Economy alert: Borrowing costs rise to 5-YEAR HIGH in 'another hit' to Rachel Reeves before Budget

GB NEWS

Chancellor Rachel Reeves is having to find more fiscal headroom ahead of her Autumn Budget despite rising borrowing costs

Don't Miss

Most Read

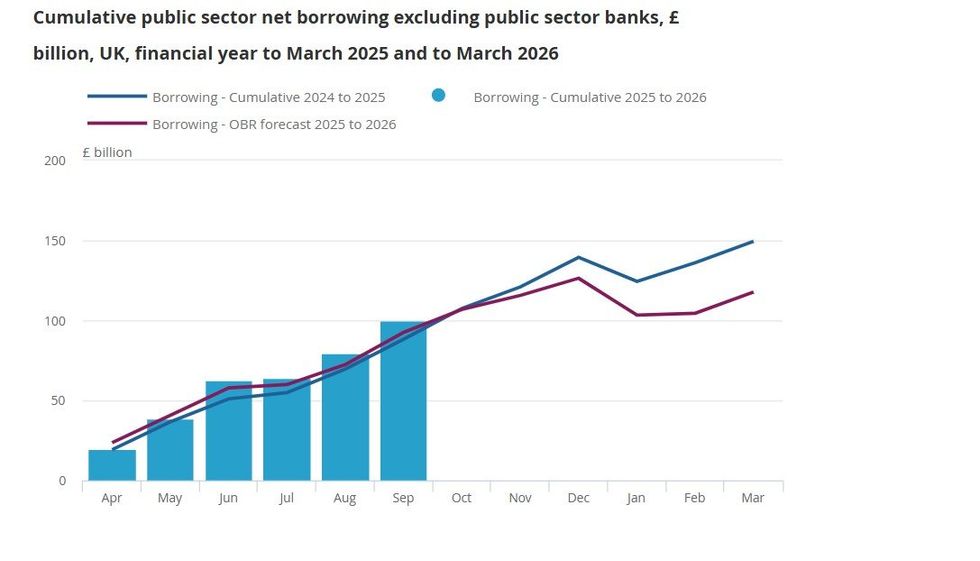

Public sector net borrowing in the UK excluding public sector banks, came to £20.2billion in September 2025, according to the latest figures from the Office for National Statistics (ONS).

This comes as a further blow to Chancellor Rachel Reeves ahead of her Autumn Budget on November 26, in which she is expected to announce tax rises and spending cuts in an effort to balance then books.

Notably, the September 2025 was £1.6billion more than in the year before and represents the highest September borrowing for five years.

Overall, UK borrowing in the financial year to September 2025 was £99.8billion, which was £11.5 billion more than in the same six-month period of 2024.

The Chancellor faces high borrowing costs

|GETTY

Furthermore, the ONS found these borrowing figures to be the "second-highest April to September borrowing since monthly records began" back in 1993, after that of 2020.

On the figures, ONS chief economist Grant Fitzner said: “Last month saw the highest September borrowing for five years.

“Debt interest, the cost of providing public services and benefits all increased compared with last year, more than offsetting the rise in receipts from central government taxes and national insurance contributions.

“Likewise, the first six months of the financial year saw the highest overall deficit since 2020."

Borrowing costs for September 2025 have surged

|ONS

Professor Joe Nellis, an economic adviser at accountancy firm MHA, noted September's borrowing figures represents "another hit" to Ms Reeves's fiscal agenda.

He explained: "The rise reflects a toxic mix of high debt interest payments, still-inflated public sector wage costs, and weak tax receipts from income, property, and corporate profits. Meanwhile, sluggish GDP growth is keeping revenue subdued, even as spending on health, education, and local services remains under pressure.

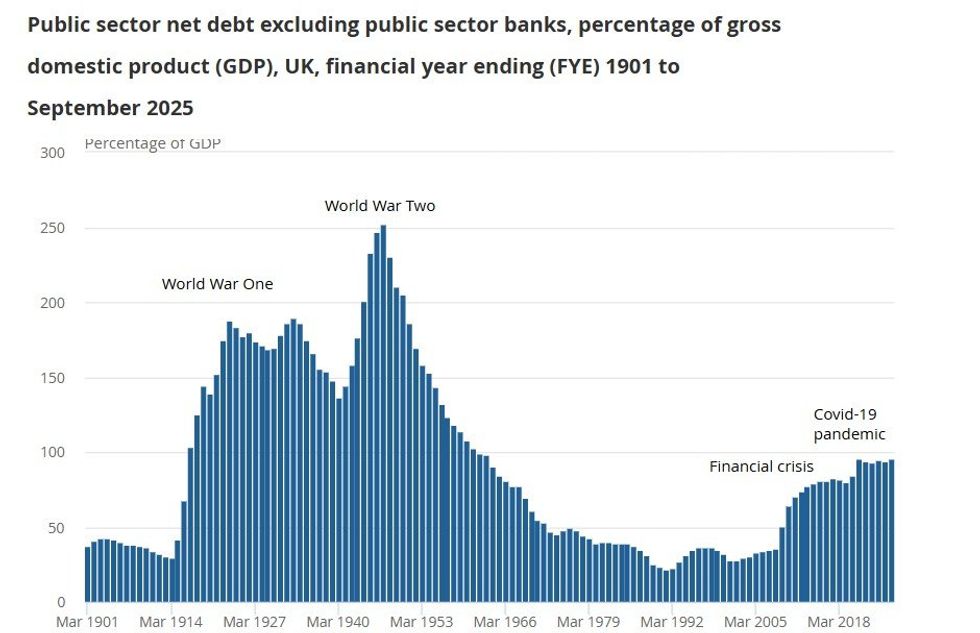

"Public sector net debt now hovers around £2.75trillion and at 95.3 per cent of GDP — nearing ever-closer to 100 per cent of gross domestic product (GDP) and at the highest level in over six decades. The last time the figure was over 100 per cent was in March 1961 — eighteen months before the Beatles released their first single.

"Debt servicing costs continue to bite, with inflation-linked bond payments alone costing the Treasury an estimated £9billion last month and around £107billion for the year."

However, Professor Nellis cited that the recent trajectory in gilt yields is a feather in the Chancellor's cap going into her fiscal statement next month.

He added: "A small consolation to the Chancellor is that the value of gilts has dropped in the past week and sits lower than some of its highs across 2025. This will curb some of the worst impacts of high debt servicing costs.

"In part, this comes as the Chancellor has made clear that tax rises are coming in November. While not the news many wanted to hear, her statements do provide some certainty and reassure the financial markets that the fiscal rules will be maintained, providing confidence that the stability of the economy won’t be put at risk by a looser fiscal strategy.

"With the Autumn Budget fast approaching, today’s figures set the stage for a politically charged balancing act. The Government is under pressure to stimulate economic growth, but the deteriorating fiscal outlook leaves little headroom under the existing rules

LATEST DEVELOPMENTS

Britain's debt bill for September 2025 has remained steady

|ONS

"Given the circumstances, the Chancellor will likely focus on targeted investment incentives and productivity-boosting measures, hoping to maintain stability while offsetting some of the negative effects of tax rises on growth prospects."

THIS IS A BREAKING NEWS STORY...MORE TO FOLLOW