France's credit rating DOWNGRADED to 'vulnerable' as borrowing costs surge

4 Are Trump’s Tariffs a Threat to the Economy or a Master Negotiation Tactic? |

GB NEWS

Borrowing costs are surging globally with France's credit rating now being downgraded due to concerns whether the Government will be able to balance the books

Don't Miss

Most Read

Latest

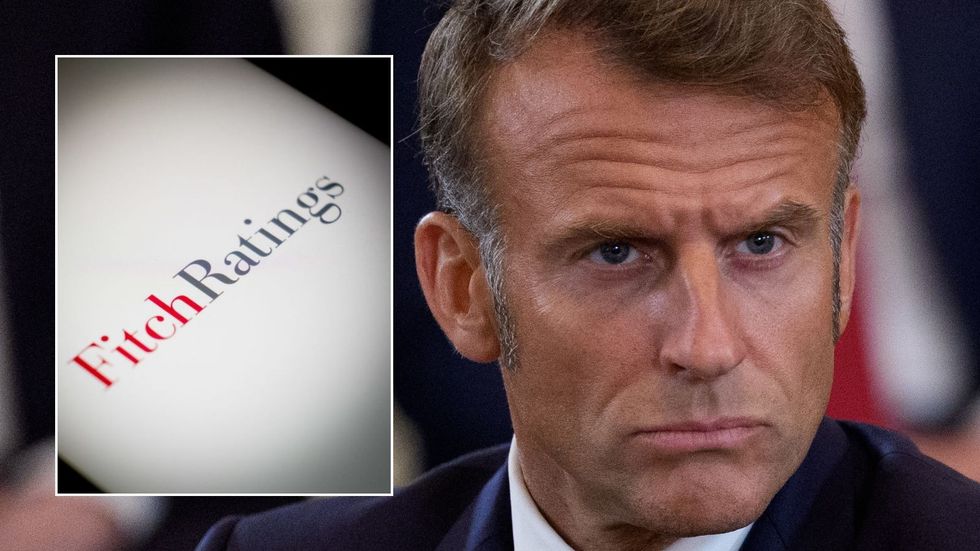

France's credit rating has been downgraded following the close of Wall Street trading by Fitch Ratings, one of the premier international bodies which determines the financial solidity of sovereign borrowing

The major credit assessment agency has downgraded the nation's credit standing from a AA- rating, which suggested France was in a "very strong capacity for payment of financial commitments".

The decision arrives mere days after Prime Minister François Bayrou's Government collapsed through a parliamentary confidence vote.

His failed attempt to pass an austerity budget aimed at reducing France's fiscal imbalances has spooked confidence in the global superpower in being able to manage its finances.

France's credit rating has been downgraded

|GETTY

Sébastien Lecornu now assumes responsibility for navigating these troubled waters as France's new minister.

France's budget deficit has reached 5.8 per cent of gross domestic product (GDP) while accumulated debt has climbed to 113 per cent of GDP.

These figures substantially exceed eurozone limits of three per cent for deficits and 60 per cent for debt.

A reduction to an A+ rating from Fitch would suggest the nation's debt repayment ability could become "more vulnerable to adverse business or economic conditions".

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

The French Government may be toppled in a matter of weeks after Prime Minister Francois Bayrou said he would seek a vote of no confidence in parliament | REUTERS

The French Government may be toppled in a matter of weeks after Prime Minister Francois Bayrou said he would seek a vote of no confidence in parliament | REUTERSOn its website, Fitch defines an A rating as being "low risk and the "capacity for payment of financial commitments is considered strong".

It added: "This capacity may, nevertheless, be more vulnerable to adverse business or economic conditions than is the case for higher ratings."

Political instability compounds these fiscal challenges, with Mr Macron's parliamentary allies lacking an overall majority.

Financial markets appear to have already priced in the anticipated downgrade, with several experts suggesting the move would be justified.

MEMBERSHIP:

- EXPOSED: Keir Starmer humiliated on eve of Donald Trump visit as bombshell letter threatens 'surrender' deal

- I fired Peter Mandelson during a fractious phone call. I warned him to be on guard - Nigel Nelson

- What our new Home Secretary said about the English flag makes her unfit to police our borders - Adam Brooks

- Keir Starmer faces fresh crisis as two connecting storm clouds could soon tear Labour apart at the seams

- POLL OF THE DAY: Would an emergency general election restore public faith in government? VOTE NOW

"Everyone is watching France's finances," Charlotte de Montpellier, an economist at ING, observed.

Eric Dor from IESEG business school stated a downgrade would "make sense", pointing to France's political circumstances that hinder establishing "a credible plan for budgetary consolidation".

French 10-year Government bond yields climbed to 3.47 per cent on Tuesday, edging dangerously close to Italy's rates.

Mr Bayrou had previously described the debt servicing costs as reaching an "unbearable" level. Rising yields would further increase France's borrowing costs at a critical juncture.

LATEST DEVELOPMENTS:

Chancellor Rachel Reeves is under more pressure after gilt yields soar | GETTY / MARKETWATCH

Chancellor Rachel Reeves is under more pressure after gilt yields soar | GETTY / MARKETWATCHSome analysts believe Fitch might postpone its decision to allow Lecornu an opportunity to assemble a Government capable of addressing the fiscal challenges. Lucile Bembaron from Asteres described this scenario as "plausible".

Hadrien Camatte of Natixis noted there's no pressing need for immediate action on the rating, as "economic growth is holding up" and the budget hasn't deteriorated dramatically this year.

INSEE reported Thursday that GDP is expected to expand by 0.8 per cent in 2025, exceeding the previous administration's forecast by 0.1 percentage points.

However, Anthony Morlet-Lavidalie from Rexecode economic institute warned that S&P Global is unlikely to maintain France's rating when it publishes its assessment in November, regardless of Fitch's decision tonight.

THIS IS A BREAKING NEWS STORY...MORE TO FOLLOW

More From GB News