Economy update: S&P 500 hits 7,000 mark ahead of major interest rate decision

Investors are preparing for the Federal Reserve's interest rate announcement later today

Don't Miss

Most Read

The S&P 500 breached the 7,000 threshold for the first time today, marking a significant moment for American equities as investors awaited the Federal Reserve's rate announcement this evening.

The benchmark index climbed 0.2 per cent during the session, touching an intraday peak of 7,002.28, before slipping below the new benchmark in afternoon trading. Meanwhile, the Nasdaq Composite gained 0.4 per cent whilst the Dow Jones Industrial Average remained largely unchanged.

Semiconductor shares propelled the broader market higher following encouraging quarterly results. China's decision to permit ByteDance, Alibaba and Tencent to purchase Nvidia's H200 artificial intelligence chips further buoyed sentiment, lifting Nvidia shares by approximately two per cent.

Seagate Technology saw its shares leap more than 17 per cent after the storage infrastructure firm delivered second-quarter earnings and revenue that surpassed analyst forecasts.

The US economy has hit a new record ahead of the Fed's interest rate announcement

|GETTY / GOOGLE

Chief executive Dave Mosley attributed the strong performance to robust demand for artificial intelligence data storage solutions.

The company's revenue increased 22 per cent year-on-year, with forward guidance also exceeding expectations due to substantial appetite for cloud and edge computing infrastructure essential to AI applications.

Dutch semiconductor equipment manufacturer ASML added to the positive momentum, announcing record fourth-quarter orders alongside an optimistic outlook for 2026, driven by the continuing artificial intelligence expansion. Intel, Micron Technology and other chipmakers also advanced on the news.

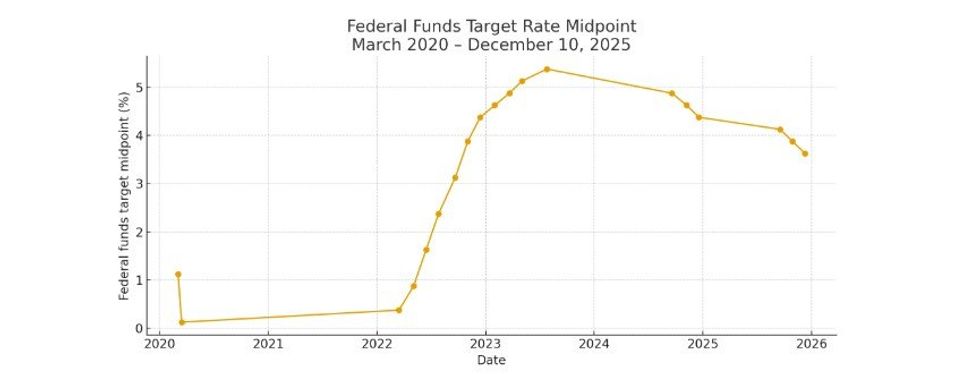

The Federal Reserve is widely anticipated to hold its benchmark interest rate steady at between 3.5 and 3.75 per cent when it announces its decision later today.

Traders will be scrutinising any indications regarding the longer-term direction of monetary policy.

According to the CME FedWatch Tool, fed funds futures currently point to two quarter-point reductions by the close of 2026.

"The current U.S. economic outlook remains positive, with ongoing growth and a labor market that, although somewhat soft, has stabilized. Inflation continues to run above the Fed's target, leaving little justification for immediate rate cuts," said Christian Hantel, portfolio manager at Vontobel Asset Management.

Notably, the US dollar experienced its steepest single-day decline since April yesterday, dropping more than one per cent.

US Federal Reserve Chair Jerome Powell speaks during a press conference | Reuters

US Federal Reserve Chair Jerome Powell speaks during a press conference | ReutersOver the past twelve months, the currency has shed more than 10 per cent of its value. Tuesday's slide followed President Donald Trump's refusal to suggest the dollar had fallen too far, instead describing it as "doing great." The greenback recovered modestly on Wednesday.

Susannah Streeter, chief investment strategist at Wealth Club, noted that with the labour market cooling and core inflation coming in below expectations, markets continue to wager on borrowing costs declining this year, which is helping fuel the technology rally.

She shared: "Sentiment has been boosted by a raft of results, showing demand for semi-conductors is racing ahead. Dutch chip equipment maker ASML reported record fourth quarter orders and boosted its outlook for the year.

"Seagate Technologies, the data storage provider, also unwrapped results which exceeded expectations. Revenue rose 22 per cent compared to a year ago, but guidance for the current quarter also beat expectations, showing huge demand for cloud and edge computing environments, crucial for new artificial intelligence tools.

How has the Federal Funds Rate changed? | Federal Reserve / Chat GPT

How has the Federal Funds Rate changed? | Federal Reserve / Chat GPT "Results like these are helping to put worries to bed about the AI boom faltering any time soon. It’s helped power up the share price of Intel, Micron Technology and other chip stocks, with giant Nvidia joining the party and heading higher. Investors are wagering that the AI juggernaut has much further to run.

"With stocks gaining yet more ground, it’ll help with wealth perceptions among richer, invested Americans who are more likely to keep spending, supporting growth in the economy.

"But a K shaped world is emerging, with confidence among poorer citizens taking a hit as parts of the US jobs market freeze up, just as the wealthiest in society enjoy another upswing in their financial situation.

"These are trends Fed policymakers will have been keeping an eye on in their decision over interest rates. The decision later today looks set to be a holding one, with rates not likely to budge. But with the labour market cooling, and the latest core inflation reading coming in lower than expected, markets are still betting on borrowing costs coming down this year, which is helping put fire under the tech rally.'"