Blow to Donald Trump after US inflation SURGES as tariffs pose 'significant risks' to economy

JP Morgan's Jamie Dimon has taken aim at the Trump administration's tariff agenda

Don't Miss

Most Read

President Donald Trump has been dealt a blow to his economic agenda with inflation in the US, which analysts claim is in partial response his administration's sweeping tariffs.

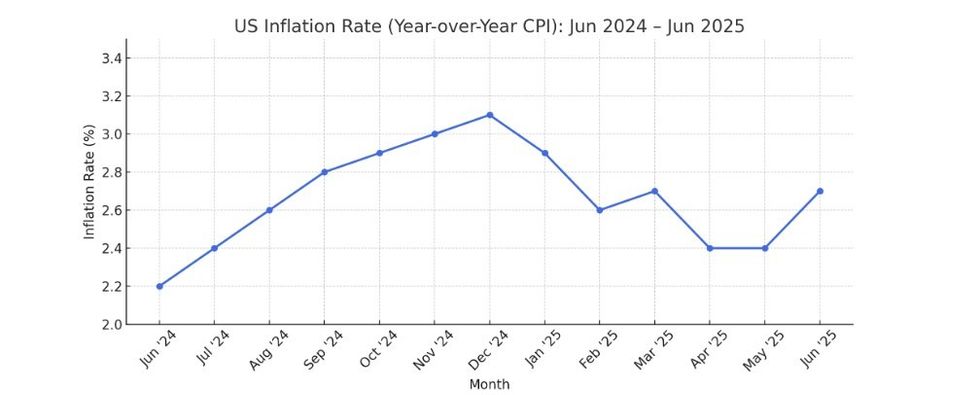

US inflation accelerated to 2.7 per cent in June from 2.4 per cent in May, according to the latest data from the Bureau of Labor Statistics (BLS0. The figure came mostly in line with economists' expectations of 2.6 per cent.

The Consumer Price Index (CPI) showed monthly prices rose 0.3 per cent compared to May's 0.1 per cent uptick, matching analysts' estimates. The acceleration was driven by a reversal in falling petrol prices.

This latest inflation data arrives as investors scrutinise whether Trump's expanding tariff programme is beginning to affect consumer prices across the American economy.

Donald Trump's tariffs are being blamed for partially contributing to US inflation rising

|GETTY / CHAT GPT

Trump has unveiled new letters to over 20 countries outlining tariffs ranging from 20 per cent to 50 per cent, including a 35 per cent duty on Canadian goods and 30 per cent tariffs on imports from Mexico and the European Union.

The Republican President has also floated sweeping 15 per cent to 20 per cent tariffs on most trading partners.

The EU is scrambling to negotiate while preparing potential countermeasures in response to the proposed duties.

Trump imposed a 10 per cent tariff on almost all trading partners in April and separately implemented steeper duties on imports of steel, aluminium and cars.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

How has inflation changed over the years?

|CHAT GPT

Core inflation, which excludes volatile food and energy costs, rose to 2.9 per cent over the past year in June, ahead of May's 2.8 per cent.

Monthly core prices increased 0.2 per cent, also ahead of the prior month's 0.1 per cent gain.

Energy costs rose notably, contributing to the headline inflation increase.

Other areas experiencing cost increases included household furnishings and apparel—both segments that experts are monitoring for signs of price hikes following Trump's sweeping tariffs this year.

The Department of Labor data showed these sectors as key drivers of the overall price acceleration in June.

Economists caution that tariff hikes could fuel inflation and weigh on economic growth.

LATEST DEVELOPMENTS:

JP Morgan Chase CEO Jamie Dimon has issued a warning about the impact of tariffs on the US economy

| GETTYHowever, US Treasury Secretary Scott Bessent has dismissed such expectations as "tariff derangement syndrome."

US officials have pushed back against warnings that the tariffs could spark price increases, despite the latest CPI data showing acceleration in several import-heavy sectors.

JP Morgan Chase boss Jamie Dimon has warned there remain "significant risks” to the US economy from tariffs and trade uncertainty.

Dimon explained: "However, significant risks persist – including from tariffs and trade uncertainty, worsening geopolitical conditions, high fiscal deficits and elevated asset prices. As always, we hope for the best but prepare the firm for a wide range of scenarios."

More From GB News