Economy alert: UK faces sharp slowdown as growth forecast to fall to 0.9% in 2026

GDP growth falls in blow for Rachel Reeves - WATCH |

GB NEWS

Allianz Trade warns Britain is entering a 'mild stagflationary phase', with inflation set to stay above 3 per cent until 2026

Don't Miss

Most Read

Britain's economy faces a dramatic deceleration next year, with growth forecast to fall to 0.9 per cent in 2026 following an unexpectedly robust 1.4 per cent expansion this year, according to a major new economic report.

The warning comes from Allianz Trade's Global Economic Outlook, which paints a challenging picture for the UK as it grapples with persistent inflation and tightening fiscal policy.

The projected slowdown represents one of the sharpest decelerations among major economies, with Britain's growth rate set to fall by more than a third.

The report, released on Thursday identifies the UK as particularly vulnerable to what economists are calling a "mild stagflationary phase" — a combination of sluggish growth and elevated inflation that has not been seen since the energy crisis.

TRENDING

Stories

Videos

Your Say

UK economic growth is set to slow sharply to 0.9 per cent in 2026, down from 1.4 per cent this year, a new report warns

| BBC/ONSThe Bank of England faces an extended period of monetary policy paralysis as inflation refuses to drop below three per cent well into 2026, the analysis reveals.

This stubborn price pressure will compel policymakers to maintain their current stance despite the slowdown, marking a significant departure from the European Central Bank's position.

The report forecasts that British inflation will remain elevated through spring 2026 before gradually easing, ultimately reaching the two per cent target only by spring 2027.

This contrasts sharply with the eurozone, where inflation has already stabilised near the ECB's target since the second quarter of this year.

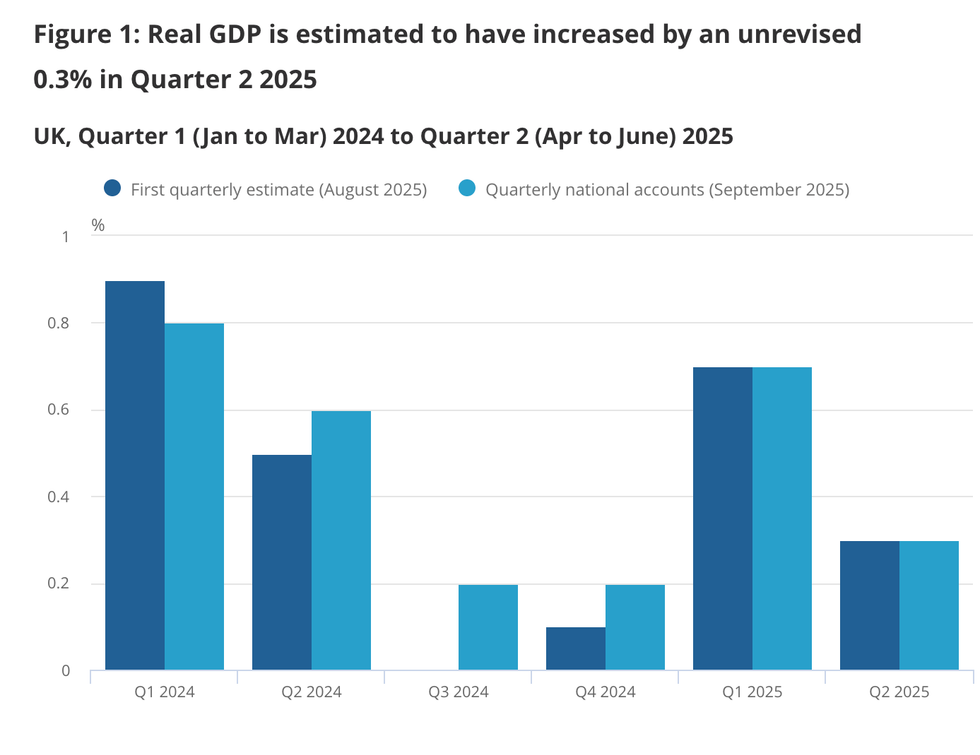

Real GDP is estimated to have increased by an unrevised 0.3 per cent in Quarter 2 2025

|ONS

Treasury officials are reportedly examining various revenue-raising options for the Autumn Budget, including a possible VAT increase that could generate substantial funds while minimising damage to business investment.

Maxime Darmet, senior economist at Allianz Trade, said: "VAT, while politically sensitive, is among the least damaging taxes for growth and can raise significant revenue quickly — unlike higher corporate or national insurance contributions, which risk choking economic momentum.

"The UK economy has delivered a positive surprise in the first half of 2025, with momentum still holding up."

The Government's forthcoming fiscal measures will intensify the economic headwinds, with spending cuts and potential tax rises set to dampen domestic demand throughout 2026.

"The Bank of England's accommodative stance has been the main driver, but Government policies have also played a role — most notably higher wages for public service workers and stepped-up investment programmes," Mr Darmet said.

"Looking ahead, however, 2026 will bring tougher challenges. Inflation remains stubbornly high, forcing the BoE to pause rate cuts for an extended period.

"At the same time, the Government faces the difficult task of finding fresh savings in the Autumn Budget to bring down the deficit."

LATEST DEVELOPMENTS:

Chancellor Rachel Reeves faces pressure ahead of her autumn Budget

| PA/Google FinanceUK GDP grew by 0.3 per cent in the second quarter of 2025, slowing from 0.7 per cent at the start of the year.

Growth was driven by services and construction, while the production sector contracted by 0.8 per cent.

Real household disposable income per head edged up by 0.2 per cent in the latest quarter, following a fall of 0.9 per cent in the first three months of the year.

The household saving ratio rose to 10.7 per cent, suggesting families are holding back more income amid ongoing economic uncertainty.

More From GB News