 per cent as retailers cut prices to stay competitive.

Industry figures have highlighted the cumulative financial burden facing their sectors. The British Retail Consortium reports that retail and hospitality businesses already confront over £10billion in additional expenses from the previous Budget, including elevated wages and employer National Insurance contributions.

Sir Tim Martin, founder of JD Wetherspoon, characterised the proposed changes as a "ferocious tax disadvantage" that would compound existing pressures on pubs grappling with elevated energy costs and reduced customer numbers.

Rachel Reeves' business tax raid 'puts 120,000 jobs at risk'

| GETTYMr Dickinson urged: "We urge the Chancellor to exempt these businesses from the surtax, helping safeguard hundreds of anchor stores and the vital jobs they sustain."

Recent Confederation of British Industry data revealed retail sales fell 27 per cent below last year's October figures, reflecting weakened consumer confidence and curtailed discretionary spending ahead of the autumn Budget.

Treasury officials have defended the proposed system as creating a more equitable business rates structure.

A Treasury spokesperson said: "We're making business rates fairer by introducing permanently lower rates for retail, hospitality and leisure from April, funded by a higher rate on less than one per cent of the most valuable business properties."

The government maintains that the restructuring will support traditional high street businesses

|GETTY

The government maintains that the restructuring will support traditional high street businesses by addressing disparities with online retailers operating from extensive warehouse facilities.

Officials highlighted that corporation tax remains capped at 25 per cent, positioning it as the lowest rate among G7 nations.

The Treasury also noted that interest rates have been reduced five times since the election to assist British businesses. Ministers argue the reforms form part of a broader strategy to revitalise city centres and support smaller retailers and local entrepreneurs.