Boon for UK economy as active funds bounce back in 2025 amid Ftse record streak

'The bond markets are applying what they call the moron premium to the UK economy.' |

GB News

UK equity portfolios led by human managers deliver exceptional returns this year

Don't Miss

Most Read

Active fund managers are celebrating a strong resurgence in 2025, with numerous funds delivering returns that significantly exceed passive alternatives and market benchmarks.

Human expertise has outperformed automated strategies across UK equity portfolios during the first nine months of the year.

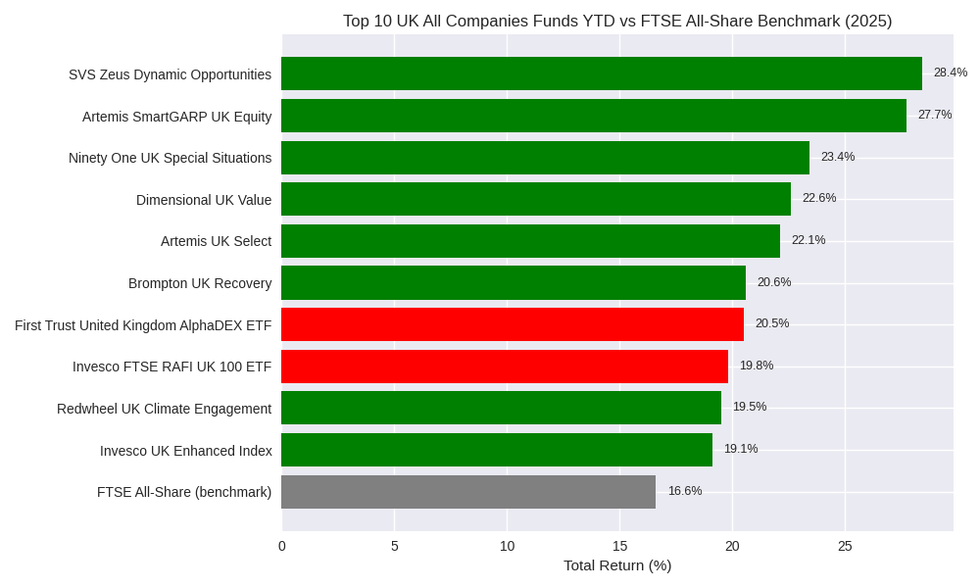

Data from AJ Bell shows that 47 funds in the UK All-Companies category have outperformed the Ftse All-Share index this year.

The best-performing active funds have achieved returns approaching 30 per cent, while the benchmark index delivered 16.6 per cent.

TRENDING

Stories

Videos

Your Say

This comes after years of investor scepticism about active management.

The industry has faced pressure as investors increasingly favoured cheaper tracker funds and ETFs, questioning whether higher fees for active management are justified.

The standout performer has been SVS Zeus Dynamic Opportunities, which has delivered returns of 28.4 per cent since January.

Artemis SmartGARP UK Equity follows with 27.7 per cent gains, while Ninety One UK Special Situations achieved 23.4 per cent.

Active fund managers are celebrating a strong resurgence in 2025

|GETTY

The broader UK equity market has also experienced an exceptional year.

The Ftse 100 has reached record highs, with ten constituents generating returns exceeding 50 per cent year-to-date.

Five of these companies have more than doubled in value since the start of 2025, including mining company Fresnillo and defence contractor Babcock.

Over 100 funds across the UK All Companies and UK Equity Income categories have produced double-digit returns including dividends.

Top 10 UK All Companies Fund Year-to-date

|AJ Bell/CoPilot

Dan Coatsworth, head of markets at AJ Bell, said: "In the battle of the manager versus the machine, humans have been punching above their weight with UK funds so far this year."

He noted that actively managed funds dominated the top ten performers in both UK All Companies and UK Equity Income categories.

"Fund managers will be jumping for joy given the active fund industry has faced growing criticism over widespread sub-par performance," Mr Coatsworth added.

He acknowledged that investors have gravitated towards passive investments due to lower costs and convenience."

"It's incredibly hard for fund managers to beat their benchmark year in, year out and many people are happy to simply track the market," he said.

"The challenge now for active funds is to sustain this year's outperformance. That's easier said than done."

The Zeus fund, managed by Caspar Trenchard, allocates approximately 25 per cent to Ftse 100 companies, 38 per cent to Ftse 250 stocks, and 30 per cent to smaller companies, with the remainder in cash.

Mr Coatsworth described it as "a real stock picker's portfolio rather than an index hugger".

Artemis SmartGARP UK Equity uses a hybrid approach, combining computer-based stock selection with human oversight.

The system identifies shares with specific characteristics before managers select the most promising opportunities.

Income-focused strategies have also performed well, with seven of the ten best-performing UK Equity Income funds being actively managed.

Barclays UK Equity Income leads with 20.6 per cent returns, slightly ahead of the iShares UK Dividend ETF at 20.4 per cent.

LATEST DEVELOPMENTS:

Barclays UK Equity Income leads with 20.6 per cent returns, slightly ahead of the iShares UK Dividend ETF at 20.4 per cent

| GETTYThe Barclays fund is a multi-manager vehicle, with Jupiter and Aberdeen each managing parts of the portfolio.

Not all fund managers have benefited from market strength.

Nick Train's Lindsell Train UK Equity fund has declined by 2.7 per cent year-to-date.

Mr Train, who has faced criticism for consecutive years of poor performance with his Finsbury Growth & Income Trust, attributed losses to holdings in consumer brand companies that proved "less reliable" than expected, particularly Diageo.

Despite repositioning the portfolio towards digitally-focused companies, the changes have not reversed its performance.

Mr Coatsworth suggested that delivering negative returns during a strong period for UK equities may test the patience of even loyal investors.

More From GB News