Halifax to join rivals in cutting mortgage rates - reduction of up to 0.71 percentage points

Halifax will sharply cut rates on some of its fixed mortgage deals

|PA

Halifax is joining TSB and Nationwide in cutting mortgage rates this week.

Don't Miss

Most Read

Halifax will sharply cut rates on some of its fixed mortgage deals, which could be good news for some homeowners.

The lender will slash rates by up to 0.71 percentage points from tomorrow.

The lender's two-year fixes are reduced by 27 basis points, while five-year fixes are down by up to 71 basis points. Its 10-year fixes are being reduced by 10 basis points.

Nationwide, TSB and HSBC cut rates on fixed mortgage products yesterday, by up to 0.55 percentage points, up to 0.40 percentage points and up to 0.35 percentage points respectively.

Mortgage rates are being cut by some lenders which could be good news for homeowners

|PA

Henry Jordan, Director of Home at Nationwide Building Society, said: “These latest changes build on the reductions we made last week for existing customers.

“With swap rates having fallen from their early July peak and stabilised somewhat, we are now able to reduce rates for new customers.”

An HSBC UK spokesperson said: “We're firmly focused on supporting customers in the current environment.

"Following review, we are pleased to announce cuts to mortgage rates across our residential mortgage range in addition to reintroducing a Cashback incentive of £500 on a number of deals."

GB News’ Economics and Business Editor Liam Halligan said yesterday: “There’s a growing sense that inflation is coming down and that means expectations of where interest rates are going to peak are coming down.

“Even though rates may go up next month - I think they probably will - mortgage rates are coming down.”

Mr Halligan said he thought the reductions were "really significant".

He added: “Almost no-one thinks that the Bank of England isn’t going to put interest rates up a little bit more, but what those mortgage companies are saying, is that over a two-year period they think rates are going to be coming down and coming down considerably."

LATEST DEVELOPMENTS:

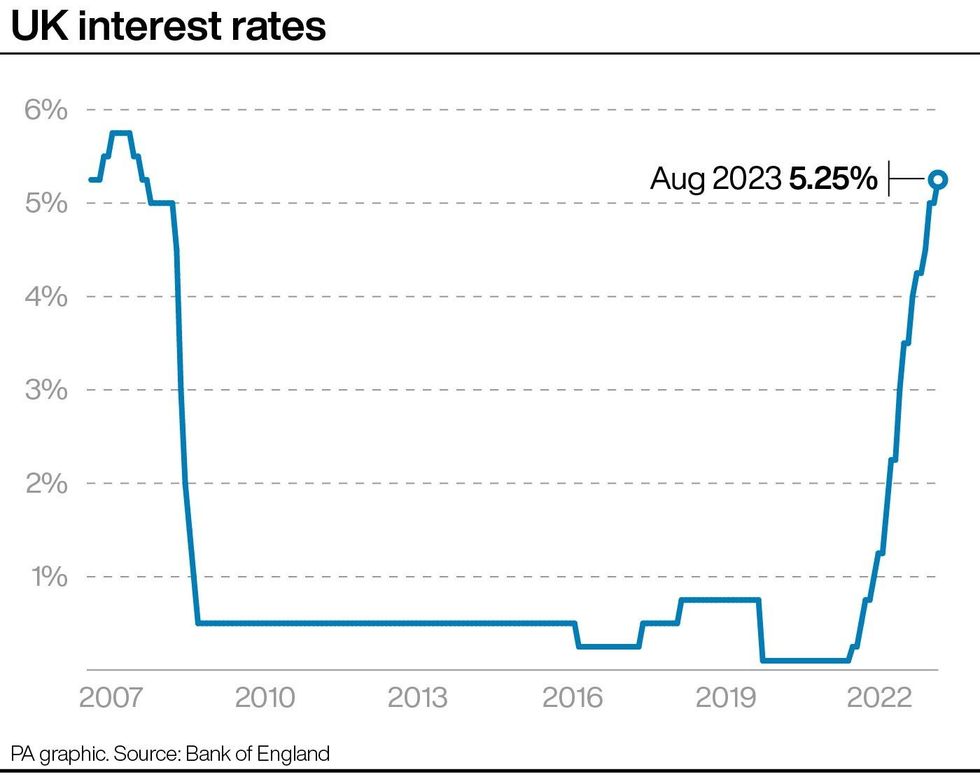

The Bank of England base rate is at a fresh 15-year high

|PA

The Bank of England base rate increased by 0.25 percentage points last Thursday to 5.25 per cent, a fresh 15-year high.

The central bank decided to make a slightly smaller increase than the 0.5 percentage point rise which some experts had initially predicted, following an easing in inflation.

The UK rate of inflation was 7.9 per cent in the year to June, down from 8.7 per cent in the year to May.