UK economic growth FLATLINES in hammer blow to Labour's core manifesto pledge

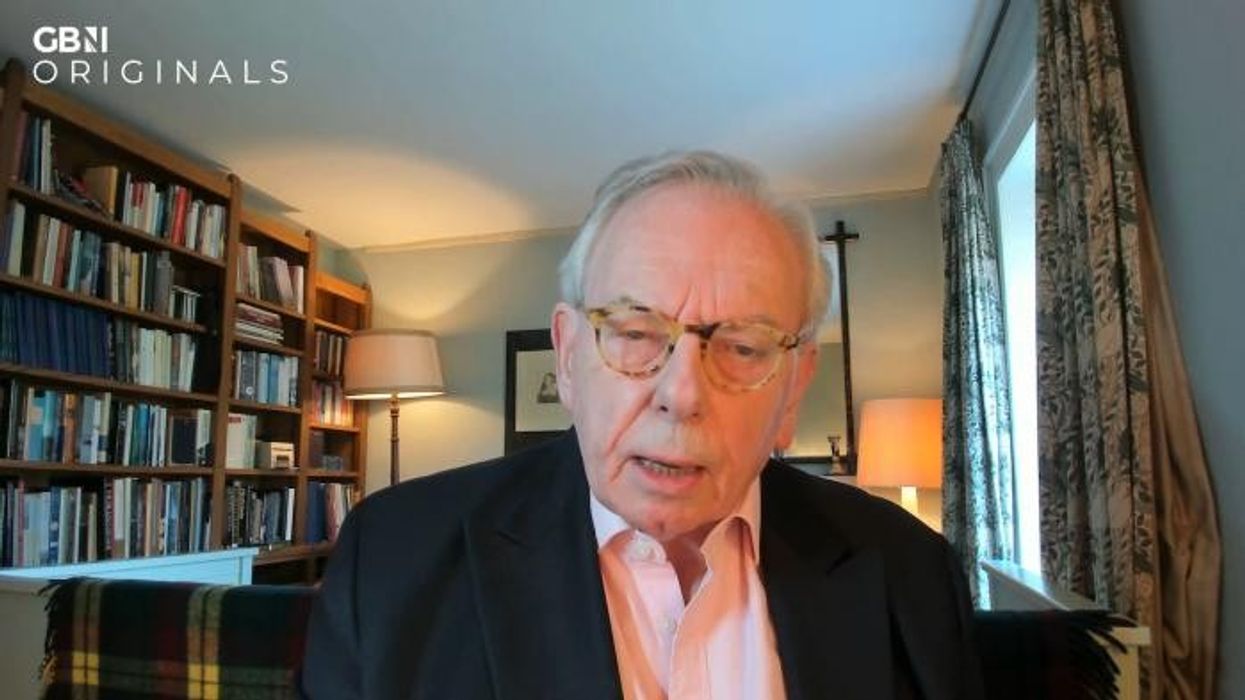

David Starkey slams Rachel Reves and Labour's economic policy |

GBNEWS

'Kickstart economic growth' was the first of the party's five central pledges before the election

Don't Miss

Most Read

Britain's economy flatlined in July after a mere 0.4 per cent expansion in June, the Office for National Statistics has said.

In a hammer blow to Labour's core manifesto pledge, the economy recorded zero growth for the last month on record.

"Kickstart economic growth" was the first of the party's five key pledges ahead of last year's General Election.

The UK economy stalled in July 2025, with a sharp contraction in manufacturing offsetting gains in other areas. The Office for National Statistics (ONS) reported zero month-on-month growth in GDP, following 0.4 per cent growth in June.

Manufacturing activity fell by 1.3 per cent, marking its largest decline since July 2024, while production output overall dropped 0.9 per cent, erasing rises in other sectors.

By contrast, the services sector edged up 0.1 per cent, boosted by a 0.6 per cent increase in retail, and construction grew 0.2 per cent.

Liz McKeown, ONS director of economic statistics, said: "Falls in production were driven by broad-based weakness across manufacturing industries."

Professor Joe Nellis, economic adviser at MHA, the accountancy and advisory firm said: "The UK economy did not grow in July, a drop off from the 0.4 per cent growth in GDP recorded in June.

"This is worrying news for the Chancellor, making her decisions at the Budget in November even more difficult than previously expected. The pattern of growth this year highlights an uneven recovery.

"Services continue to provide the main engine, while industrial output struggles to gather pace amid global trade frictions. Household spending remains constrained as high living costs limit disposable incomes, and business investment has yet to rebound in any meaningful way.

UK economic growth FLATLINES in hammer blow to Labour's core manifesto pledge | PA

UK economic growth FLATLINES in hammer blow to Labour's core manifesto pledge | PA"With the Autumn Budget scheduled for November 26, the risks to momentum remain tilted to the downside. Rising U.S. tariffs, fragile corporate confidence, and uncertainty around fiscal plans could all act as drags in the months ahead.

"With the Prime Minister taking firmer control of economic policy, the Chancellor finds herself under increased pressure. The economy has been edging forward rather than slipping back into stagnation, but she will be praying for growth to accelerate in the coming months."

Business groups have blamed Reeves’s £25billion increase in employer national insurance contribution, which came into force in April alongside a significant rise in the “national living wage”, for putting the brakes on growth.

Economic growth is slowing, while inflation jumped to 3.8 per cent in July, higher than expected. This has led investors to dial back hopes of more interest rate cuts from the Bank of England anytime soon.

The UK economy flatlined in a blow to Rachel Reeves

| GETTYThe Bank’s nine-member monetary policy committee is widely expected to keep rates at four per cent when it meets next Thursday.

Jobs and inflation figures, due earlier in the week, should give a clearer picture of the economy. However, policymakers warn that flaws in official ONS data are making it tricky to know exactly how things stand.

In response to the latest GDP data, a Treasury spokesperson said: "We know there’s more to do to boost growth because whilst our economy isn’t broken, it does feel stuck.

"That’s the result of years of underinvestment, which we’re determined to reverse through our plan for change.

Speculation is already rife about which taxes will be raised, and without the ability to raise the main revenue generators

| GETTY"We’re making progress: growth this year was the fastest in the G7; since the election, interest rates have been cut five times and real wages have risen faster than they did under the last government.

"There’s more to do to build an economy that works for, and rewards, working people."

Lindsay James, investment strategist at Quilter said: "With the summer now over and the economy supposedly getting out of its slumber, we now face continuing uncertainty in the lead up to the budget in November given the precarious position the Chancellor finds the public finances in.

"It is estimated that the fiscal hole that needs to be plugged is anywhere between £20bn and £50bn. While that is a wide range, it means one thing for a government that has shown it will struggle to cut spending – more tax rises.

"Speculation is already rife about which taxes will be raised, and without the ability to raise the main revenue generators – income tax, national insurance and VAT – the government is left with targeting multiple sectors for small amounts of revenue.

"This is increasing the headwinds for the UK economy and with still over two months to go, GDP readings for the second half of the year are unlikely to pretty reading. For government under as much pressure as it is at the moment, this will be a very difficult corner to get itself out of."

More From GB News