Ftse 100 hits 9,000 points for the first time ever in major win for Britain

GBNEWS

The Ftse 100 breaks records as investors seek UK stability

Don't Miss

Most Read

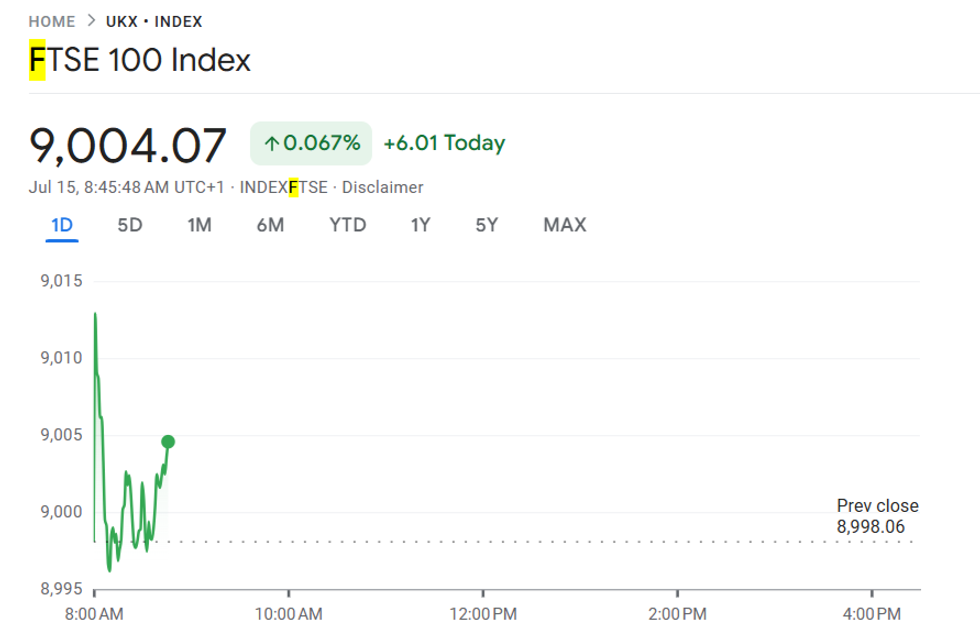

Britain's flagship stock index has smashed through the 9,000-point barrier for the first time on record.

The Ftse 100 opened at 9,016.98 this morning, rising around 0.2 per cent in early trading.

The milestone reflects growing investor confidence in UK-listed firms and comes amid a weaker pound, strong overseas earnings, and shifting global trade sentiment.

It has already gained 10 per cent since the start of the year, making 2025 a standout year for UK stocks.

Investors have been pouring into London-listed companies as they look to reduce exposure to the US market, amid mounting concerns over Donald Trump’s policymaking.

At the same time, confidence has grown that the US president will avoid a full-blown trade war and strike deals instead, a shift dubbed the 'TACO trade'.

The Ftse 100 has been helped by a weaker pound, which makes the overseas profits of many UK-listed companies worth more in pounds.

Defensive stocks, which tend to be more stable during economic uncertainty, have attracted cautious traders too.

A recently signed UK-US trade deal has further lifted sentiment, just as European markets brace for a potential 30 per cent US tariff from April.

The FTSE 100 has been helped by a weaker pound, which makes the overseas profits of many UK-listed companies worth more in pounds

|GETTY/GOOGLE

John Moore, wealth manager at RBC Brewin Dolphin explained the reasons behind the Ftse 100's ascent to 9,000 points today.

He said: "While the index’s composition had been a brake on its progress compared to other markets, now it is providing a tailwind, with strong earnings momentum in the banking and defence sectors, in particular, supported by the likes of some of the larger operators in other industries such as Next, Tesco, and National Grid.

"Currency has also played a role, though its impact is likely to fluctuate over time. If UK earnings grow by, say, 7-8 per cent, but the pound moves 2-4 per cent relative to the dollar, then you can meet or exceed what you might reasonably expect from the US market with the added benefit of sectoral and stylistic diversification in your investment."

Defensive stocks, which tend to be more stable during economic uncertainty, have attracted cautious traders too

|"At the same time, the UK still offers robust income and optionality. That may have been out of favour in recent years, but the cash flow can be helpful in terms of managing a portfolio and providing a form of income beyond cash yields and bonds.

"And, while resource companies – which often produce a reasonable level of income – haven’t been working out recently, that could turn and provide some cyclical upside along with some indirect exposure to China.

"A number of UK companies have been taking self-help measures, with lots refining their portfolios and buying back shares. Oxford Instruments is a prime example, selling a non-core asset at a good price and then undertaking a £50 million share buyback programme. The likes of Hiscox and DCC have done similarly, and it is becoming more universal.

"Finally, the UK offers relative political stability compared to other parts of the world at present. While there may be tax increases to come, which was part of the reason for the sell-off of the pound in early June, the government has a clear mandate and tenure for the next few years. That compares favourably to other parts of Europe, even, where coalition governments are having a tough time."

The Ftse 100 ended Monday at a record high of 8,998.06, lifted by optimism over the new US-UK trade deal.

While the EU faces the threat of 30 per cent tariffs from Washington, Britain has sidestepped the fallout, boosting confidence in UK markets.

The FTSE 100 ended Monday at a record high of 8,998.06, lifted by optimism over the new US-UK trade deal

| PAAsian markets were mixed overnight. Tokyo’s Nikkei 225 rose 0.24 per cent, while China’s SSE Composite dropped 0.8 per cent after second-quarter GDP growth showed signs of slowing.

In the currency markets, the dollar held steady against a basket of major currencies. Gold climbed 0.6 per cent to $3,363.90 an ounce on safe-haven demand, while oil edged down 0.3 per cent to $69 a barrel.